3 min read

Germany Records Highest Ever Biodiesel Exports with 55% Increase to US

ResourceWise

:

May 11, 2024 12:00:00 AM

Germany's production output for biodiesel has set a new record—and created a noteworthy shift in the biofuels market.

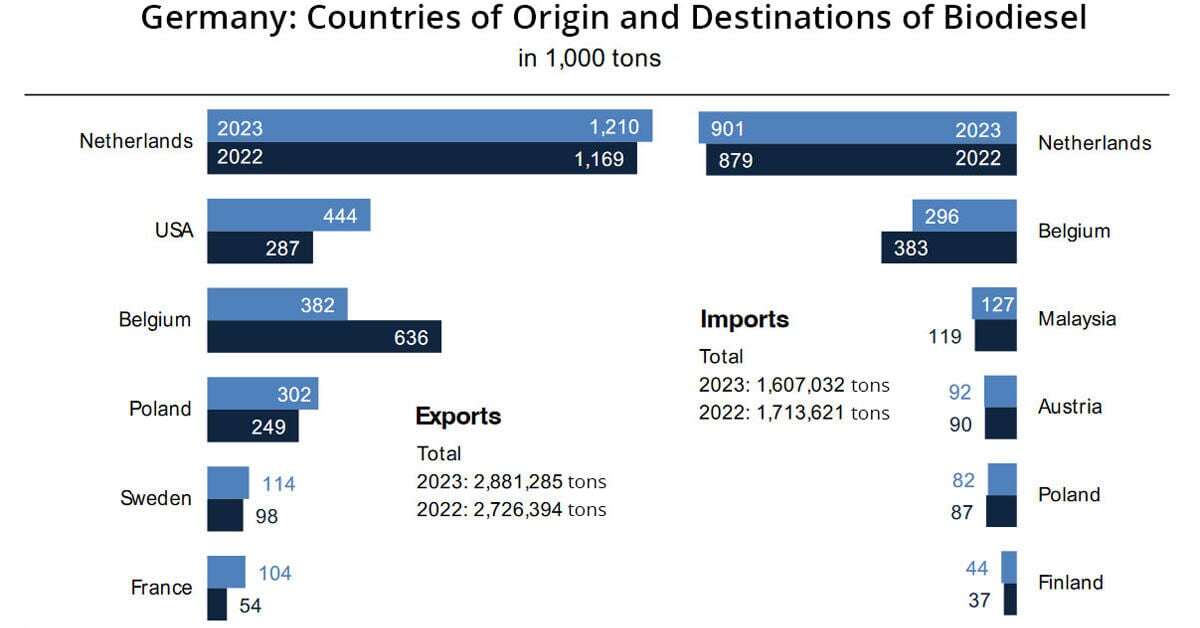

According to Biofuels International, Germany recorded the highest-ever export of biodiesel in 2023 at around 2.9 million tons.

On the flip side, biodiesel import figures showed a drop of 6.2% compared to the previous year. An estimated 1.6 million tons were brought into the country.

For clarity's sake, this data excludes the import of HVO, which is not produced in the country. Around 0.48 million tons of HVO were imported in 2023.

Top Importers of German Biodiesel: Netherlands and the US

The Netherlands, a global destination in biofuel trade (owing to Rotterdam's strategic position), held its position as Germany's leading biodiesel trade partner.

Both the US and Poland also recorded a surge in trade. Most notably, the US saw a huge boost with a 55% jump to 444,100 tons. This moves the US up as the second-highest importer of German biodiesel next to the above-mentioned Netherlands.

However, imports to Belgium drastically fell by about 40% to 381,800 tons. Amidst these shifts, Germany set a new milestone with biodiesel exports reaching a record 2.9 million tons. The total output was about 3.9 million tons.

German Quota Policy, Efficiency Contributes to Rise in Exports

Based on a report from the Union for the Promotion of Oil and Protein Plants, or UFOP, the robust trade in biodiesel can be attributed to Germany's GHG quota policy and the race for GHG efficiency.

A significant portion of total biodiesel consumption in 2022 (HVO included) came from waste oils and fats. The numbers accounted for around 60% of the total 2.54 million tons consumed.

Germany's greenhouse gas (GHG) quota policy and the robust competition for GHG efficiency have become serious contributors to the broader resource trading market. As the latest assessment by the German Federal Office for Agriculture and Food (BLE) notes, these trends are the anticipated results of ongoing environmental regulations.

In 2022, biodiesel and HVO derived from waste oils and fats totaled around 1.57 million tons. It was made up of roughly 60% of the aggregate consumption of approximately 2.54 million tons.

The UFOP predicts that the consumption figure for 2023 is around the 2.62-million-ton mark. Those levels maintain a comparable proportion of waste-based biofuels.

German Biodiesel Exports May Impact the Country's Own GHG Goals

The UFOP also says that exporting over 1.28 million tons of biodiesel may have some unintended effects on national emissions objectives.

Any exported biodiesel no longer counts toward meeting the national GHG quota obligation in Germany. As a result, the fuel will not contribute toward the GHG goals for the transport sector.

The implications suggest that producers will need to better consider their domestic responsibilities as well as their export demand. This is especially important as no new investments in biodiesel or HVO production facilities are currently expected in Germany.

While UFOP encourages the promotion of synthetic renewable fuels and hydrogen, they maintain that achieving the targets set for 2030 and 2040 requires supplemental solutions. They cite shipping and especially aviation as two additional sectors that need to be addressed. The latter has continued to generate buzz thanks to all the adopters and producers of sustainable aviation fuel (SAF) globally.

Read More: SAF Market Booming as More Companies Shift to Renewables

Dip in German Wood Exports Could Impact Biodiesel

Biodiesel is not the only resource experiencing such a dramatic export shift in Germany. In fact, the country’s softwood log market has undergone some dramatic changes in the last few years.

According to a report from ResourceWise’s Forest Products division, exports of softwood logs have seen sharp declines since an enormous peak in 2020. Various factors, such as beetle infestation and economic decline, also contributed to the fall.

Read More: Navigating Germany's Softwood Log Market: Trends and Challenges

Wood demand and production continue to generate attention as a major renewable source for the production of biofuel. The current situation in Germany’s softwood log market may also play a role in the future of the country’s biodiesel production.

Get Market Intelligence and Expert Insights for Your Carbon Transition

Germany’s current trends in biodiesel will have resonating impacts on the global biofuel market. Understanding these market movements will play an enormous role in the pathway to decarbonization.

That’s why your business needs the best possible data and intelligence for strategic decision-making.

ResourceWise’s Carbon Mitigator report provides a wealth of pricing data, insights, and intelligence. This critical market intelligence will help you understand trends, identify opportunities, and successfully decarbonize your value chain.

The Carbon Mitigator is only available in Prima CarbonZero, ResourceWise’s online low-carbon fuels and feedstocks platform. Click the link below to learn more and schedule a demo to see all the ways our solutions can work for you.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)