Brazil is currently experiencing significant growth in the forestry plantations sector. As per the 2023 annual report from the Brazilian industry group Iba, the country's expansive forest plantations serve as a valuable asset, hosting nearly 10 million hectares of forest plantations rich in wood fiber. This allows the country to cater to diverse industries ranging from pulp and paper to solid wood products.

Eucalyptus and pine dominate the landscape, covering 76% and 19% of the total planted area, respectively. Many market leaders such as Suzano, Klabin, Eldorado, Cenibra, and Bracell are actively investing in new production facilities and forest resources, influencing wood costs in the region.

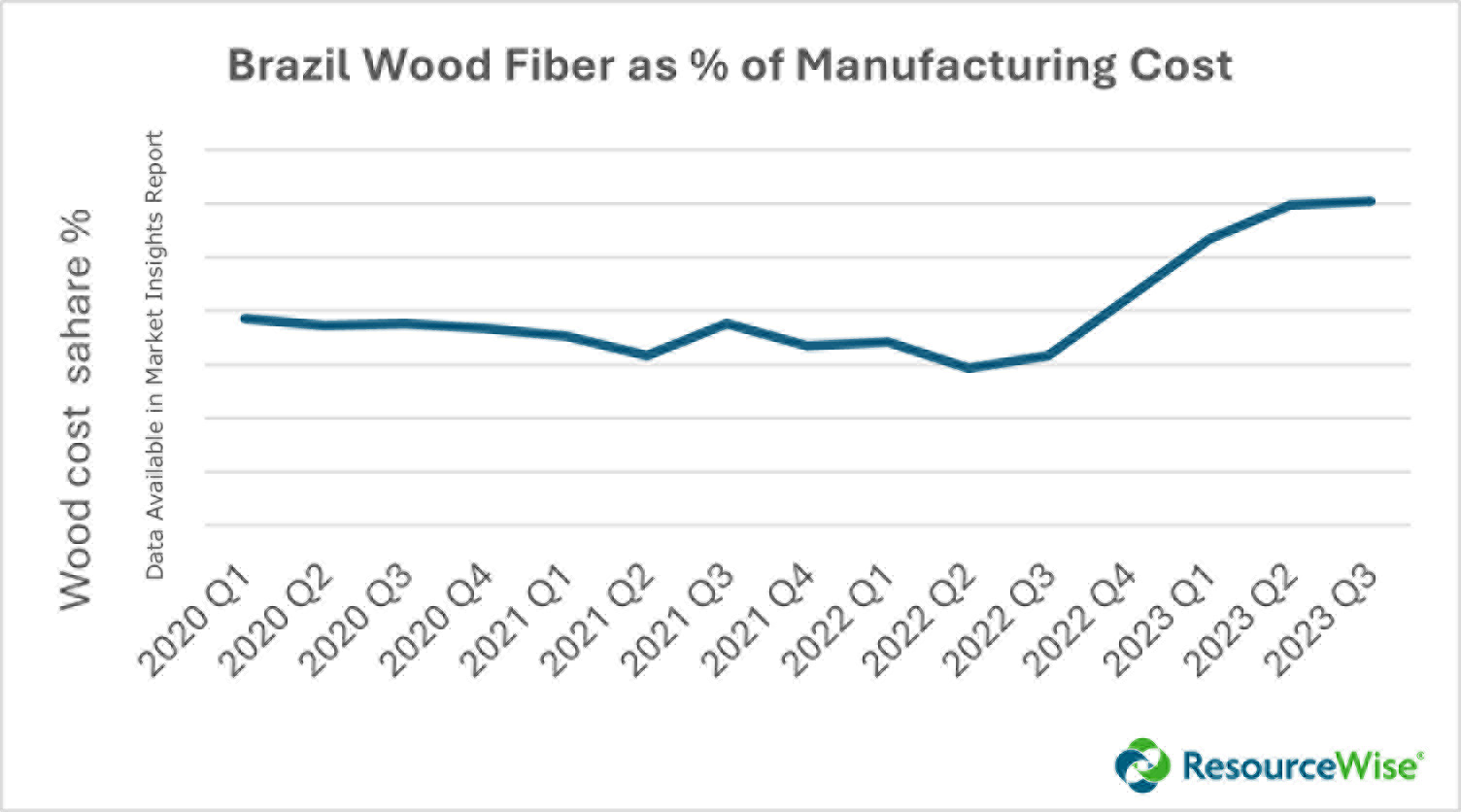

With notable projects like Suzano’s Cerrado project, anticipated to be the world’s largest single-line pulp plant, and Arauco's $3-billion hardwood pulp mill, Brazil's market presents abundant opportunities. However, these new pulp mill investments have led to increased wood costs in Brazil as well.

Why Is Latin America the Leading Producer in Market Pulp?

As noted above, there is an exciting wave of greenfield pulp projects announced in not only Brazil but Latin America in general. For example, Paracel plants to produce 1.5 to 1.8 million tons a year of pulp through its new project in Concepción, Paraguay. The roughly $4 billion project is expected to open by 2027 and will be Paraguay’s first large-scale pulp mill.

What sets Latin America apart as the hub for market pulp projects?

Latin America's favorable climate conditions nurture the rapid growth of trees, creating an ideal environment for efficient pulpwood production. Ample sunshine, rainfall, and fertile soil in this region allow trees to flourish. In addition, Latin America's close proximity to abundant water sources, including prominent rivers, further solidifies its reputation as a prime location for pulp production.

Moreover, Latin America's vast and plentiful land resources play a crucial role in enabling large-scale pulp production. The expansive landscapes offer ample space for cultivating extensive plantations of pulpwood trees. This ensures a reliable supply of raw materials for the industry. This abundance of land also facilitates the establishment of large-scale pulp mills for optimal production efficiency.

Related: An Overview of Latin America's Wave of Greenfield Pulp Projects

What Potential Effects Might Arise from These Developments?

However, with these new developments comes intense competition for land and wood resources. This has propelled land prices, consequently affecting wood costs and potentially leading to increased pulp prices in the coming years.

The recent substantial timberland transactions between major Brazilian pulp producers raise questions about their impact on the country's pulp log prices. Additionally, the notable 62% surge in land prices over the past five years has contributed to heightened wood costs.

For comprehensive insights on Brazil's wood fiber market, market pulp projects, and more, download our complete report.

Audrey Dixon

Audrey Dixon

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)