7 min read

Glycerine: A 21st Century Biobased Feedstock Sweet Spot?

Jane Denny

:

Dec 4, 2023 12:00:00 AM

Jane Denny

:

Dec 4, 2023 12:00:00 AM

It is two centuries since French scientist Michel Chevreul, an organic chemistry founder, described the oleochemical glycerine in a patent. Chevreul was exploring fatty acids and alkali-treated fats to advance soap-making.

The following century, glycerine combined with nitric and sulfuric acid formed nitrogylcerine—a dangerously shock-sensitive explosive—stabilised by Alfred Nobel to commercialise dynamite.

Dynamite comprised half the 8,000 tons of explosives that carved the Panama Canal out of the Americas' mountain ranges. The new millennium further transformed this versatile compound's profile—it is now a biodiesel sector waste stream and liquid used in vapes.

As Tecnon OrbiChem augments its chemicals market intelligence platform OrbiChem360 with regular crude glycerine price insights, glycerine's profile in supply chains continues to evolve.

How Glycerine Became Supply Chain Star

Glycerine (also known as glycerol and glycerin) is both a natural and a synthetic product. A non-toxic polyhydroxy chemical and biodegradable compound, its synthetic version has been a fossil-based propylene derivative since the mid-20th century. Glycerine's natural form is derived from animal or vegetable oils or fats.

Traditionally a byproduct of the soap-making process, today's glycerine output is a biodiesel derivative—essentially a waste product from a sector that has grown exponentially with the drive towards sustainable transportation.

For every ton of biodiesel produced from vegetable oils and animal fats—and/or used cooking oil (UCO)—the crude glycerine yield is about 100 kg.

For every ton of biodiesel that is made from vegetable oils and animal fats, about 100 kg of glycerol is generated.

Both natural and synthetic outputs can be classified as technical or refined. Purification processes remove methanol and free fatty acids, promoting crude to refined grades. The process is costly but necessary for glycerine use within food & beverage and pharma sectors.

Several hundreds of applications from food, medicine and personal care to detergents, solvents and plastics use either crude or refined glycerine feedstocks.

Glycerine in the 2020s

At the height of the Covid pandemic, glycerine was subject to a sudden surge in demand as a raw material for hand sanitizers. But just as sterilizing agents topped panic-buying product lists, the feedstock’s supply was drying up.

Lockdowns simultaneously triggered gasoline/petrol and biofuels market slumps. And as these market pressures played out in 2020, the price of biofuels’ waste stream glycerine surged globally.

Glycerine’s 2023 story—as with many chemical intermediates—is very different. Throughout much of this year, the feedstock’s main customer base—namely epichlorohydrin (ECH) producers for epoxy resins market participants—has suffered.

Glycerine prices in the US have fallen dramatically this year. The spot price per ton within the US has remained stable at $132 since April 2023, around six times lower than its peak in 2022.

Depressed housing markets globally have reduced requirements for epoxy resin. The knock-on effect is low demand for its input into concrete coatings, grouts, bonding agents, paints, sealants, and adhesives. The ECH value chain relies on these downstream products for its custom. According to Biomaterials ChemFocus report commentary, glycerine plants in Asia have run at half capacity and even lower.

Biofuel Bonanza

Earlier in the 2020s, the Paris-based intergovernmental organization International Energy Agency predicted a massive surge in biofuel demand. The prediction was based partly on post-COVID recovery and government policies on sustainable transport.

Biofuel output in 2020, says the agency, was 144 billion liters—almost 2500 barrels daily. In the main case, the agency's experts predicted global demand for biofuels would grow by 41 billion liters, or 28%, during the period 2021-2026.

But, according to analysts, accelerated case growth in certain geographies will be even greater. "Over the medium term, major policy discussions in the United States, Europe, India and China hold the promise of a more than doubling of biofuel demand."

Using Resource Wisely

The IEA's prediction is supported by Tecnon OrbiChem's sister company, Prima Markets. Prima's business development director, Fiona Ribbins, says the biodiesel sector isn’t set to wane any time soon.

“Our analysis does not indicate that biodiesel production will dwindle significantly. In order to meet sustainability targets and decarbonize at the scale needed, a combination of all solutions will be needed.

“The marine sector, for example, is huge. And it is just starting to decarbonize. The marine sector will use biodiesel rather than hydrogenated vegetable oil as it is cheaper. It will be blended into fossil fuel for the next decade.

“Competition for all waste feedstocks will increase, but the indication is that biodiesel will continue to have a place.”

Indonesia's government increased its biodiesel blending mandate from 30% to 35% earlier this year.

According to a US Department of Agriculture report, Indonesia's government increased its biodiesel blending mandate from 30% to 35% in February 2023.

Our chemicals data and market analytics platform OrbiChem360 registered Indonesia's glycerine exports at around 70 kilotons per month during the first three quarters of 2023. The government's biodiesel mandate will increase the country's glycerine waste stream production by up to 14%.

Source: Tecnon OrbiChem

Evidence of growth in Indonesia's glycerine market is emerging already. Exports were in excess of 85.5 kilotons in August 2023, well over double the volume exported during August 2019, August 2020, and August 2021.

The country's glycerine exports began to show significant growth in the latter part of 2022, peaking at around 75 kilotons in September. With the extra capacity expected by the early 2023 mandate change, it will be interesting to see what levels its exports reach once the trickle-down effects are fully realized in 2024.

Glycerine Markets: A Snapshot

Source: Tecnon OrbiChem

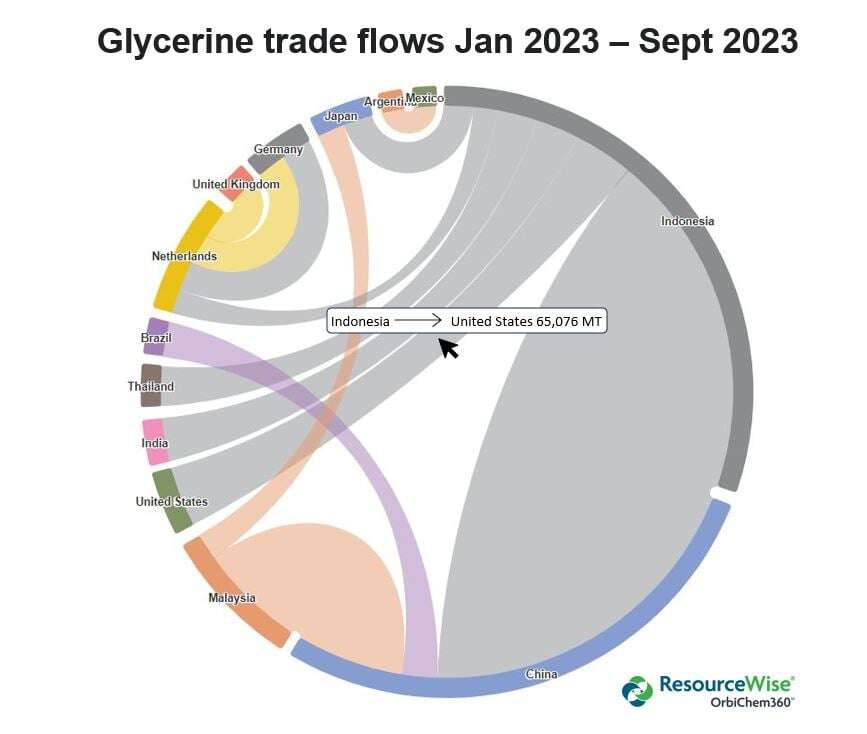

The chart directly above shows how glycerine is being traded around the world.

Tecnon OrbiChem consultant Kaiyin Hu monitors biomaterials alongside maleic anhydride markets. Hu sees no evidence of a slowdown in US biodiesel production despite the expansion in HVO renewable diesel.

Oleochemicals producers in the US are under pressure not only because of cheap imports of glycerine from Asia and domestic biodiesel production, which hit.

"Cheap imports of refined glycerine in particular from Indonesia, as well as low offers of refined glycerine from domestic biodiesel producers in the US, have put pressure on oleochemicals producers.

"Glycerine prices seem to have reached the bottom and have remained stable in recent months. But no one knows for sure. And the competition will remain tough among suppliers in 2024," Hu adds.

Glycerine Versus Propylene Epoxy Feedstock

From the 1940s, epoxy resins relied on a propylene-derived ECH as one of the two feedstocks. And, despite glycerine's prominence in personal care and other products long before that, the glycerine-based ECH alternative epoxy resin component only emerged in the 2000s.

Solvay first brought patented technology for converting glycerol to high-purity ECH to market. The Belgian company’s innovation turned rapeseed oil-based glycerine into ECH. This renewable raw material increasingly replaced petrochemical-based ECH in coatings, composites, and adhesive applications.

Solvay’s development—and success—using an oleochemical ECH input to produce epoxy resin fed off the sudden excess of glycerine entering markets due to ramped-up biodiesel production early in the new millennium. Then, in 2018, Solvay sold the technology it had designated Epicerol to Paris-headquartered engineering and technology company Technip Energies.

Source: Tecnon OrbiChem

Biobased glycerine now meets around 50% of ECH feedstock for epoxy resins demand in China. The remaining demand is met using the traditional propylene route. Outside of China, a glut of new plants and facilities looks to shift the propylene/glycerine ECH output ratio yet again. As a general rule, the price of glycerine and the price of propylene remain on similar trajectories. Following Putin's invasion of Ukraine is an example of a time when this was not the case. And though the two chemicals' prices appear to be close from mid-2022, they are currently hundreds of dollars apart. Full prices for both propylene and glycerine are available to OrbiChem360 subscribers.

New Ventures in Glycerine Output

A 100 ktpa ECH plant will be built by the South Korean joint venture Ocikumho in the Borneo-based state of Sarawak in Malaysia. The partnership—of polysilicon producer OCI and Kumho P&B Chemical—will use Technip Energies’ Epicerol technology and glycerine feedstock. Test operation is due at the site as early as Q1 2024, and once onstream, 95% of output will go to global markets.

Indian chemicals manufacturer Meghmani Finechem commissioned a 50 ktpa domestic ECH plant with glycerine as the raw material this year. The firm says the captive raw materials will give it a competitive advantage.

According to OrbiChem360, India imported 55 ktpa of glycerine from its south and southeast Asian trading partners in the year up to August 2023. The country also imported 47 ktpa of ECH during the same period.

Glycerine innovation

In Germany, chemical manufacturing firm Zeon has developed a renewable rubber from a glycerine-based ECH monomer. The company is targeting producers of elastomer products for the automotive sector with its reduced carbon footprint offering. Designated Bio Eco, the product is on the market and offers an alternative to petroleum-based oil- and heat-resistant rubbers.

US-based chemical company Hexion had planned to add 25 ktpa biobased ECH output to its manufacturing site in Pernis, the Netherlands, using glycerine-to-ECH production technology to deliver the extra capacity.

Update: Commentary by Jennifer Hawkins, Business Manager ResourceWise Chemicals, in the July Epoxy Resin ChemFocus report. "Westlake Corporation [which completed its acquisition of Hexion in February 2022] revealed plans to mothball its allyl chloride and ECH units at its Pernis site in the Netherlands in 2025.

Update: Commentary by Jennifer Hawkins, Business Manager ResourceWise Chemicals, in the July Epoxy Resin ChemFocus report. "Westlake Corporation [which completed its acquisition of Hexion in February 2022] revealed plans to mothball its allyl chloride and ECH units at its Pernis site in the Netherlands in 2025.

Hawkins' commentary: "According to a regulatory filing, the company said it expects to incur €80 million in total pre-tax costs related to the mothballing of the units and will result in a workforce reduction of approximately 30 employees.

"The company will continue to operate its liquid epoxy resins and bisphenol A facilities as well as its production of epoxy specialty resins. The Pernis ECH plant is assessed to have a nameplate capacity of 80,000 tons a year. The closure will make little impact to the European market as most of the ECH production has been for captive use, with volumes thought to have been sold to the merchant market only when surplus material was available.

"In 2021, the company, then known as Hexion, announced proposals to build an additional 25 ktpa of glycerine-based ECH capacity to the Pernis facility, with the production start-up anticipated for late 2024. There has been no further news since, not even after Hexion's acquisition. [It is now assumed, though not confirmed by Westlake Epoxy, that the planned 25 ktpa glycerine-based ECH plant has been shelved.]

"Hexion also permanently shut its Norco ECH site in the US in 2016," Hawkins reported.

Glycerine-based monopropylene glycol

A relatively new kid on the biobased block, monopropylene glycol has only existed in the 21st century, as explored in our earlier blog post Biobased monopropylene glycol: The bumpy road to a decarbonized world. That blog post explored—among other things—Brazilian petrochemical company Braskem and Japanese firm Sojitz’s plan to produce biobased monopropylene glycol (MPG) at a number of sites.

Since we published that blog post, Sojitz Indonesia has inked an agreement with Jakarta-based PT Protech Mitra Perkasa on a 30 ktpa glycerine-based-MPG plant in Java. And in March 2023, GreenGlycols—a joint venture between Argentina’s Grupo Bahia Energia and Belgian investment firm ChemCom—confirmed funding for its 40 ktpa glycerine-based MPG facility in the Netherlands. The plant will use BASF technology and is expected onstream in 2025.

Endgame: Glycerine and Biodiesel Future

With China's late November announcement about boosting the use of biodiesel within the state, could yet another shift be on the horizon?

What is certain is that biodiesel holds great potential for a sustainable transport future. By default, its waste stream, glycerine, also holds great potential.

With the addition of West Europe's crude glycerine spot price to our OrbiChem360 platform this month, we now show six global prices for a mix of crude and refined glycerine.

References

1. Gacia, E et al. ACS DOI:10.1021/ef800477