3 min read

Europe’s Biogenic CO₂ Bottleneck: Why Sustainable Supply Falls Short

ResourceWise

:

Dec 2, 2025 10:01:53 AM

A new study commissioned by Transport & Environment (T&E), a leading European clean-transport NGO (non-government organization), is shining a spotlight on a growing bottleneck in Europe’s decarbonization strategy. There is a severe shortage of truly sustainable biogenic CO₂.

According to the report, Europe can currently count on 92 million tons of biogenic CO₂ per year that meets T&E’s sustainability criteria. However, as industries ramp up production of e-fuels and carbon-removal technologies, that supply will fall dramatically short.

How T&E Defines Sustainable Biogenic CO₂

To arrive at its 92mn t/yr estimate, the report applies a narrow definition of what qualifies as sustainable biogenic CO₂. Only three types of facilities make the cut:

- Pulp and Paper Mills

- Energy-from-Waste Plants

- Biogas Upgrading Facilities

Meanwhile, major sources such as bioethanol fermentation and biomass power plants are excluded for relying on feedstocks T&E views as unsustainable. The result? Most traditional biogenic CO₂ producers besides pulp mills are left out.

A Limited Supply for a Rapidly Growing Market

Based on the limited pool of CO₂, T&E suggests that Europe may be able to support up to 11.5mn t/yr of e-SAF (sustainable aviation fuel) production. While this number may seem large at first sight, it reflects less than a quarter of the EU’s current jet fuel demand.

And that’s just the beginning.

Demand for biogenic CO₂ won’t be driven just by e-fuels. The report notes that carbon dioxide removal (CDR) projects, such as bioenergy with carbon capture and storage (BECCS), will begin to compete heavily for the same CO₂ streams.

By 2050, combined demand from e-fuels and CDR could reach anywhere from:

- 140 million tons of CO₂ per year (minimum scenario)

- to nearly 400 million tons per year (high-demand scenario)

In both cases, Europe’s 92 million tons of sustainable supply will not even come close to meeting that demand.

T&E is blunt in its conclusion: even under conservative assumptions, “the minimum demand case already exceeds supply.”

Waiting on Direct Air Capture

One long-term solution, direct air capture (DAC), could theoretically supply unlimited atmospheric CO₂. But the report points out that commercial-scale DAC remains years behind schedule. Developers are still grappling with the jump from pilot plants to full-scale deployment, and timelines continue to slip.

Until DAC becomes viable at scale, biogenic CO₂ remains the only near-term option. And simply stated, Europe doesn’t have enough of it.

EU Policy Signals Are Emerging

The European Commission has taken note. In its newly published Bioeconomy Strategy, the Commission announced plans to release rules for biogenic carbon capture and storage in the coming year.

According to the statement, the EU ETS review will explore pathways to recognize biogenic permanent removals under the Carbon Removal and Carbon Farming Certification Framework (CRCF). Meanwhile, the Innovation Fund will continue supporting Bio-CCUS (carbon capture, utilization, and storage) projects that can scale.

This policy clarity could help unlock infrastructure investment. But it won’t solve the underlying supply crunch.

T&E’s Recommendations on e-Fuels and Infrastructure

Given the scarcity, T&E argues that the EU should prioritize biogenic CO₂ for e-fuel production. This solution can directly displace fossil fuels in hard-to-abate sectors like aviation and maritime.

But prioritization alone won’t help unless CO₂ can actually move from where it’s produced to where it’s needed. So the report evaluates four options for transporting CO₂ from point source to e-fuel producers, ranking them by cost and practicality:

1. Pipelines: Most efficient, but geographically limited

Pipelines offer the cheapest transport for large, steady volumes. But current plans focus heavily on the North Sea, leaving major biogenic CO₂ sources in Finland, Sweden, Slovakia, and Central/Eastern Europe disconnected.

2. Rail: A strong fit for medium-scale e-fuel plants

Rail transport works well for e-fuel facilities using ~300kt/yr of CO₂ over medium distances (~300 km). The study highlights rail as a cost-effective option for distributed sources.

3. Trucking: Best for early-stage, smaller volumes

High-purity CO₂ streams, such as those from biogas plants, can be aggregated and moved by truck at smaller scales. This would serve as an important bridging solution while the market grows.

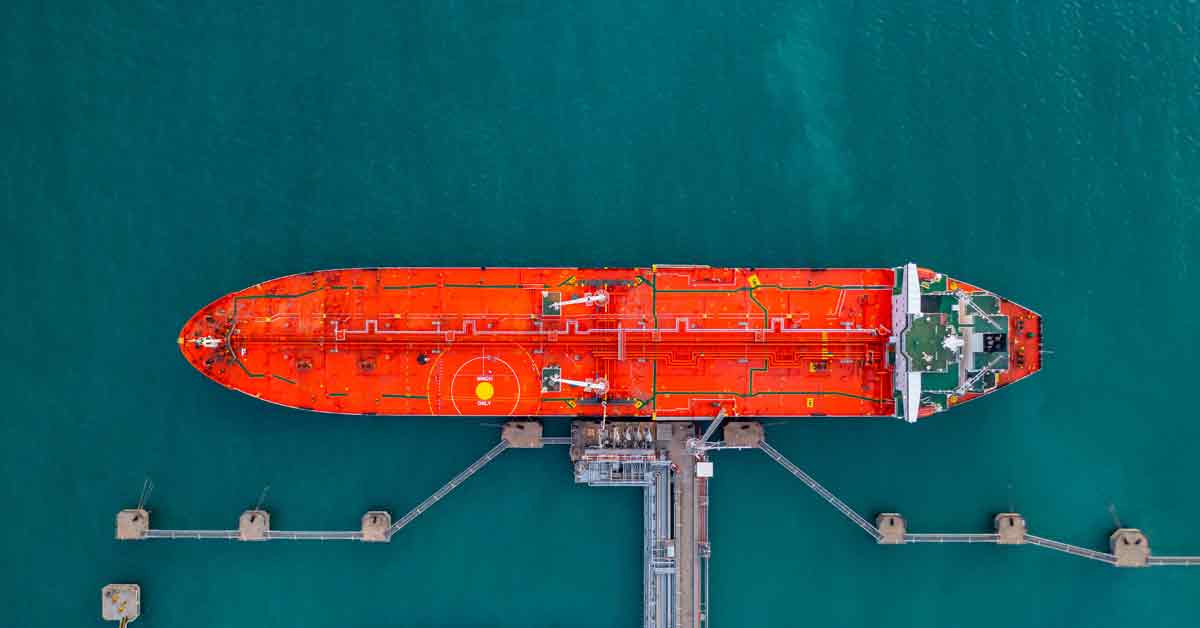

4. Shipping: Useful for coastal hubs

For large coastal clusters of CO₂ producers and users, shipping provides flexibility and additional long-distance capacity.

A Strategic Constraint Europe Must Address

Europe’s decarbonization roadmap increasingly depends on biogenic CO₂ as a critical feedstock for next-generation fuels and carbon-removal projects. But T&E’s analysis makes one point clear: Europe doesn’t have enough sustainable biogenic CO₂ to meet its future needs.

Unless policymakers expand infrastructure, tighten sustainability definitions consistently, and accelerate investment in technologies like DAC, the region risks hitting a hard supply ceiling long before reaching its climate goals.

Live Webinar with Comprehensive Biofuels Update

Need some help navigating the uncertain pathway of the biofuels market? Join ResoureWise for a live webinar covering the most important topics in the industry.

Hosted by Matthew Stone, ResourceWise's VP of Business Development and Low Carbon Fuels, the webinar will cover all these major topics:

- Regulation Rollout: Get a broad overview on all major policy and regulatory fundamentals, including the German RED III rollout and its influence on EU trading.

- Feedstock Dynamics: Understand the balance betwen Annex IX, Annex IX B, and crop-based feedstocks.

- SAF Market Outlook: Get a direct look into what's driving the SAF market.

- Marine Biofuels Trends: See where and how bio-bunkering is taking shape in the global shipping market.

You won't want to miss this critical update on what to look out for in the 2026 biofuels market. Register today to secure your spot.

![[Video] Molecules to Markets Episode 2: Electrification, Interest Rates, and Emerging Chemical Market Upside](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-2-CHEMICAL%20PRODUCTS%20SOCIAL%20SPEAKER%20HIGHLIGHT.png)