3 min read

Oleochemicals: Uses in 21st Century Manufacturing Supply Chains

Jane Denny

:

Jul 15, 2024 12:00:00 AM

Jane Denny

:

Jul 15, 2024 12:00:00 AM

A decade ago, a unique concept car built using eco-friendly polyols by a 185-year-old US-based company left some sector participants scratching their heads in astonishment.

After all, petroleum had amply met the automotive sector's need for fabrics and fuel feedstock for a century and continues to do so.

It is worth remembering that early in 2014, crude oil prices were escalating to hitherto unseen highs with no sign of abating. The impenetrable grip petroleum-producing countries had on global economies and transport was becoming increasingly apparent.

As a result, the relative pricing stability biobased feedstocks enjoyed was becoming an attractive proposition. Sectors making end products using flexible and rigid plastics suddenly saw the fringe benefits of sustainable profiling…

Not that Emery Oleochemicals’ bioplastic car was a new concept. Had US taxation not derailed Henry Ford's vision of biofuels-powered vehicles built with soy and hemp feedstocks, car manufacturing would have taken a different turn. That is explored in our blog post Compelling Concepts To Kick-off A Sustainability Conversation.

Source: ResourceWise

When the price of a barrel of oil dropped suddenly in June 2014, the attractiveness of biobased feedstocks waned.

However, now in the 21st century, manufacturers are increasingly seeking non fossil fuel-based raw materials to produce components like car paneling, casing, seating and dashboards.

Biofuels Bonanza

It soon came to pass that biomass would play a huge role in the automotive industry anyway—as a biodiesel feedstock. And now, with the advent of sustainable aviation fuel (SAF), biomass, seeds, grains, plant oils, and animal fats are being seen as a way to meet stringent air travel-focused decarbonization targets. Transport biofuels—which includes SAF—is a sector set for 20 per cent growth between 2022 and 2027, according to a report by the International Energy Agency.

The traditional customer base for oleochemicals—namely makers of detergents, soaps, personal care products, industrial lubricants, plastic enhancers, emulsifiers, coatings, as well as food and feed additives—is being eclipsed.

Take tallow oil, a byproduct of the meat processing industry. Animal fats including tallow are increasingly used in the production of biodiesel. Tighter markets are consequently predicted. Kaiyin Hu, Senior Consultant ResourceWise Chemicals, says oleochemicals buyers have been frozen out of tallow markets due to tallow oil’s increasing attractiveness to biofuel producers.

The problem that the traditional customer base faces is that the biofuels sector is being incentivized by tax-based government policy. This means that those buyers have an advantage in markets because they know tax breaks will offset a certain amount of their feedstock costs for the tallow they buy.

Another raw oleochemical material, rapeseed, remains a dominant biodiesel feedstock in the European Union. In fact, rapeseed accounted for 42 percent of total biobased diesel feedstock use in 2022, according to a report from the US Department of Agriculture. This has happened as palm oil use in biobased diesel sold in the EU has declined.

Source: ResourceWise

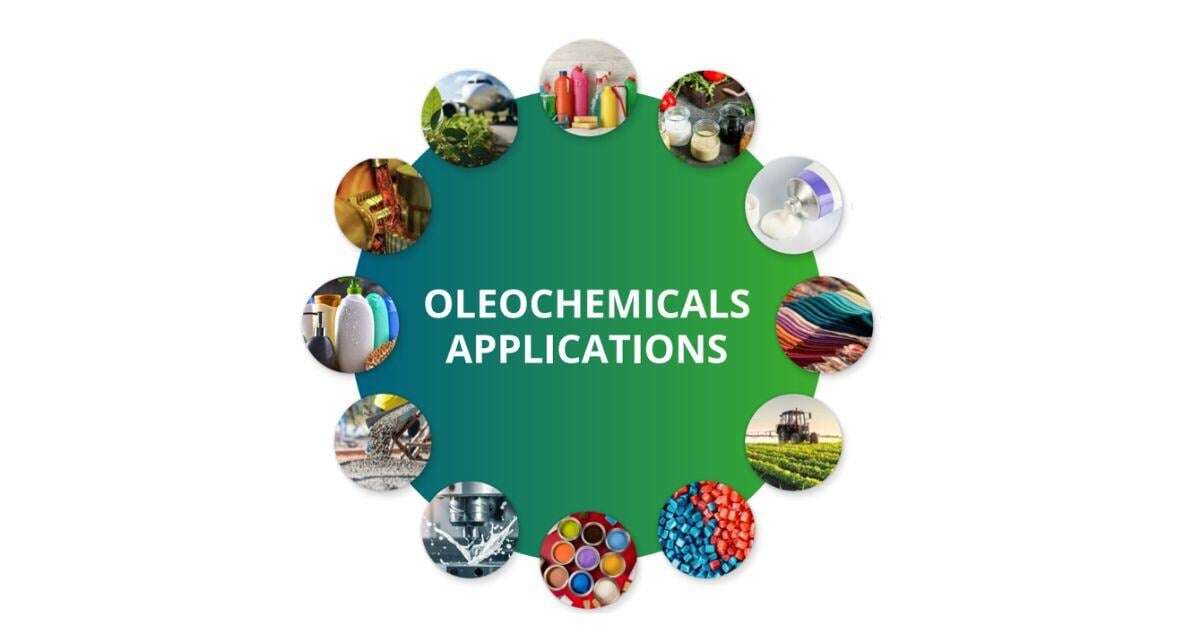

What Are Oleochemicals Used For?

Oleochemicals are used in a wide range of industries, including:

- Personal care and cosmetics

- CASE products (coatings, adhesives, sealants and elastomers)

- Household and industrial cleaning

- Lubricants, grease and metalworking

- Food and Beverages

- Pharmaceuticals and nutraceuticals

Personal Care and Cosmetics Products

Personal care products—including those for hair and skin care—often include oleochemicals in their composition. They have gained popularity due to their tendency to yield allergen and carcinogen-free end products. Glycerine (also known as glycerol) is derived from vegetable fats and found in end products, including toothpaste,

The feedstock’s hydrating and moisturizing properties—and its ability to soothe irritated and inflamed skin—make it attractive to the personal care sector. Personal care is seen as a growth area for glycerine. This is due to its humectant properties, which make it a moisturizing agent capable of pulling water into the outer layer of your skin from deeper levels of your skin and the air. Glycerine is also used as a thickener in food and beverages.

Compared to the exponential highs in US glycerine prices recently, prices have fallen dramatically this year. We explored the factors at play in our blog post Glycerine-a-21st-century-biobased-feedstock-sweet-spot. That said, in recent months, modest price point climbs have been seen in more than half of OrbiChem360's six glycerine price indexes.

Home and Industrial Cleaning Products

Oleochemicals are commonly used in the production of household and industrial cleaning products including surfactants, emulsifiers and cleansing agents. Coconut fatty acids for example, are used as foam boosters—the agent that increases the bubbles during use.

Oleochemicals can provide base oils for non-toxic, biodegradable lubricants and are used in automotive and industrial applications. As lubricants, oleochemical compounds reduce friction between moving parts. They are used to prevent wear and tear of a machine's moving parts and as a sealant for the gaps between mechanical pieces.

Degreasing agents remove grease, oils, dirt and grit from machinery and systems hardware. They also act to inhibit rust and corrosion in metal parts.

Oleochemicals are used to produce food packaging and sanitizers for food contact surfaces. In the pharmaceutical industry, oleochemicals are used as emollients, such as those used to treat eczema and psoriasis. They are also used as excipients— namely ingredients other than the active ingredient in finished drug products.

The Oleochemicals Industry of the Future

As non-renewable resources become depleted and efforts to reduce industry’s reliance on fossil fuels with stricter environmental regulations, oleochemicals are potential substitutes. Factors including the availability of raw materials, growth in demand from consumers, and the growing importance of green chemicals markets are key to oleochemicals’ future in a sustainable world.

Consequently, demand for oleochemicals is expected to increase in applications such as personal care, detergents and foods and beverages.

Download your free copy of our oleochemicals eBook using the link below.