3 min read

2023 Recap: SYP KD Lumber Prices Fall to 2019 Lows as Economy Slumps

ResourceWise

:

Dec 8, 2023 12:00:00 AM

As 2023 finishes out, SYP KD lumber prices have steadily fallen to levels not seen since 2019. With economic factors showing a potential recession on the horizon, should we expect a similar downward trend into 2024?

Despite Lows, Once Volatile Wood Market Sees Some Stability in 2023

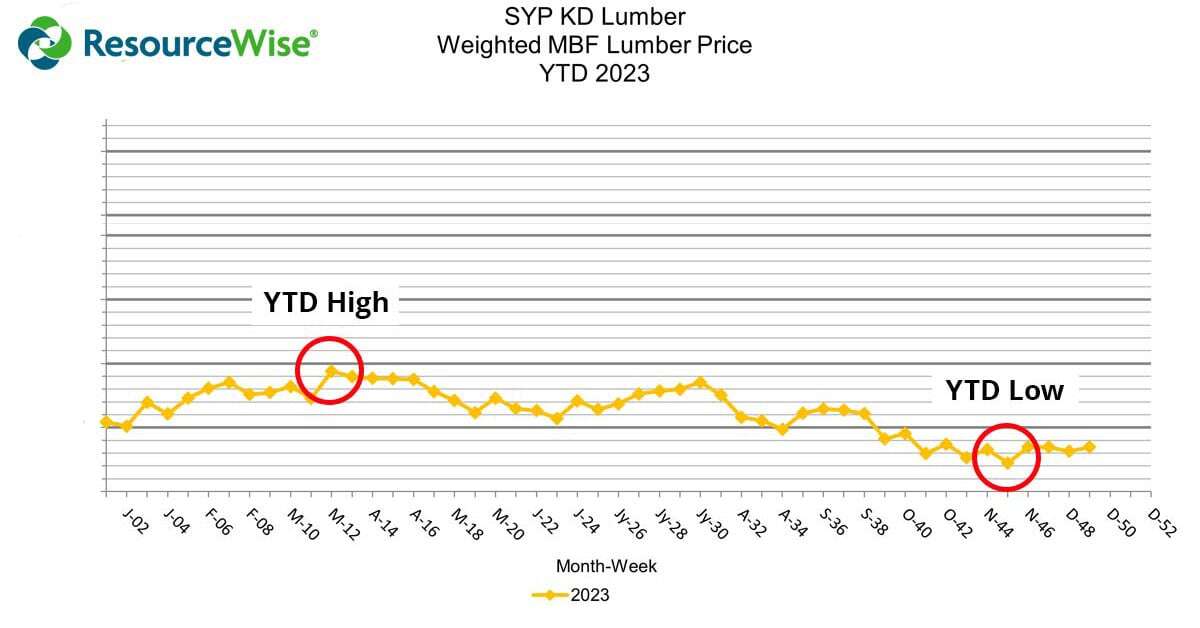

SYP lumber prices have experienced a slow but steady decrease across most of 2023. At the start of the year, prices posted right around the $400/MBF level. Price levels then fluctuated within the $400 to $500 range, with the high point occurring in March and low in November (see graph):

Toward the end of September, prices dropped below $400/MBF and have remained under that threshold since then. These levels reflect lows not seen since 2019.

When put together, 2023 prices were higher on average, although much closer to the 2019 prices compared to the years in between.

The pandemic ushered in a period of economic upheaval across the board, with wood markets bearing much of the impact. In 2020, 2021 and 2022, we saw much wilder, inconsistent and unstable price levels with enormous peaks and valleys (such as the 66% fall from May to July in 2021).

Stabilization in pricing, within a $100/MBF or so range, suggests a calming trend this year. However, the ongoing price drops reflect both an ample supply of lumber feedstock and some economic anxiety from manufacturing and other industries.

Economic Data Suggests Ongoing Uncertainty with Recession Fears Lingering

The decrease in prices in the SYP lumber sector reflects a broader level of uncertainty across the economy.

Many forecasters (ResourceWise included) have seen the writing on the wall and predict an imminent recession. As the data shows, confirming a recession is more likely a matter of when it will happen as opposed to if it will happen.

Related: The Verdict’s Out: We’re in the Starting Phase of a Recession

As far as recent data goes, the federal funds rate (FFR) remained in a range between 5.25% and 5.5%. Moreover, the FOMC left the FFR unchanged on November 1 as “the risk of doing too much [in terms of rate hikes] versus the risk of doing too little is getting closer to balance,” Fed Chair Powell argued in a statement.

The Treasury Department dropped a “financial bomb” when it reported the deficit for fiscal year 2023 (which ended on September 30) was $1.7 trillion. This marks a 23% growth only within the last year—a gravely serious incurrence of debt. To make matters worse, the Treasury used $879 billion (i.e., 52% of the deficit) just to service the federal debt.

The Federal Reserve’s rapid rate hikes since February 2021 are exacerbating the problem by causing federal debt-service costs to skyrocket. That type of debt is rolled over at higher yields, worsening the problem.

“This spiraling process: runaway deficits leading to more debt leading to higher inflation from monetary expansion, is a doom loop,” wrote Stormwall Advisors’ Michael Wilkerson. “Now that we’ve entered it, how do we get out? … [I]nstead of price stability, we can expect to see inflation return with a vengeance as the Fed is forced to reverse course on interest rates.”

Although Wilkerson’s point about resurgent inflation is well taken, one must remember the Fed controls only the short end of the yield curve. This is essentially just the overnight rate. Ultimately, it will be the market, and its control over longer-dated rates, that may force Congress to get its fiscal house in order.

To speak further to the market, the latest 30-year Treasury auction saw a yield spiking above 4.8%. This marks the highest level since the Great Recession, fanning the flame on further concerns that we’re headed down the same path right now.

Lowering Demand in Pulp and Paper Reflects Broader GDP Sentiment

Within pulp and paper, slowing demand for cardboard boxes may also be a harbinger of a coming recession. Paper output, 73% of which is packaging, is down 17.5% from January 2020 (just prior to the pandemic lockdown) and 14% from January 2021 (post-pandemic high).

“I’ve been referring to this as a cardboard box recession,” Charles Schwab’s Jeffrey Kleintop said, “because things that are manufactured and shipped tend to go in a box and because demand for corrugated fiberboard, which is what most cardboard boxes are made from, has fallen just like it did in past recessions. So, literally, cardboard boxes are in a recession.”

ResourceWise’s GDP model reflects slowing growth into the first half of 2024—with contraction during the second half. We forecast a return to consistent but anemic growth into the first quarter of 2025. Quarter-over-quarter changes will average +2.6% in 2023, zero average growth across 2024, and +1.2 growth in 2025.