Oleochemicals markets are poised for volatility as the effects of economic protectionism and environmental regulation ripple across nature-based product trade settings.

The European Commission’s initiation of provisional anti-dumping duties against the majority of China’s biodiesel and hydrotreated vegetable oil (HVO) exporters will reduce the availability of imported products in Europe. With the ruling, Europe’s largest biodiesel and HVO import source is set to be disrupted.

Not only does the duty charge—between 23.7% and 36.4%—negatively impact arbitrage opportunities in biofuels trade, but it also creates a tougher trading market for Chinese producers. Some of the country’s producers will be subject to an import volume cap under the measures.

EU Deforestation Regulation (EUDR) is already creating tight markets for oleochemicals that will be subject to its rules—namely soy and palm oils.

Partly, this tightness is led by a relative surge in demand as buyers seek to boost inventories by securing raw materials before the new regulation comes into effect at the end of 2024. From 2025, strict provenance documentation will be required by operators and traders of the materials outlined in the regulation.

EU Deforestation Regulation in a nutshell

- The regulation includes seven raw materials: Coffee; cacao; rubber; wood; palm oil; soy and cattle.

-

Raw materials and products placed on the EU market or exported must be deforestation-free and not related to forest degradation.

- Products must be produced in accordance with the relevant legislation of the country of production

- A due diligence statement must accompany any imported and/or marketed goods

- The maximum amount of such a fine is at least 4% of the total annual turnover in the previous financial year.

- It comes into effect on December 30, 2024 regulation however, it does not become effective for SMEs until June 2025.

But, the biofuels sector faces rapid shifts in the EU and the US. A heavy production demand looms as producers and consumers adapt to the growing adoption of biodiesel.

This is due to mandates and requirements such as the Renewable Energy Directive (2018/2001) or RED II in Europe and the Environmental Protection Agency’s Renewable Fuel Standard (RFS) program in the US.

Rapeseed Potential

Rapeseed is a dominant biodiesel feedstock in the EU trading block. In fact, rapeseed oil accounted for over 40 percent of total biobased diesel feedstock use in 2022.

As sustainable fuel blenders scramble for feedstock, rapeseed oil is likely to become an even more sought-after product. This has already happened as palm oil-based biodiesel sold in the EU has declined.

Europe's rapeseed oil market is looking at a perfect storm of supportive fundamentals.

International Vegetable Oils Report, ResourceWise (July 2024)

Traditionally, it was the case that an increase in the price of rapeseed oil in the EU—and of soybean oil in the US—would trigger an increase in palm oil imports to those regions. Of course, once the EUDR regulation is implemented, palm oil imports may dwindle even more than they have already due to the feedstock’s reduced use in EU-produced biofuels.

ResourceWise’s latest International Vegetable Oils Report—which is available to Prima CarbonZero subscribers—predicts that the European rapeseed oil market is looking at a perfect storm of supportive fundamentals.

They included “reduced competition from imported vegetable oils [and] a higher base demand [from] the biofuels environment,” says the report.

It is likely that the EU’s lower crop yield in the first half of 2024 also put upward pressure on oleochemicals prices. In this scenario, oleochemical feedstock crude tall oil (CTO)— a by-product of pulp and paper production in the forest products industry and an advanced biofuel feedstock—could also see an uptick thanks to the changes occurring in the biofuel industry.

CTO is a listed feedstock for the production of advanced biofuels In the EU’s Annex IX of the RED II directive. Despite this, it has often been excluded from broader biofuels-focused conversations broader conversation due to the availability of cheaper feedstocks. The closing off of Chinese HVO and biodiesel from the EU market creates opportunities for CTO producers. They can benefit from changing markets and the growing demand for biofuel feedstocks.

Source: ResourceWise

Is a Glycerine Glut on the Horizon?

A further change is the potential for greater volumes of glycerine to become available in European markets. This is because, for every ton of biodiesel produced from vegetable oils and animal fats—and/or used cooking oil (UCO)—the crude glycerine yield is about 100 kg.

As Europe's biodiesel production sector grows, glycerine supply will increase. This will likely lead to price erosions later.

Kaiyin Hu, Senior Consultant, ResourceWise Chemicals

Glycerine, however, is also produced from palm and soy oil feedstocks. This composition renders glycerine a compound subject to EUDR regulation. In recent months, it has become more expensive in markets including Europe, along with other soy oil or palm-oil-based oleochemical products.

With Europe's biodiesel production sector set for significant growth, the continent's glycerine supply is set to increase. This, says Hu, will likely lead to price erosions later.

Source: ResourceWise

Kaiyin Hu, Senior Consultant, ResourceWise Chemicals, says for now the EUDR is driving oleochemicals demand. “At least in the short and near-term, that’s what we are seeing across our oleochemicals portfolio in general. In fact, on the fatty acids and fatty alcohols side, this trend is even more pronounced.” Currently, increases in price are also being seen but this is mostly due to freight price.

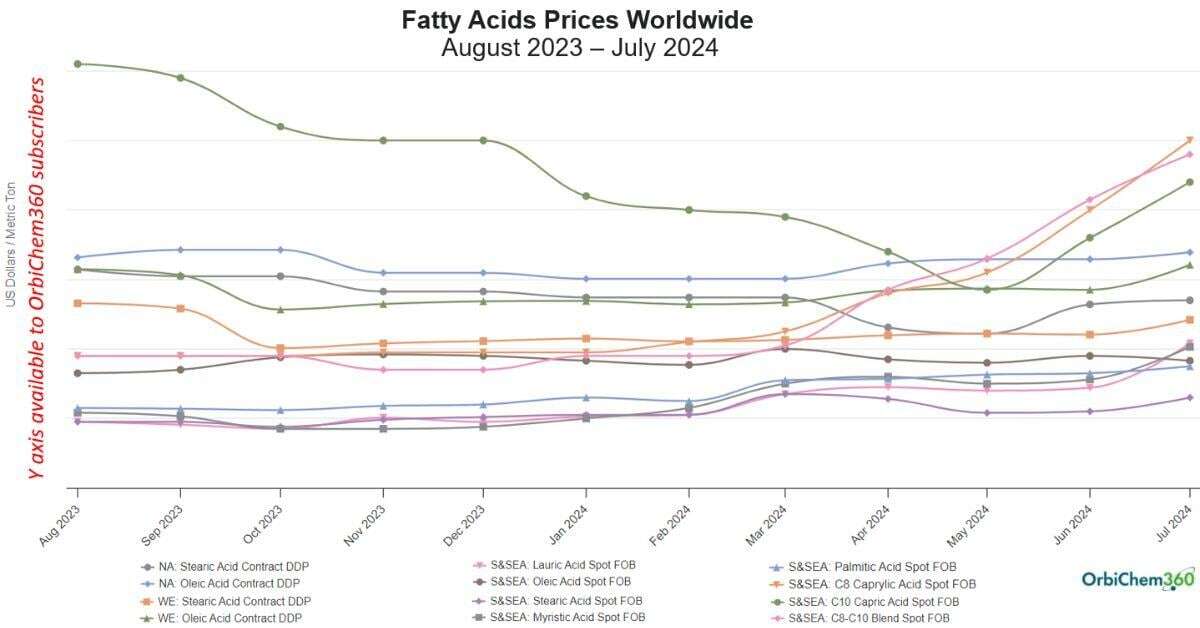

As shown in the graph above, all the 12 fatty acid price indexes have risen in the past two months, some sharply. The prices are still far below the near-US$10,000 high seen in the months following Russia's invasion of Ukraine.

However, the fast-rising price of these valuable chemical intermediates—used in food, pharmaceuticals, lubricants, cosmetics, and plastics—show how highly-sensitive they can be to market drivers.

EU Deforestation Regulation and Anti-dumping

The EUDR may not be good news for producers within wider global markets. If producers find export to Europe increasingly difficult due to EUDR, North America could become a dumping ground.

"In that case, we are likely to see more anti-dumping complaints by producers followed by more anti-dumping measures implemented by the US Department of Commerce in the future," Hu adds.

Given that the United Nations' Food and Agriculture Organization estimates that 420 million hectares of forest were lost to deforestation between 1990 and 2020, there's little doubt that deforestation measures are needed.

But industry needs its feedstocks too. As future volatility unfolds, price assessment data, trade flow indicators and expert commentary will help businesses navigate the change and adapt.

ResourceWise developed its oleochemicals-focused price and trade data in the OrbiChem360 platform earlier this year. To download our oleochemicals eBook, click below.

Jane Denny

Jane Denny

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)