1 min read

A Look at Japan's Declining Softwood Lumber Imports

ResourceWise

:

May 20, 2024 12:00:00 AM

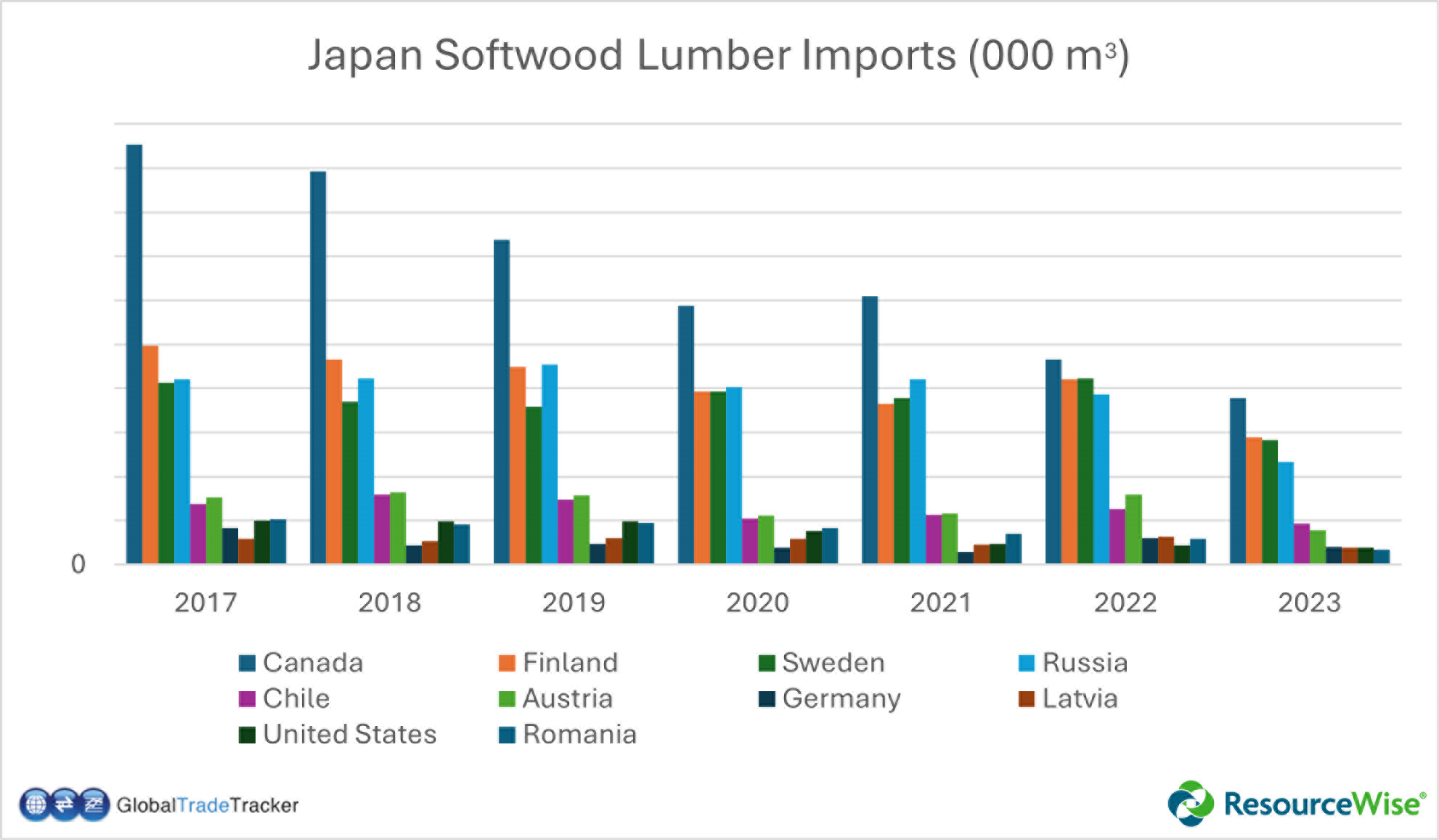

For several years, Japan has been a thriving demand center for softwood lumber exporters worldwide. However, an aging population and a declining birth rate have contributed to the country's declining demand for softwood lumber imports. Lumber imports from prominent lumber-exporting countries such as Canada, Finland, Sweden, and Russia have dropped significantly.

Between 2017 and 2023, Canadian softwood lumber volumes plummeted by about 60%. This notwithstanding, Canadian lumber exports to Japan rose by about 33% in the fourth quarter of 2023 compared to the previous year.

Japan's deep-rooted commitment to environment-friendly practices is evident in its policies supporting green buildings. The country's creative adaptation of traditional practices to modern methods has given birth to an exciting trend—the rise in tall timber buildings. This is considered a natural climate solution that helps to reduce carbon emissions from the construction sector. This has also helped increase the need and demand for timber.

Exploring the Rise of Tall Timber Buildings

In recent years, there has been a surge of interest in constructing tall buildings using mass timber materials to enhance urban density while promoting sustainable construction practices. Globally, numerous buildings now stand tall with over seven stories of timber construction.

In the United States, the 2021 International Building Code (IBC) introduces three new construction types—Types IV-A, IV-B, and IV-C—allowing for the utilization of mass timber or noncombustible materials in buildings reaching heights of 18, 12, and nine stories, respectively. These construction types build upon the previous Heavy Timber construction classification (Type IV, now IV-HT in the 2021 IBC) but with added specifications on fire-resistance ratings and the incorporation of noncombustible protection.

Coupled with this is a growing demand for cross-laminated timber (CLT), engineered wood products like Glulam and LVL, and domestic timbers. Japan's existing building codes and policies also encourage the use of domestically produced timber products, fostering a conducive environment for producing tall timber buildings.

Explore the Details with Market Insights

While Japan's traditional residential construction market may not promise a dramatic future rebound in softwood lumber imports, other avenues are opening up. The country's green building policies and the rise of tall timber buildings offer new opportunities for suppliers to increase their wood use in Japan's non-residential sector.

For a more in-depth exploration of these trends and insights, download our latest market report, "Japan’s Green Building Policies Promoting Wood Use Offer New Opportunities as Housing Demand for Softwood Lumber Trends Down." This report provides detailed information on Japan’s softwood lumber imports and lends some insight into the larger implications of these changes in the global timber industry.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)