4 min read

The Global Energy Crisis and Its Strike Against the P&P Industry

Luis Sampaio

:

Nov 3, 2022 12:00:00 AM

Luis Sampaio

:

Nov 3, 2022 12:00:00 AM

Just like a pilot’s worst nightmare is being stuck in the middle of a storm with no instruments to navigate the turbulence, a company’s worst nightmare is a volatile socio-economic market with no concrete plan set in place or tools to devise one.

The latest developments regarding the “sabotage” of the Nordstream pipelines make it very unlikely, if not impossible, that this natural gas crisis will be over in the short term. Recently, prices have jumped by 7% in Europe and 3% in the UK amid concerns over security of supply.

Energy companies have been told over the last several months to fill their gas storage, “no matter what cost” to survive the winter – which means gas prices have been through the roof. However, now that storage is full, prices have started to drop back to the €100/mWh range.

In the meantime, EU governments have done their best to keep their economies stable and running despite the ongoing issues. For example, Berlin just announced a massive €200 billion support program fueled by new debt with its primary goal to support energy intensive industries such as pulp and paper. The exact amount of energy to be subsidized remains to be settled but is looking to be as much as 80% of last year’s consumption.

This has sparked unrest in other EU countries who are afraid that this might upset competitiveness within the EU community. Early this month, Chancellor of Germany Olaf Scholz and French President Emmanuel Macron got together to discuss this particular topic as fears grow that Germany will use its economic muscle to outbid the rest of the EU for gas supplies this winter. Shortly after, European Commission President Ursula Van der Leyden proposed to EU country leaders that the European Union should consider imposing a temporary limit on gas prices and look at a specific cap on the cost of gas used to generate power. “We should consider a price limitation in relation to the TTF in a way that continues to secure the supply of gas to Europe and to all Member States that would demonstrate that the EU is not ready to pay whatever price for gas,” von Der Leyen said, referring to the Dutch Title Transfer Facility (TTF) gas price.

While this intervention seems to be a strategy to control prices in a unified manner for the EU, one has to remember that price caps may cause imbalances in supply since global energy is such a competitive market.

How has this gas crisis in Europe impacted the Pulp and Paper industry so far?

Because the energy crisis has left many parts of the P&P industry in a fragile state, we have seen a number of mill shutdowns and curtailments occurring. Some of the many mills impacted include:

- Nordic Paper’s Greaker mill halted production for three days and is estimated to have marginal financial impact on the results of the company in 3Q2022.

- Metsa Tissue’s Kreuzau mill and Zilina mill had to curtail its production for several days. These curtailments could affect the availability of tissue paper products.

- Lessebo Paper was forced to halt production as the electricity cost has unprecedently increased from €3 million to €19 million per year.

- Smurfit Kappa opted to cut production by some 30,000-50,000 tonnes in August because “with the current price of energy there’s absolutely no sense whatsoever to make stock.”

- Toilet paper manufacturer Hakle has filed for bankruptcy due to high energy costs that could not be passed on to the final customers.

- Arjowiggins Group’s UK operations – including the historic mills at Stoneywood and Chartham – were placed into administration after the business become unsustainable in the face of spiraling costs for energy.

- Lecta is to take temporary downtime at several paper mills due to energy costs and weaker demand. A combined capacity of 1.7MT is expected to be lost. The mills which are to be stopped have not yet been disclosed.

What might happen in the future? How many more companies could be on the verge of closing?

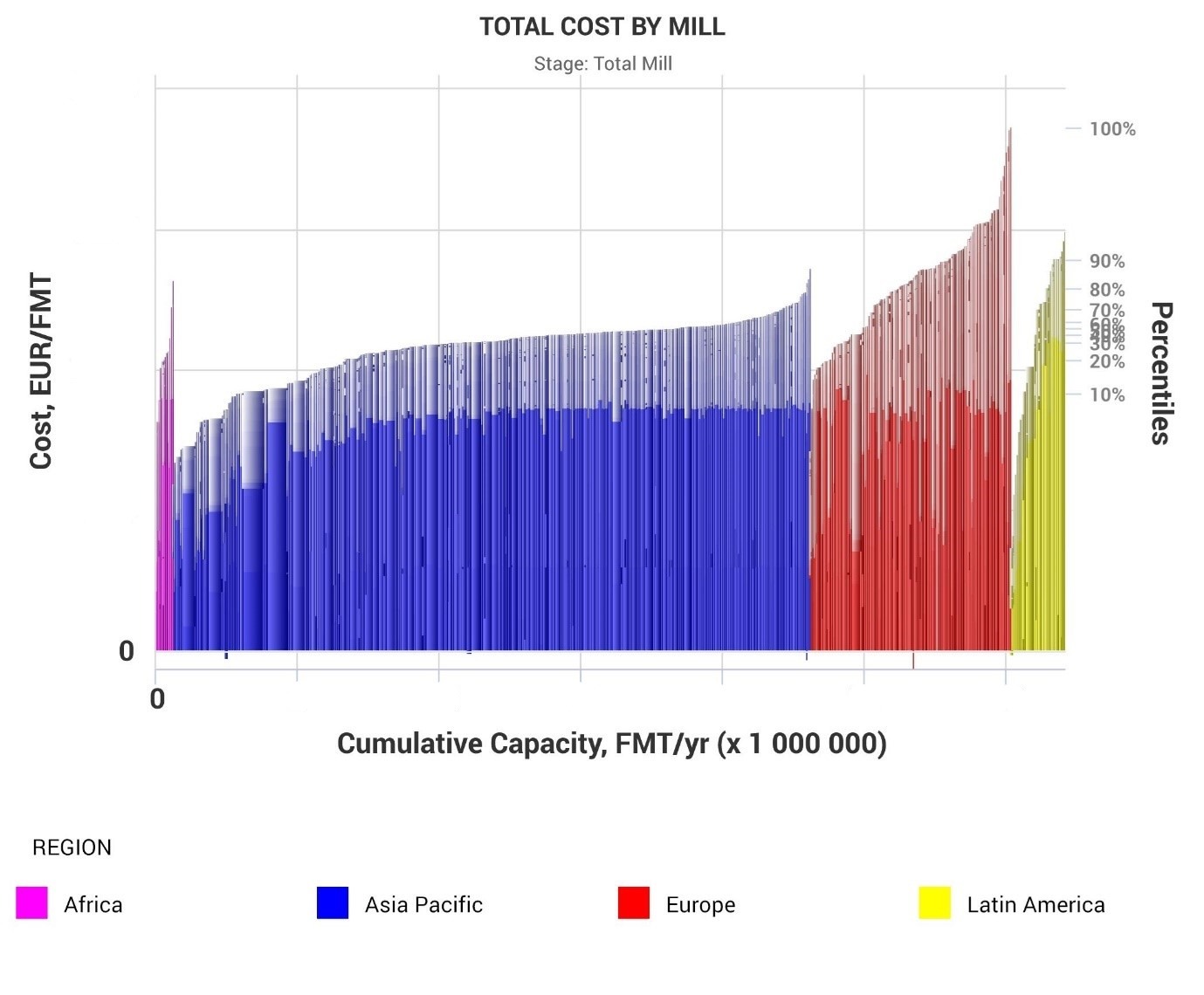

When focusing on tissue, a grade that is dependent on natural gas for paper drying, there are currently 2.4MT of tissue paper mills sitting in the 4th quartile of the cost curve for being at risk due to high costs. Making a conservative assumption that 30% of the mills located in the last percentile will not survive the strong impact of these gas costs and will have to shut down machines (both temporary and permanently), this means that roughly 720KT of capacity could be removed. Countries with highest cost pressures are mainly the UK, Germany, Italy and France.

This tonnage will have to find a supplier soon or we might see a repeat of the COVID era in the supermarkets with empty shelves– although this time it won’t be from panic buying, but because some mills won’t have enough available gas for production, or the costs of production will be too high due to energy cost increases becoming unsustainable.

This tissue scarcity would then force producers to pass on the increase to the consumer, but one has to understand the extent to which this is sustainable before the European market starts to see non-EU producers with much lowers costs making profit off this.

Right now, some producers from remote locations with much lower energy costs can already be competitive, even taking into account the cost of $200/t for transportation.

The overall price of tissue will eventually be dependent upon the outcome of prices for gas, electricity, chemicals and other raw materials, along with the price imposed by new entrants into the European market. They say tissue doesn’t travel well, but unless the EU imposes import duties to protect their markets, North African, Latin American, Asian and US players will be watching for opportunities to increase their margins with European sales.

With costs of the mills producing on the 4th percentile of the cost curve for tissue at over €1,500 per ton, these mills will be an easy target for more competitive players outside of Europe, even with the logistic costs factored in.

Source: FisherSolve

Source: FisherSolve

However, because prices for shipping containers are finally dropping back to normal pre-pandemic levels, this means that the European industry can handle competition from remote locations able to pay lower logistics costs.

At the same time, it seems that tissue reels for sale in Europe (and neighboring countries) have disappeared from the market. Could producers, integrated and non-integrated, be already stocking for the coming winter in expectations of scarcity in Central Europe to sell their reels at a better price?

More importantly, how are you preparing for the looming storm? Do you have clear vision of your options?

In order to better prepare for the uncertainty and turbulence ahead, Fisher International’s expert consultants and highly detailed business intelligence system FisherSolve can help you:

- Find a network of new potential new partners.

- Evaluate your position in terms of energy and other costs regarding your competitors. Which companies are under pressure? Which one’s are not?

- Understand the trade dynamics (integrated vs non-integrated, virgin vs recycled) and which markets are the most attractive for non-European newcomers.

- Understand the future scarcity by region and/or create what-if models with different local government subsidies.

- Run price models forecast scenarios for certain grades as mill capacity is taken out.

In the middle of the storm, FisherSolve helps you to find your way through with a clearer outlook into the market ahead. Contact us for more details today.

About the Author:

Luis Sampaio has spent over 15 years of his professional career in the European pulp and paper industry focusing on strategic and consultative sales, growth initiatives, management strategy, production and cost structure, and key account management.

At Fisher International, Luis leads sales and support for our Eastern European client base which includes the top producers in the region, providing advanced business intelligence resources as well as leveraged consulting services.