3 min read

Recycled Fiber Prices: Are You Using Accurate Indexes? You May Not Be

Fisher International

:

Jun 29, 2023 12:00:00 AM

Throughout the last few years in the recycled fiber market, a prevalent issue has been inaccurate OCC (Old Corrugated Container) pricing indexes. Many of the largely used, available pricing indices use survey-based methods to gather information on market prices. However, this method has led to inconsistencies and inaccuracies in reported figures.

To address this challenge, Fisher International introduced Recycled Fiber 360, a transaction-based recycled fiber price benchmark. Since its launch in 2022, it has gained a majority share of users in the North American market and validated the premise that the market is transacting in a different manner than reported by historical indices.

Industries have rapidly transformed digitally, and we agree that using real transaction data provides actionable insights that traditional qualitative research cannot.

Survey-Based Data vs Transaction-Based Data

While qualitative research and survey-based methods can certainly help shine some light on price trends, they often lack systematic, reliable data. The subjective nature of surveys can introduce biases, potentially making it more of a discussion than formal data reporting. In contrast, transaction-based benchmarks, like Recycled Fiber 360, offer a more accurate representation of market prices.

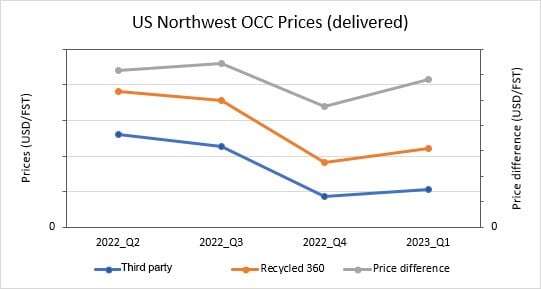

In fact, we’ve seen a notable disparity between the numbers reported by our transaction-based benchmark and survey-based benchmarks. As we can see in the image below, in 1Q2023, there was a little over 50 USD/FST difference between the prices reported by Recycled Fiber 360 and a third-party benchmark. This is quite a significant gap. But the more important question is which one is more accurate?

Figure 1: US Northwest OCC Prices (Delivered)

When comparing the actuals versus indexing, Recycled Fiber 360’s reported prices were right on the money. And while the third-party benchmark reports a nearly identical price pattern, this goes to show that you could be receiving prices that are off by quite a bit from the actual market conditions.

Why Precise Pricing Is Imperative

Using prices that are not reflective of what’s really occurring in the market can be detrimental. The main issue companies face when it comes to inaccurate reporting is the inability to make confident business decisions. Not only that, but it could also lead to additional headaches amongst various purchasers and suppliers of OCC and other wastepaper grades, such as:

- CEOs and CFOs at manufacturing companies that use wastepaper needing to speculate about the effectiveness of their fiber buyers. As recycled fiber is one of their largest costs, managing these costs can add up to millions of dollars.

- Procurement professionals not having the proper data needed to plan and benchmark their own performance. Without this, there is no way to effectively and accurately communicate their success and opportunities to leadership.

- Buyers and sellers managing needless friction caused by unexpected index movements.

- Generators lacking the ability to maximize the value they get while also receiving frustration-free service.

Recycled Fiber 360 in the Real World

Knowing that Recycled Fiber 360 can provide you with accurate data on current market price movements opens up the door to endless possibilities regarding what you can do with this insight.

To gain a better understanding of how exact pricing data can help you, let’s look at a hypothetical market example.

Let’s say a mill in the Southeast would like to compare the fiber prices it is paying to the fiber prices other mills located within the region are paying. Using the mill-to-mill benchmark, shown in the figure below, the mill can set its preferences for its exact region and compare OCC fiber cost with peer mills located within its defined area.

Figure 2: OCC Mill-to-Mill Benchmark

By understanding what other mills in the region are paying for recycled fiber, with a few button clicks, our hypothetical mill can now leverage its knowledge of the market to negotiate new buying contracts, leading to significant cost savings.

Get Accurate Pricing Information

Until now, no one had the ability to use real-world prices for benchmarks. Recycled Fiber 360 is based on actual transactional sales data and doesn’t rely on the interpretation of qualitative research and is built specifically to eliminate unreliability.

Recycled Fiber 360 offers:

- Contract versus spot market trends

- Mill-to-mill benchmarking

- Delivered vs FOB pricing

- Export trade breakdown

With features like these, market movements will no longer feel unexpected. Instead, the numbers will mirror the movements that participants are seeing in their businesses.

Companies can use the benchmarking capabilities found within our product to understand the competitiveness of their purchasing or sourcing strategy. This can lead to opportunities for negotiations regarding base price, transportation, etc.

Contact us today to schedule a free demo of Recycled Fiber 360 and learn more about how it can help you shape the future of your business.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)