3 min read

Canada’s New Plastic Ban Could Drive Renewed Interest in the P&P Industry

Fisher International

:

Jul 18, 2022 12:00:00 AM

Consumer awareness about excessive plastic pollution and its hazardous effects to the environment has intensified in recent years, and we are beginning to see more countries begin to impose bans in an attempt to significantly reduce plastic pollution.

On June 20, Canada’s government announced its plan to ban the manufacture and importation of single-use plastics by the end of the year in a major effort to combat plastic waste and its effects on climate change. This ban will apply to checkout bags, cutlery, straws and food-service ware made from or containing plastics that are hard to recycle – excluding a few exceptions for medical reasons. It will take effect in December 2022 with sales of the mentioned items prohibited as of December 2023 in order to give the country enough time to transition and deplete existing stocks.

According to the Canadian government, single-use plastics make up most of the plastic waste found on Canadian shorelines; up to 15 billion plastic checkout bags are used each year along with 16 million straws used every day. Once the plastic ban is in place, it is expected to eliminate more than 1.3 million tons of plastic waste over the next decade – which is the equivalent of 1 million garbage bags of trash.

In addition, Canada will also prohibit the export of single-use plastics by the end of 2025 as an extensive step to ensure the reduction of plastic pollution worldwide. However, Sarah King, Head of Greenpeace Canada’s oceans and plastics campaign, stated that while Canada’s ban is a critical step forward, there is still lots of room for improvement. “The government needs to shift into high gear by expanding the ban list and cutting overall plastic production. Relying on recycling for the other 95% is a denial of the scope of the crisis.”

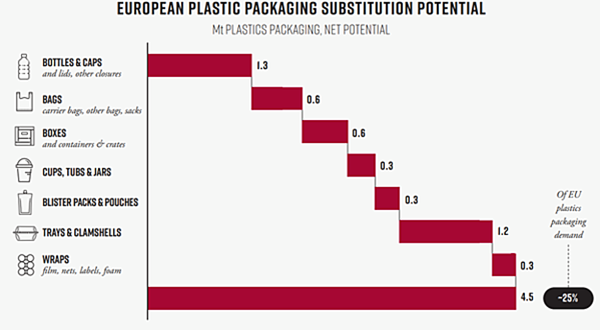

The Pulp and Paper industry now has a major opportunity to step in and supply replacement products in numerous segments that once heavily relied on plastic.

Source: Material Economics

Source: Material Economics

In order to capitalize on the moment, Pulp and Paper participants need to first identify areas of new investment as plastic substitution continues over the next few years. Availability of paper and pulp by grade and by region can be analyzed using the FisherSolve platform to model estimates of additional capacity needs and possible machine conversions.

When taking a closer look at this, we project that virgin and recycled paperboard will see a significant increase in demand, as paper food-grade containers and paper cups replace plastic over the next five years. Through the numbers obtained through FisherSolve, we can say that for the US, replacing 56 billion plastic and Styrofoam drinking cups would take roughly 758,000 tons of SBS paperboard.

In addition, to satisfy increased demand for paper and pulp in place of plastic, capital investment in new capacity will be required as well. The industry uses about 60-70% of virgin bleached hardwood pulp in producing SBS. This means that investment would likely increase in hardwood pulping mills if more producers in Canada were to produce SBS using today’s cost-effective process. Softwood could also potentially see an increase in production if refined, however it’s more expensive to do so. Another investment opportunity could be recycled fiber – if the company producing the product had it tested and cleared for use by the FDA as most recycled fibers are contaminated with various chemicals and materials.

While there appears to be better opportunity in using the aforementioned materials, if companies did decide to use and invest in virgin pulp from new pulp mills, there is plenty of fiber availability in certain wood baskets across the US and Canada, meaning those areas could see a noticeable increase in demand. Also, an additional consideration relating to fiber supply is the intention of companies like Apple and Samsung to source packaging materials from sustainably-managed forests, as defined by organizations like the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certifications (PEFC).

The anti-plastics movement continues to gain traction in the marketplace, and the range of traditional and new packaging materials available to replace plastic present important questions and opportunities for the pulp and paper industry. A few issues to consider include:

- If more pulp is required to meet demand for paperboard and molded fiber packaging, will pulp prices increase to a point that fiber-based alternatives to plastic become cost-prohibitive?

- What will be the pace of new investments and substitutions of plastics globally?

- Will fiber from sustainably-managed forests be enough to support growth in pulp and paperboard?

For further insight into how sustainability trends could affect the pulp and paper industry, click below to read Fisher International’s complete study “Plastic Replacements Driving Sustainability Trends in Pulp & Paper Industry.”

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)