This year has been a very turbulent year for the chlor-alkali industry with several weather-related and supply chain issues. They have affected the chlor-alkali market and downstream products such as polyvinyl chloride (PVC), ethylene dichloride (EDC) and vinyl chloride monomer (VCM).

As the global economy recovered from the effects of the pandemic, the market suffered from logistics issues, extreme weather in the US, surging natural gas prices in Europe, and energy control policies in China.

Caustic soda demand began to recover in December 2020, following a very soft period, with production beginning to ramp up following the dip in the spring of 2020 caused by COVID-19.

As the market began to see some normalization and rebalancing in mid-February, the US was hit by extremely cold weather and blackouts in some parts of the country. Southern US plants were not built for such cold weather and the Deep Freeze wreaked havoc on production. At one point, around 80% of US production capacity was offline.

Restarting plants took several weeks in many cases and resulted in a reduction of 375kt of caustic soda. Compared with the previous month, operating rates dropped by around 35%. Consequently, the caustic soda supply became very tight, which caused prices to skyrocket and remain at high levels ever since.

Several Louisiana plants reduced output in late August as a consequence of Hurricane Ida, though most were back online within a couple of weeks. This worsened the short supply in the US but did not have the same catastrophic impact as the Deep Freeze in February. Since then, plants have been operating better. Fewer issues and demand held strong in both caustic soda and chlorine.

Current Market Omicron-averse

News of the Omicron variant of the COVID-19 virus has not had a major influence on market sentiment in the US, which remains positive. That positivity is reinforced by strong demand and low inventory levels, despite the crude oil price blip that coincided with Omicron’s arrival. The US government has not implemented many measures to combat the spread of the new variant compared to European countries.

Chlorine and caustic soda are already showing some of the usual consumption slowdowns as the year comes to an end. However, with plants running more smoothly – and in the absence of further unexpected production issues – supply will begin to improve.

The market for caustic soda in the US is expected to begin to rebalance in Q1 2022 with more or less all sectors expected to show good demand in 2022. The pulp and paper sector has been good throughout the pandemic. Packaging performed well and the soap and detergent sectors thrived in Covid-19 times thanks to the focus on cleanliness and sterility. Chlorine will likely remain short for at least the first half of the new year due to the continued strong demand for PVC and other derivatives. Chlorine demand is supported by low interest rates, which keeps the construction market strong. It will take quite some time for supply to catch up.

Petrochemicals Markets: The Bigger Picture

"For all the petrochemicals, the market in the US has been the most volatile. This is extremely unusual. The Big Freeze earlier in 2021 knocked out production along the Gulf Coast then Hurricane Ida led to plant stoppages. Meanwhile, the US's Gulf Coast companies endured internal logistics issues including truck driver shortages and railroad delivery disruptions due to extreme weather conditions there."

"Europe was unusually volatile as well. Germany’s flooding in July caused disruptions. The Autumn saw water levels in the Rhine drop so significantly that barges transporting cargoes along them could only be half-loaded. Asia by comparison, which is usually the center of volatility, was much more stable. Because China emerged from COVID-19 earlier, there were 12 months of very good business there."

"Any big change is destabilizing. Even change for the better causes worries."

~Charles Fryer, Senior Advisor, Tecnon OrbiChem

"The second half of this year has seen that progress steadily declining – a normal situation once inventory levels get back to normal. Buyers are being more cautious. Coming out of a recession, there’s a boost as companies restore inventory levels that were run down in the recession. There was an inflation effect as China restored its inventory levels, but the economy is slowing, and growth is slowing too."

"Growth in China is currently less than 5% per year, which is low for the country. There is some kind of pessimism that will probably be increased by the fall in the price of crude oil. Crude oil energy will be cheaper, but the industry likes stable markets because then they know where they are going."

"A 10% drop in the price of oil will see buyers asking themselves, ‘What’s going on here?’ They think their customers might start cutting back and that there is no point in them stocking up if their customers stop buying. Any big change is destabilizing. Even change for the better causes worries."

Europe's Supply Switch: From Oversupply to Excessive Demand

Europe’s caustic soda market began 2021 oversupplied, with operating rates quite high due to strong chlorine demand and a softer caustic soda market. Demand was somewhat depressed due to Covid-19 restrictions across the continent.

In the first quarter, the main struggle in the caustic soda market was oversupply caused by high operating rates, with an average of 83.9% rate in Q1 of 2021. Once COVID-19 restrictions began to be lifted in early Q2, travel began to resume, supporting the cleaning products and detergents sector. A major factor in the recovery of caustic soda demand was the COVID-19 vaccine program which allowed for lockdown restrictions to be eased. Additionally, the effects of the US winter storm began to affect European supply as there were fewer import opportunities from the US.

Following this point, demand for caustic soda began to outstrip supply in Europe, worsened by the usual spring maintenance turnarounds in the region as well as production issues in late summer and then further autumn planned maintenance turnarounds. This kept supply tight but for the most part, exports remained available. Prices rose significantly in Q4, as a result of skyrocketing energy costs, supported by robust European demand and the global shortage of caustic soda. Due to cost pressure put on producers as a result of high energy costs, in some cases, contract prices were renegotiated, or surcharges were added.

In the short term, the European caustic soda market largely depends on energy costs which will play a large part in caustic soda pricing, as well as production rates of chlor-alkali plants, though it is quite unlikely that producers will reduce operating rates due to the tight supply and demand balance. In the coming months, if high energy costs persist, there may be some impact on caustic soda due to consuming sectors reducing production. So far, this has not had any effect on the market. In fact, the seasonal softening of caustic soda and PVC is somewhat reduced compared with previous years. On the other hand, as Asian prices are dropping and supply is improving, competition may bring prices down. However, buyers may be reluctant to purchase import product due to longer lead times considering the uncertainty in the market.

More recently, the Omicron variant of Covid-19 added concerns, particularly due to strict restrictions in Europe. Its potential to exacerbate existing challenges around truck driver shortages is one such apprehension.

Introducing Tecnon OrbiChem's Benchmarking Capacity

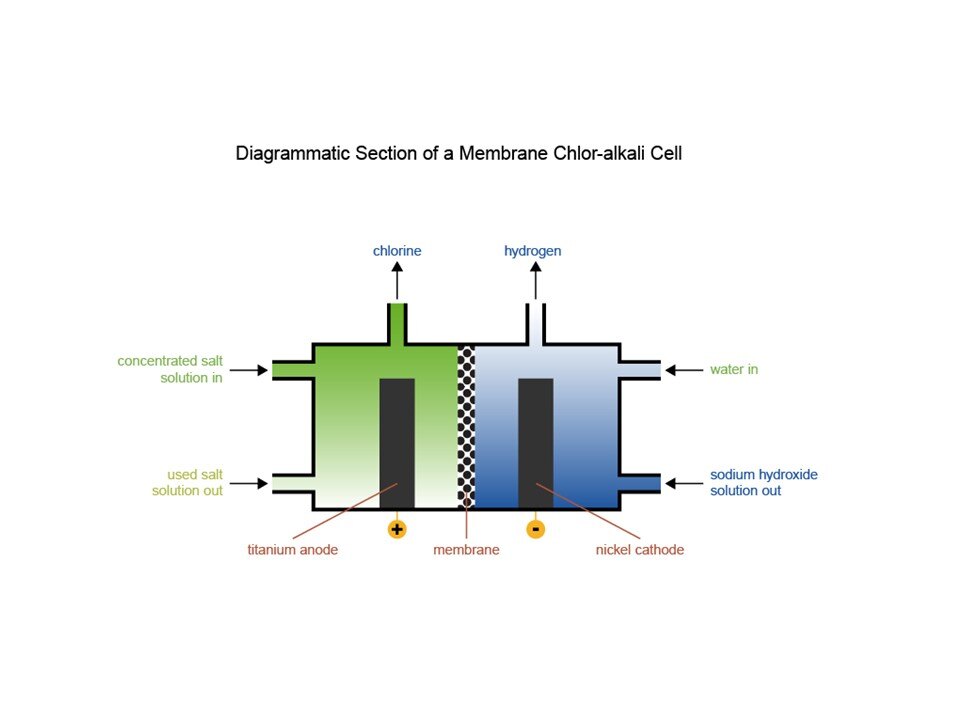

The infographic below shows the cost breakdown for the electrochemical unit (ECU) used in chlor-alkali plants in China. Y-axis data will be available to subscribers first. Tecnon OrbiChem leveraged proprietary data and insight from its OrbiChem360 platform to produce the report in collaboration with the Hong Kong-based Lantau Group, which specializes in analysis of Asia's electricity market.

The full report outlines factors shaping the caustic soda and chlorine industry cost structure in China. The report focuses on the sector's 55 largest enterprises, from Xinjiang province in the west to Shanghai in the east. Fill in the form at the end of the article – ticking the box beside chlorine; chlor-alkalis and/or caustic soda – to receive a link to a video providing further details of the study in your inbox as soon as it is released.

Read Related: What's Driving Chinese Chlor-alkali Markets?

Subscribe to our blog to get market insights and updates delivered right to your inbox.

Hira Saeed

Hira Saeed

![[Video] Molecules to Markets Episode 1: Chemical Markets Begin 2026 in a Supply-Driven, Margin-Sensitive Environment](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-Episode-1.png)