3 min read

The US Now Has the Largest Share of Chinese Used Cooking Oil Exports

ResourceWise

:

Oct 27, 2023 12:00:00 AM

The UCO market has seen some immense changes related to its trade flow. Chinese exports have now shifted its sights to the US in a big way. In fact, the US has now become the single biggest export destination for China’s UCO exports.

Shifts in UCO Volume at Levels Never Before Seen in US

According to ResourceWise data, UCO export volume from China to the US was already growing quickly over the last several months. However, it has seen an even more significant jump between August and September.

China provided 54% more UCO to the US markets in September than in August. This number comes second only to July’s export amount. These trends show that the demand for UCO has gone up substantially throughout 2023.

To put things in perspective, this time last year showed practically zero UCO exports to America. However, the trade flow began kicking up toward the end of Q4 2022. Since then, we’ve seen extraordinary jumps in US demand.

Chinese Exports Fueling Renewables Across the World

Despite the record-setting volume, the amount of UCO received by the US from China was only 38% of the country’s total exports.

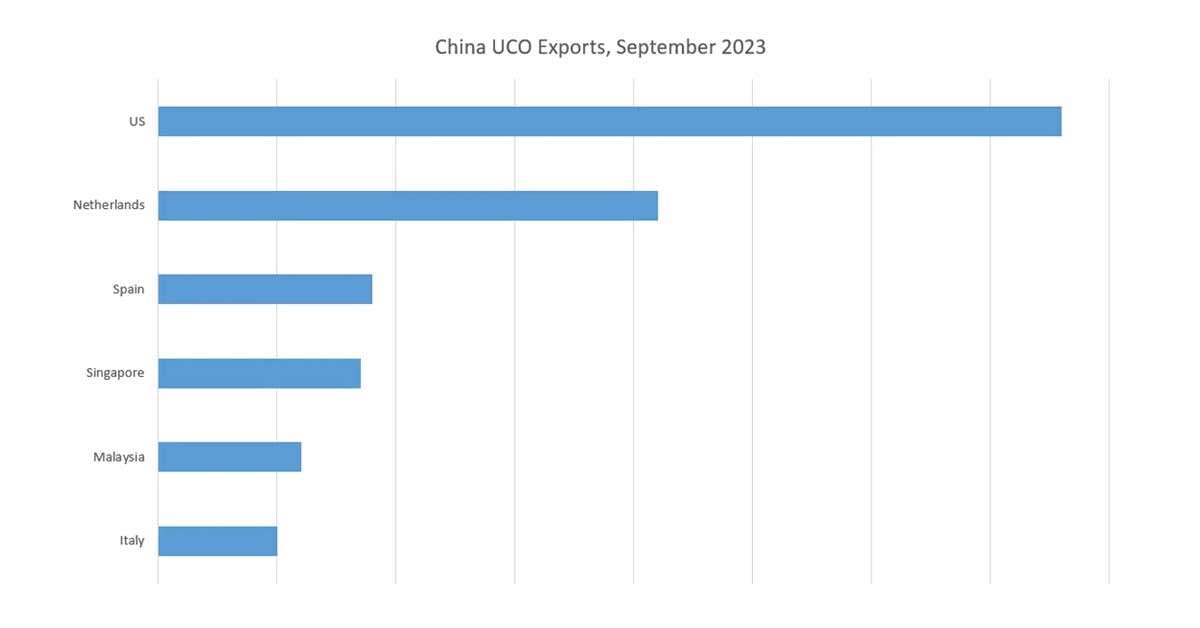

As the global leader in UCO production, China is helping lead the charge to shift to renewables for many countries. September’s exports were up 25% across the board compared to August and only -1% down from the same time last year. The Netherlands was second on the list of Chinese UCO exports, followed by Spain, Singapore, Malaysia, and Italy (see chart).

(Source: China Customs Data)

Inflation Reduction Act Leading the Charge to UCO and Renewables

Investment in renewables like UCO is quickly growing in the US thanks to the provisions of the Inflation Reduction Act (IRA). Various incentives in the IRA have led to this emerging UCO market—now worth nearly $390 million dollars per a Reuters report.

The uptick of UCO shipments began in Q4 2022, but they really started taking off right around the 2023 New Year. The IRA includes various incentives to promote the production and adoption of clean energy. This includes benefits like tax credits for producing sustainable aviation fuel and perks for biodiesel creation.

Related: Inflation Reduction Act Bringing Clean Energy to Rural US

These incentives explain the main driving force behind the adoption of renewables: economics. Right now, many companies are taking advantage of the benefits the IRA offers to early adopters. As standards and requirements continue to ramp up, we'll see continued benefits to transitioning and integrating renewable feedstocks like UCOs.

The IRA currently offers a tax credit of $1 per gallon on biodiesel production. This number is even higher for SAF with a potential $1.75 per gallon credit when carbon reduction hits a 50% threshold.

Related: Inflation Reduction Act & Sustainable Aviation Fuels: Come Fly with Me?

UCO fits the bill in helping make this biodiesel shift possible. With a lower price than many alternatives, it provides nearly the same energy potential as traditional petroleum diesel fuel. And it does so while reducing emissions by upwards of 80%.

Competition for UCO Likely to Rise as China Faces Fraud Allegations in Europe

With all these potential savings in mind, how will the markets continue to shift? Right now, US producers are jumping on Chinese UCO in droves. But this may change in the near future as competition ramps up in the carbon transition.

According to the Green Diesel North America report (available in Prima CarbonZero from ResourceWise), we may see challenges to current UCO exports. Chinese biodiesel exports to Europe are facing investigations after a flood of the product hit their markets. Producers are accused of fraud in the products they export with potential mislabeling of the actual constitution of feedstocks like UCO.

Some experts forecast this investigation to confirm these allegations. If this is the case, we’ll likely see a sharp drop in biodiesel exports out of China. European producers will then likely enter into play to fill in the market gap. Accordingly, European feedstock and biofuel producers could expect a proportional growth in demand for their offerings.

Depending on this outcome, European producers may then return to the UCO market and increase their demand for exports primarily to the US. The increased competition will probably impact demand, prices, and eventually margins.

How much this could affect the US market is too far into the future to tell. But the main takeaway is that we’re gearing up to see some fireworks in UCO exports in the coming months.

Unlock Vital Biofuel and Feedstock Data with Prima CarbonZero by ResourceWise

Data and insights from this post came from the Weekly Green Diesel North America report available in Prima CarbonZero from ResourceWise.

Prima CarbonZero is an online biofuel and sustainable feedstock analytics platform.

Our weekly price reporting data offers week-over-week tracking on all critical green diesel markets across Europe, North America, and South America. International ethanol and vegetable oils data give you a clear picture of where the market has moved from and where it currently sits. And insights from our industry experts can help you understand how the market is moving so you can plan accordingly.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)