3 min read

Plasticizers and Their Raw Materials: eBook of Mid-year Analysis

Tecnon OrbiChem

:

Jun 26, 2023 12:00:00 AM

Plasticizer market participants and producers within the sector's supply chain – plus raw materials producers – began the year with breath baited. And that looks to be the default position still since no significant shift in demands or markets has materialized thus far this year.

Could a fresh out of extreme lockdown measures in China help kickstart the wider global economy? And if so, how might the shifting dynamics in this key chemical market play out, we wondered? Well, in 2023 we wait still. And now it seems, we may be forced to look to 2024 or even beyond for the seeds of recovery we had all pinned our hopes upon.

That's the message emerging from Tecnon OrbiChem consultants Rachel Uctas and Carol Li – based in Europe and China respectively – at the turn of the year.

Their observations of plasticizer markets – including DOP, DOTP, and the feedstock 2-ethyl hexyl acrylate (2-EH) – have uncovered the odd anomaly in demand. These applications and geographically driven market movements are fully explored in our free-to-download eBook.

'...Plasticizer and oxo-alcohol markets are in a stagnant state globally...'

Tecnon OrbiChem senior consultant Rachel Uctas

Plasticizer and oxo-alcohol markets are in a stagnant state globally. Consequently, prices remain low. As we moved through H1 2023, downstream stock levels turned out to be more than sufficient for demand level.

Plasticizers' Propylene Proposition

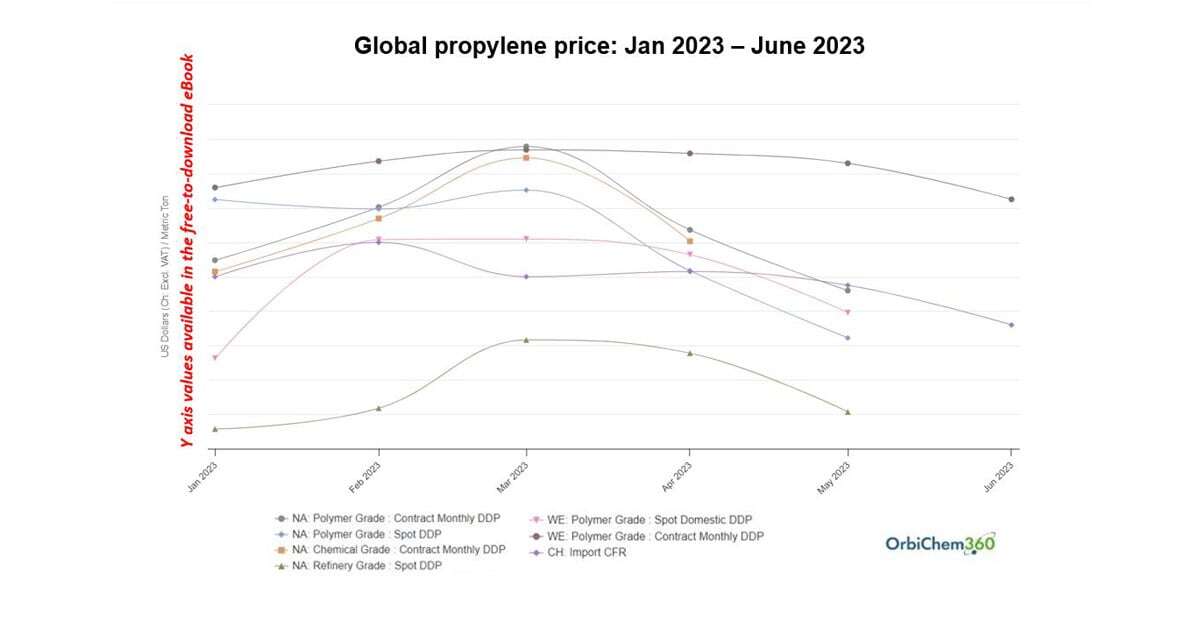

The cost of propylene – as shown in the graph below – has been volatile this year so far. Whilst market participants globally have come to expect these price peaks in Europe, March was characterized by a substantial rise in US prices too – one particular stateside price point even topping the highest European.

Source: Tecnon OrbiChem

"...there were some increases in 2-EH imports to China early in 2023 compared to 2022 and China's export of DOP near doubled 2022 a four-month 2022 timeframe..."

Tecnon OrbiChem senior consultant Carol Li

Is a Chinese 'Revenge Spend' Still Possible?

China's zero-covid restrictions – which really only ended earlier this year – subdued domestic demand for plasticizers throughout 2022. Of course, wider economic challenges – including the global energy squeeze triggered by Russia's invasion of Ukraine – played their parts in softening demand for China's feedstocks too.

Consequently, the DOTP market became very long with operating rates adjusted down to around 50%. A number of new DOTP plants were also delayed. But the overcapacity already in the Chinese market as 2023 got underway meant that even in the event of a significant rebound in its markets, there would be little need for imports from other countries in Asia.

Tecnon OrbiChem's data intelligence platform OrbiChem360 indicates some import increases for 2-EH in 2023 compared to 2022. (Marked declines in the movement of plasticizer raw materials too.)

Source: Tecnon OrbiChem

Our China-based consultant Carol Li explains how this outcome was triggered by an unexpected occurrence within the Chinese plasticizer's supply chain. Li fully outlines the matter in the free-to-download eBook.

Isononanol Capacity...Awaiting

Another development in China is the planned start-up of new isononanol (INA) capacity. Petronas’s long-awaited 250ktpa INA plant in Malaysia – delayed since the original start-up date in 2019 – was expected onstream during Q2 2023 according to some sources. Evonik has traditionally been the major supplier of INA in Asia, but these new domestic plants are set to alter the market dynamics.

Although no new 2-EH capacity started up in China in 2022, Chinese 2-EH producers raised operating rates and increased production. The knock-on effect was that 2-EH prices were reduced. As a result, production profits decreased substantially during 2022. With a total 2-EH capacity of around 340ktpa planned to start up in 2023, it was felt that supply tightness in China would diminish further.

Price points for plasticizers DOTP and DINP began to diverge in 2020. Historically, the two had a strong tendency to mirror one another. Exactly how and why this occurred is a subject fully explored in our blog post An Investigation of Plasticizers in the 21st Century.

Monitoring Markets

Tecnon OrbiChem has followed plasticizer market trends and prices globally for several decades. Our portfolio of information services includes a mix of current, historical, and forecast price data for plasticizer feedstocks including 2-EH, DOP, DOTP, DIDP, and DPHP/DINP. Our team also monitors new capacities and plant closures globally.

Market commentary for the products within the plasticizers supply chain is collated by consultants based in both Europe and Asia.

Tecnon OrbiChem's objective analysis and reliable data allow procurement teams throughout the plasticizer's value chain to react to shifting supply and/or logistics dynamics better prepared.

OrbiChem360 provides comprehensive chemical business intelligence to assist business managers and purchase teams in their strategic planning and operations optimization.

To download the eBook Plasticizers and Their Raw Materials: eBook of Mid-year Analysis fill in the form and we’ll send it directly to your inbox.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)