5 min read

Orthoxylene and Phthalic Anhydride: 2024 Review and 2025 Outlook

ResourceWise

:

Jan 16, 2025 12:00:00 AM

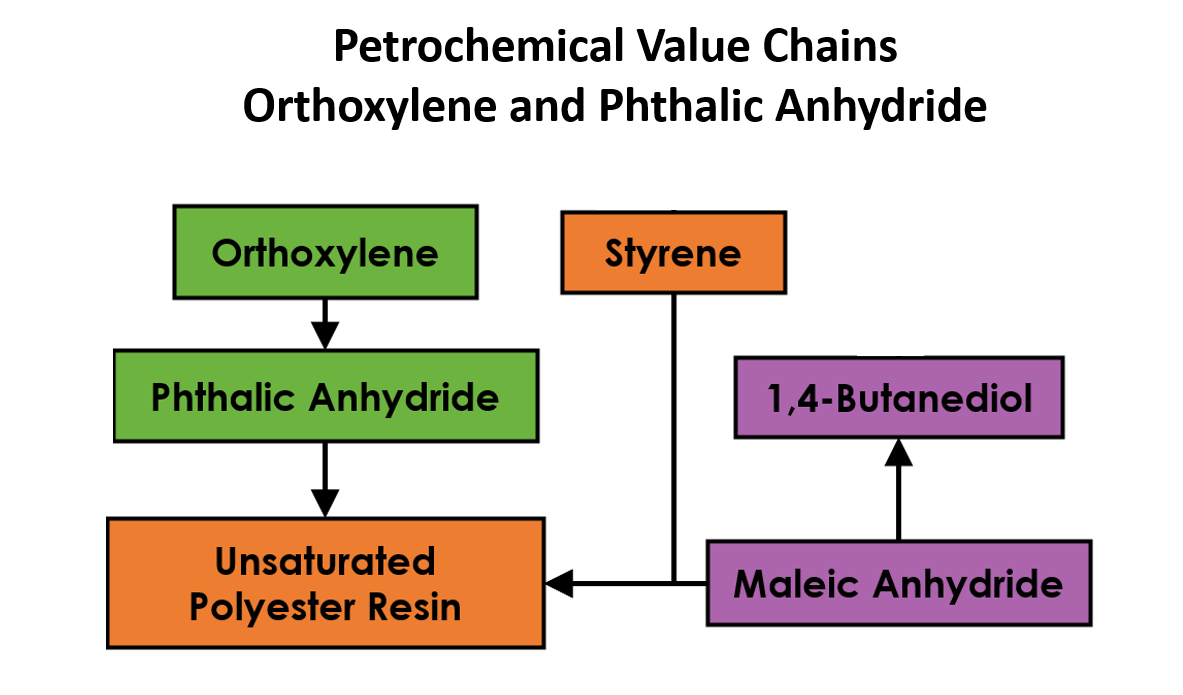

As the second largest outlet for the intermediate chemical phthalic anhydride, unsaturated polyester resin (UPR) markets remain key. What happens in Unsaturated Polyester Resin markets will directly impact the market landscape for phthalic anhydride (PA). Since orthoxylene is used to make PA, those markets will also be affected by the market fundamentals—i.e., the demand versus availability ratio—within UPR trade settings.

Other end uses for PA are phthalate-based PVC plasticizers, resins, and coatings. Globally, there is capacity to produce almost 7 million metric tons of PA annually, with more than half of that capacity in China or Northeast Asia.

However, in 2024, output was just over 4 million metric tons per annum, the lowest capacity utilization recorded in the ResourceWise chemicals business intelligence platform OrbiChem360.

Orthoxylene (OX) capacity is currently over 5 million metric tons per annum, but only half of that capacity was realized last year.

Ask the Experts (NEW!)

Today, we are launching a new initiative called Ask the Experts. Essentially, we want you to tell us your burning question related to OX and PA markets going into 2025.

ResourceWise customers who submit a question to our experts can choose between a scheduled video conference call from either of our consultants—Ben Edmunds or Jane Zhu, or both together—or receive a personalized email answering the question in their inbox.

If you are not a ResourceWise customer (though this is a good reason to become one), we will answer your question publicly (though respecting your privacy) by updating this blog post.

United States in 2024: A Tale of Two Halves

According to the sources canvassed by Ben Edmunds, Consultant ResourceWise Chemicals, year-over-year demand for OX was described as mostly stable compared to 2023, maybe with minor increases.

“This was despite the downstream PA production issues experienced in the first half of the year,” he said.

“This was despite the downstream PA production issues experienced in the first half of the year,” he said.

Global specialty and intermediate chemical supplier Stepan, one of North America’s largest PA producers, experienced technical issues following the “Little Freeze” early in the year—a subject we explored in our blog post How A US Gulf Coast Snow Flurry Roused Quiet Markets.

Although Mexico accounts for just 2.5 percent of global PA capacity, the country’s droughts in mid-2024 resulted in process water restrictions, which impacted overall production rates. “That said, OX demand was supported by increased output/demand from unaffected producers in the region.”

These issues then stabilized throughout the second half of the year, says Edmunds.

Year-over-year PA demand was difficult to read due to the above-mentioned longstanding issues and resulting shifts in market share during that time, but the general consensus is similar to the upstream market, stable or slightly improved compared to 2023.

Improving economic indicators (mostly interest rates) in late 2024 and expectations to continue in 2025 could lay good ground for improved consumer confidence and market activity in key end-use industries (automotive and construction) in 2025, particularly in the second half of the year, improving demand throughout the chain when these trends materialize.

However, the timing and extent of demand recovery remains unclear, meaning market participants are planning for another stable year as a worst-case scenario while still hoping for minor increases. Market sentiment appears more positive compared to other regions, as seen in 2024.

The market structure will change as well, as chemical company Koppers announced the planned closure of its Stickney, Illinois-based PA plant by mid-2025. This could result in increased OX exports and or increased PA imports, though market participants suggested domestic capacity could still be sufficient to pick up most of the slack. Koppers will also build inventories to close out contracts for the rest of the year, so the full impact may not be realized until 2026, says Edmunds.

European Market Sentiment Still in the Doldrums

Market sentiment in Europe was much poorer throughout 2024 and into 2025, with no signs of positivity in the market at present.

Year-over-year OX demand was reported to have decreased around 5-10 percent compared to 2023, with stagnant expectations for 2025 at present.

Year-over-year PA demand was also generally described as declining around 5-10%, though with a wider range of results. Some reported volumes as being almost comparable to 2023, while others reported much higher declines (notably integrated plasticizers producers). Expectations for 2025 appear mixed also, with some expecting a very slow, stagnant year again, thinking consumer confidence will take longer to recover than economic conditions, while others remain hopeful economic improvement will spur on a year-over-year improvement, though not significantly.

European energy prices eased significantly in late 2023/early 2024, which eased production costs in turn. Those costs did climb gradually throughout the year, though they remained well below the 2022/2023 averages.

The graph below (click image to open in a new window) shows the ebb and flow of prices for phthalic anhydride during 2024. In some cases, the difference between a price index's peak and its trough reached several hundred dollars.

The most volatile price indexes were seen in Europe, but the products that fetch the highest prices were produced in North America.

Source: OrbiChem360

Logistics and Geopolitical Impact on Markets

The closure of the Suez Canal and the resulting increase in logistics costs also weighed on import volumes, particularly spot volumes, providing limited support to domestic producers. While the recent Middle Eastern ceasefire talks could help stabilize the region, shippers are reporting diverted traffic to continue well into 2025, keeping import pressure low, at least for the low-demand season.

“The main issue for the European market has and continues to be very poor demand, which outweighed any positivity from reduced production costs and/or reduced import pressure and continues to be the main driver for the mostly cautious/ pessimistic outlook.

“As with the US, the timing and extent of demand recovery remains the main question mark for the coming year. Last year’s performance generated a much more reserved outlook with seemingly lower expectations for year-over-year improvement. It is important to note though, that this is not a case of there being ‘no expectations’.

“Demand will certainly improve to some extent due to regular seasonality, improved economics, consumer confidence, end-use market activity, and so on, particularly in the second half of the year. However, it remains to be seen whether it will be too little too late to generate a year-over-year improvement,” Edmunds adds.

The graph below (click image to open in a new window) shows the ebb and flow of prices for orthoxylene during 2024.

As with phthalic anhydride, North America's prices are the highest, followed by Western Europe and the Chinese price index the lowest globally. All prices demonstrated a largely downward spiral during the year, though with some volatility.

Asian Orthoxylene Amidst Capacity Increase

Looking back at 2024, the import quantity for OX in the Chinese market slid down sharply. Total imports reached around 10 ktpa in 2024. “This figure marks a new low,” says Jane Zhu, Consultant ResourceWise Chemicals.

“However, the export quantity for domestic OX reached 83 kilotons from January to November 2024, increasing 29.4 percent compared to the same period in 2023, which also marked a new high,” adds Zhu.

“However, the export quantity for domestic OX reached 83 kilotons from January to November 2024, increasing 29.4 percent compared to the same period in 2023, which also marked a new high,” adds Zhu.

The new 150 ktpa Phase I orthoxylene capacity at Yulong Petrochemical officially came on stream at the end of October 2024, meaning total orthoxylene capacity in China has continued increasing. China’s OX market has observed an oversupply status. It means that export business will continue to be a priority for OX producers in 2025.

Additionally, Asian OX prices in 2024 remained weaker than those seen in 2023 due to soft downstream demand throughout the year. Asian OX prices might recover slightly in January 2025 after lingering at low levels for a long time, primarily due to firming crude oil and mixed xylenes prices in early 2025.

Mixed Outlook for Phthalic Anhydride

Reviewing PA market performance in 2024, it was certainly a unique year for many PA producers. OX-based PA producers suffered deep profit losses from Q1 to Q3 last year. This was due to heavy cost pressures and depressed demand. In fact, losses for many OX-based PA producers were in the Rmb1000/ton region. Such market fundamentals led operating rates to remain at low levels, with some producers even shutting down for long periods of time.

Moving into Q4, the market status changed dramatically, such that the price of naphthalene-based phthalic anhydride (instead of orthoxylene-based phthalic anhydride) started going down in the Chinese market.

Regarding the outlook for 2025, PA producers presented mixed opinions. One market participant said that in light of increased OX supply, the OX-based PA market may turn around this year. Loss margins at Rmb100-200/ton would be a normal status for OX-based PA producers, much improved from the deep loss status seen this past year.

Another market source added that the domestic PA market in China Chinese will likely continue to see a weak trend throughout Q1 2025. However, another market participant envisaged the PA market sustaining strong movements in Q1 but weakening again in Q2 2025.

Asian markets outside of China experienced price volatility in 2024. There was a general weakening in prices due to soft demand throughout the year. That said, demand may warm up in early 2025 in view of recent strengthening in demand from the plasticizer market, according to Zhu.

Stay up to date by subscribing to our newsletter.

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)