The European softwood lumber industry has had a tough time since it peaked in 2021. Production has fallen to adjust to declining demand and the European Organisation of the Sawmill Industry (EOS) has forecast that 2024 lumber production is expected to be 12% lower than it was in 2021.

Softwood Lumber Market Dynamics: Challenges and Opportunities

Sweden and Finland are both in the top five of global softwood lumber exporters. Between 2017 and the end of 2023, the two countries combined exported more than 150 million m3 of softwood lumber. Of the 2017-2023 total, Sweden accounted for 60% and Finland for 40%.

Sweden is the world’s third largest softwood lumber exporter after Canada and Russia. In 2023, its total lumber exports reached 14.0 million m3. Finland in 2023 produced an estimated 10.4 million m3 of lumber, of which it exported about 80%.

At the October 2024 International Softwood Conference in Italy, delegates—notably from Europe and Canada--highlighted the low availability and affordability of raw materials as a key challenge.

In the Nordic countries, record-high log prices are hurting sawmill profitability. Gross margins for sawmills in Finland and Sweden are substantially lower than in 2022, as reported by WoodMarket Prices.

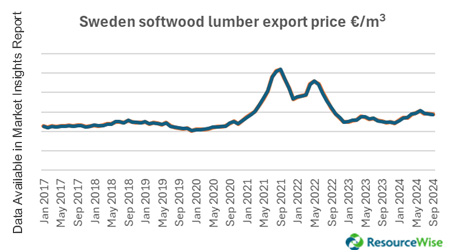

However, on a more upbeat note, Swedish average softwood lumber export prices in the first nine months of 2024 were 8% higher than one year ago and Finland’s prices were 5% higher.

Also, one important market, Japan, appears to be bouncing back amid a strengthening economy, a growing interest in engineered wood and mass timber construction, and pro-wood government policies.

The US market — particularly important to Sweden — holds potential for European exporters as lumber production in western North America is expected to continue to decline. On the other hand, certain policies of the incoming US administration could hamper the construction sector’s recovery, while any import tariffs on softwood lumber would dim the prospects of European producers increasing their market share.

Stay Ahead in 2025 with the Latest WMP Market Insights

The global softwood lumber market is experiencing significant transformations that may redefine industry profitability and growth prospects. For professionals navigating this intricate and changing landscape, having access to reliable and timely insights is crucial. Staying updated can enable you to make informed decisions that address both immediate challenges and future objectives.

To gain a deeper understanding of these changes and explore practical insights, download our comprehensive report, "Nordic Softwood Lumber Exporters Will Gain More Confidence that the Market Has Stabilized if Construction Markets Recover, Although Record-High Log Prices Are Impacting Sawmill Profitability," now to access detailed analysis, pricing information, and market forecasts that can inform your business strategy.

Audrey Dixon

Audrey Dixon

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)