3 min read

India Halts Imports for Key Intermediate Chemical from China

Jane Denny

:

Aug 2, 2023 12:00:00 AM

Jane Denny

:

Aug 2, 2023 12:00:00 AM

Plastics, packaging, textiles and automotive manufacturers in India are currently prohibited from sourcing purified terephthalic acid from mainland Chinese producers.

The blanket ban on Chinese purified terephthalic acid (PTA) exports to India emanates from a decision by Indian authorities. India’s latest list of Bureau of Indian Standards-certified global PTA suppliers excludes mainland Chinese producers.

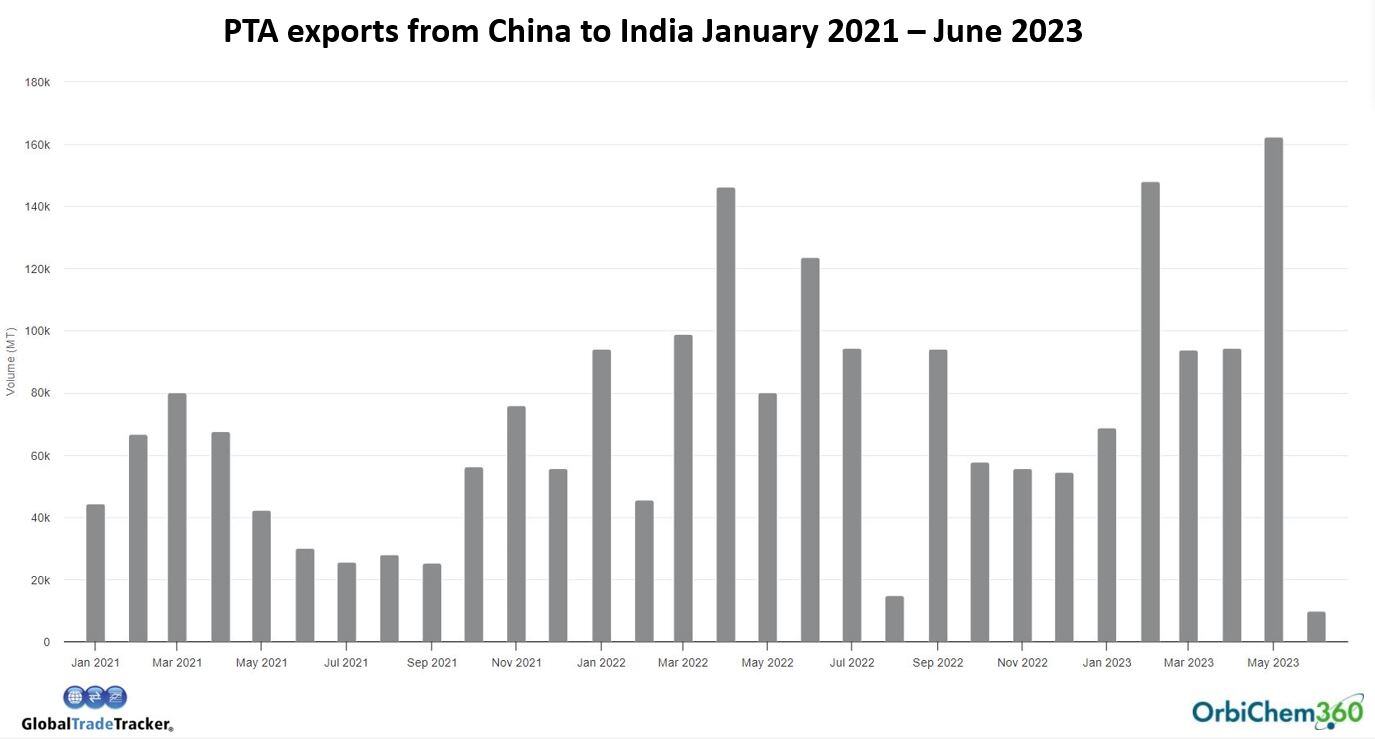

India’s imports of purified terephthalic acid (PTA) from Chinese producers was close to 1 million metric tons in 2022. That represented a significant rise from the 595,000-plus metric tons China exported to India in 2021.

Across the two years – 2021/2022 – imports of Chinese PTA by India averaged 64,000 metric tons per month. However, from February to May 2023, that monthly average more than doubled. And in June, China’s PTA exports to India fell below 10,000 tons.

Tecnon OrbiChem’s China-based consultant Michelle Yang said Chinese PTA exporters remain calm about the Bureau of Indian Standards (BIS) ruling. ‘India’s producers cannot guarantee that the country’s own production will match China’s offering both in terms of price and supply.’

The draft also contains a stipulation around reporting the use of biogenic inputs – substances produced or derived using living organisms.

Chinese producers take a hit

One Chinese PTA producer told Tecnon OrbiChem that the removal of Indian demand would halve the company’s overall export volume.

Major Chinese producers assured Yang they had complied with India’s BIS certification conditions. ‘They have done what they need to do,’ she said. ‘For them, the matter is now wholly in the hands of the Indian government.’

The suspension began when India’s government published its latest global list of suppliers with BIS certification. A mandatory quality control accreditation, BIS certification for chemical trade flows into India emerged in 2019. Other chemicals targeted by the regulation include styrene, acrylonitrile butadiene styrene (ABS) and maleic anhydride. However, full implementation for some chemicals has stalled a number of times since.

Shifting to alternative markets

South Korean and Taiwanese PTA suppliers have indicated an increase in inquiries from India since June, Yang adds. ‘However,’ Yang says, ‘PTA from South Korea and Taiwan generally costs more than PTA from mainland China.’

The latest formula for China’s PTA export price includes a paraxylene price multiple of 0.665, plus a 90 US dollar processing fee. ‘The processing costs from South Korea will be around $130/ton, or higher. The price gap exists because China’s PTA units are newer and bigger than South Korea’s.

"...If the Indian government limits mainland China’s PTA supply to the country, its domestic producers must pay higher prices on PTA imports..."

Tecnon OrbiChem senior consultant Michelle Yang

‘If the Indian government limits mainland China’s PTA supply to the country, its domestic producers must pay higher prices on alternative PTA imports,’ Yang (pictured below) concludes.

In June 2023, China's export volume of PTA was 309,000 tons, a decrease of 148,000 tons compared to May, mainly due to the reduced exports to the Indian market.

In the first half year, the total exported volume for PTA from China mainland to India added up to 577,462 tons.

Although the export volume is still relatively small compared to domestic consumption, it has put some pressure on producers given the overcapacity of the PTA industry.

Internal opposition

Opposition to the Indian government’s move to increase trade barriers using BIS certification has grown since the policies emerged. ‘Imposition of this non-trade barrier will increase the price of polymers for Indian importers, making domestic plastic processors uncompetitive,’ according to India’s Plastic Export Promotion Council.

In fact, it is possible that India’s buyers were stocking up in 2023 in anticipation of BIS standard implementation limiting their supply.

Tecnon OrbiChem’s business intelligence platform OrbiChem360 shows India as the largest consumer of Chinese PTA in 2023. The country imported a third of China's total export volume in the first five months of 2023.

China’s two main PTA exporters – and the country’s top PTA producers overall – are Yisheng and Hengli.

Yisheng’s total PTA capacity is nearly 14,000 ktpa. Hengli’s recent new capacity start-up will bring its total PTA capacity to 16,600 ktpa.

PTA production at-a-glance

China’s PTA output has increased significantly this past decade. Back in 2013, its capacity to produce PTA overall was around 30,000 kilotons. By 2022, output capacity was in the region of 80,000 kilotons.

During 2022 however, operating rates were estimated to be as low as 70%. The country’s capacity to produce PTA is expected to expand by around 10,000 kilotons this year.

India, meanwhile, is shoring up its domestic supply of PTA. To that end, French engineering firm Technip Energies has been contracted by petroleum refineries company Indian Oil.

The planned complex includes an 800,000 tpa PX facility and 1.2 million metric tpa PTA plant on India’s east coast.

It will use technology developed and licensed by British multinational oil and gas company BP originally, now owned and licensed by fellow British firm Ineos Aromatics.

The location for the site is the port town of Paradip, in Odisha, according to a Technip Energies press release.

![[Video] Molecules to Markets Episode 2: Electrification, Interest Rates, and Emerging Chemical Market Upside](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-2-CHEMICAL%20PRODUCTS%20SOCIAL%20SPEAKER%20HIGHLIGHT.png)