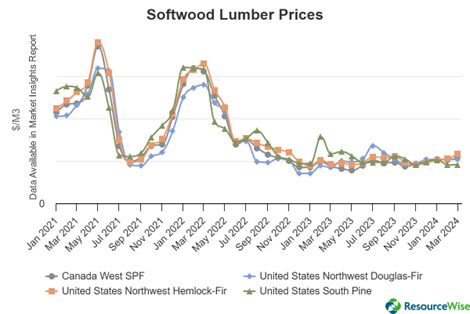

In recent years, North American lumber prices have experienced significant fluctuations with prices in late 2023 nearing levels seen a decade ago. By December 2023, the prices of Southern pine and US Northwest hemlock-fir rose by 8% compared to December 2013. Meanwhile, Canada Western SPF had increased by 13% during the same period.

At the end of 2023, the lumber market experienced a notable price increase. While this momentum initially struggled to gain traction in the first quarter of 2024, signs of a continued rise were evident.

Between December and March, Canadian SPF and hemlock-fir prices surged by 12% and 21% respectively. These levels marked a significant uptick in the market.

Factors Driving the Price Swings

The COVID-19 pandemic fueled the fluctuations in the North American softwood lumber market. The fundamental principles of supply and demand were starkly illustrated as the need for essential items like lumber persisted. This resulted in a sharp rise in lumber demand that only intensified as sawmills were forced to temporarily shut down.

The surge in home repairs and renovations, driven by individuals confined to their living spaces, further propelled this demand. This resulted in unprecedented peaks in lumber prices in 2021.

Following the aftermath of COVID-19, lumber prices continue to fluctuate—albeit at reduced levels. Various factors, including heightened demand, escalating tariffs, supply chain challenges, and inadequate domestic production, have contributed to this ongoing instability.

The housing market reflects a mixed picture. March experienced a surge in new home sales due to limited inventory, while builder sentiment remained stagnant in April.

Additionally, the projection indicates a decline of over 7% in spending on renovations and maintenance, crucial to the lumber industry, expected in the third quarter of this year.

An Update on the Housing Market

In March 2024, there was an uptick in homebuilder sentiment, but various housing market indicators experienced a decline. Total housing starts witnessed the most significant decrease since April 2020, and permits also dropped. The slowdown in multifamily construction was attributed to rising costs and sluggish rental growth.

Despite challenges like fluctuating mortgage rates impacting resales, builders resorted to offering discounts and sales incentives to drive new-home sales. While homebuilder sentiment remained steady, uncertainties surrounding interest rates led to some hesitancy.

The increasing prices of homes and mortgage rates are posing affordability challenges for potential homeowners. Many renters question their prospects of homeownership altogether. Furthermore, stricter energy regulations and tight monetary policies are anticipated to further strain the housing market.

Gain Deeper Insights with Market Insights

It's clear that the dynamics of the lumber market are complex and constantly changing, affected by various factors from global events like the pandemic to local market conditions. To stay updated with the latest developments in the global forest products markets, WoodMarket Prices offers valuable insights with its pricing data service.

This unique global analytics platform from ResourceWise tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key worldwide regions.

To delve deeper into the details of North American lumber prices, download our full Market Insights report "US Housing Market Holds Key to Any Upturn in North American Softwood Lumber Prices." Our Market Insight reports provide comprehensive data and insights that can greatly assist in making informed decisions.