In the ever-evolving landscape of the recycled fiber market, staying informed is more crucial than ever. With continuous price shifts and a growing emphasis on sustainable practices, stakeholders must keep abreast of market movements to make strategic decisions.

The recycled fiber market is centered around the processing and trading of materials like OCC and other recovered fibers, which are vital for creating sustainable packaging and paper products, in line with global environmental goals.

This market is known for its volatility with prices fluctuating rapidly due to shifts in demand, regional supply, and economic influences. To maintain a competitive edge, market participants require precise data to comprehend market conditions and evaluate performance.

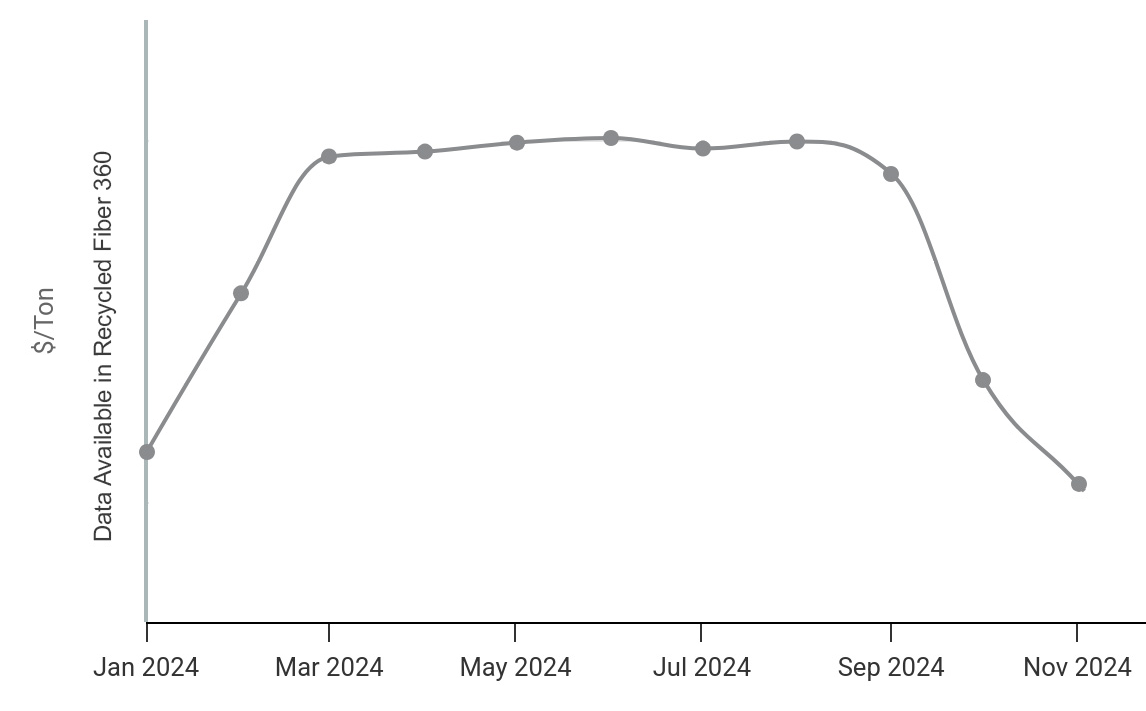

2024 North American OCC Fiber Price Trend

The 2024 market for OCC in North America experienced significant and noteworthy price fluctuations, as highlighted by ResourceWise's transaction-based benchmarks, Recycled Fiber 360.

Source: Recycled Fiber 360

At the beginning of the year, from January to March, there was a sharp and rapid increase in prices, reflecting a surge of 20-25%. This upward trend was driven by a combination of factors, including heightened demand and constrained supply, which pushed prices to new heights.

As the year progressed into the summer months, prices increased about 20% from the start of the year and then stabilized, maintaining a steady level that provided a temporary sense of predictability for stakeholders.

However, in the fall and winter months, the market saw a notable decline, with prices falling approximately 18% from August to November.

Key Trend Breakdowns

1. Price Trends by Region

Regional price variations have also characterized the market this year. In particular, the Northwest region experienced significant volatility.

At the beginning of the year, the Northwest was identified as one of the regions with the lowest prices. However, as the year progressed, the region saw a dramatic increase in prices, peaking around mid-year.

Despite this mid-year peak, the Northwest did not maintain its elevated price levels for long. By August, prices had dropped significantly, returning to one of the lowest positions in the market.

2. Price by Source

In 2024, OCC fiber prices exhibited a consistent trend based on their source. From January to March, prices increased by about 20-25% and then stabilized through the middle of the year. Commercial/Industrial prices experienced the most noticeable movement.

Source: Recycled Fiber 360

Source: Recycled Fiber 360

3. Indexed vs. Open-Market Pricing

Indexed prices—linked to formal contracts—differed from open-market prices at different points throughout the year. Open-market transactions showed more volatility but consistently remained slightly higher than index-based prices. This divergence presents opportunities for businesses to negotiate better contracts by leveraging clear market trends.

4. Exporting Trends

India's CIF import prices started strong at $225/ton in January, peaked mid-year, then dropped below $175/ton by November due to reduced demand, oversupply, and trade changes. Similarly, US export prices from New York and Los Angeles were stable in the first half at $175-$190/ton. However, they declined in the third quarter, mirroring India's trends and indicating global market saturation.

This highlights the interconnectedness of markets and raises concerns about global demand, urging stakeholders to monitor demand, diversify markets, and use tools like Recycled Fiber 360 to adapt.

The Value of Real-Time Data

Staying updated on recycled fiber price changes is crucial for businesses operating in the recycled fiber market. With data from ResourceWise's Recycled Fiber 360, companies can gain a comprehensive understanding of market trends and fluctuations. This knowledge is essential for making informed business decisions, as it allows companies to anticipate cost changes, adjust pricing and fiber purchasing strategies, and optimize supply chain management.

Understanding monthly changes in recycled fiber prices can significantly impact a company's bottom line. By analyzing these trends, businesses can identify patterns and predict future price movements, enabling them to adjust their procurement strategies proactively. This foresight can lead to cost savings and improved profit margins as companies can purchase materials at more favorable prices or adjust their inventory levels to avoid overpaying during price spikes.

Moreover, staying informed about price changes helps businesses remain competitive. In a market where margins can be tight, having the latest data allows companies to offer competitive pricing to their customers while maintaining profitability. It also aids in negotiating better terms with suppliers, as businesses can leverage their knowledge of market conditions to secure more favorable contracts.

Unlocking Market Insights with ResourceWise's Recycled Fiber 360

ResourceWise's Recycled Fiber 360 platform stands as an indispensable tool for businesses navigating the complexities of the fiber market. By enabling users to confidently negotiate fiber prices, it bridges the critical gap between traditional indices and real-time market data.

The platform's advanced data visualization capabilities empower users to make informed decisions swiftly, keeping them ahead of the competition. By tracking market momentum and aligning with the industry's digitalization needs, Recycled Fiber 360 enhances operational efficiency and positions businesses for sustained success in an ever-evolving market landscape.

To gain insights into price movements and remain informed about upcoming trends, Recycled Fiber 360 provides the necessary data. Learn more about Recycled Fiber 360 today.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)