4 min read

Engineered Plastics for High Voltage Automotive Applications

ResourceWise

:

Dec 16, 2024 12:00:00 AM

The electric vehicle revolution and battery-powered transportation systems are introducing increasingly higher-voltage components to human mobility.

While alternators and batteries in internal combustion engine cars require low double-figure voltages only, electric vehicles (EV) are now using up to 800-volt architecture. The shift is designed to increase efficiency, improve performance, and allow faster charging capacities.

The distinct properties of the engineering thermoplastic polymer polybutylene terephthalate (PBT) will be key to ensuring the safety of high-voltage components and protecting vehicular powertrains.

With these high voltages vital to EV transmission and propulsion, the materials that surround electrically charged mechanism require insulation. Vehicles' overall safety pivots on withstanding—and/or containing—intensely high temperature, and, is some circumstances, ignited flames.

The engineered thermoplastic polymer polybutylene terephthalate (PBT) meets the property demands of a high-voltage insulator due to its high-temperature resistance and tolerance to strong currents.

PBT Pricing and Availability Q4 2024

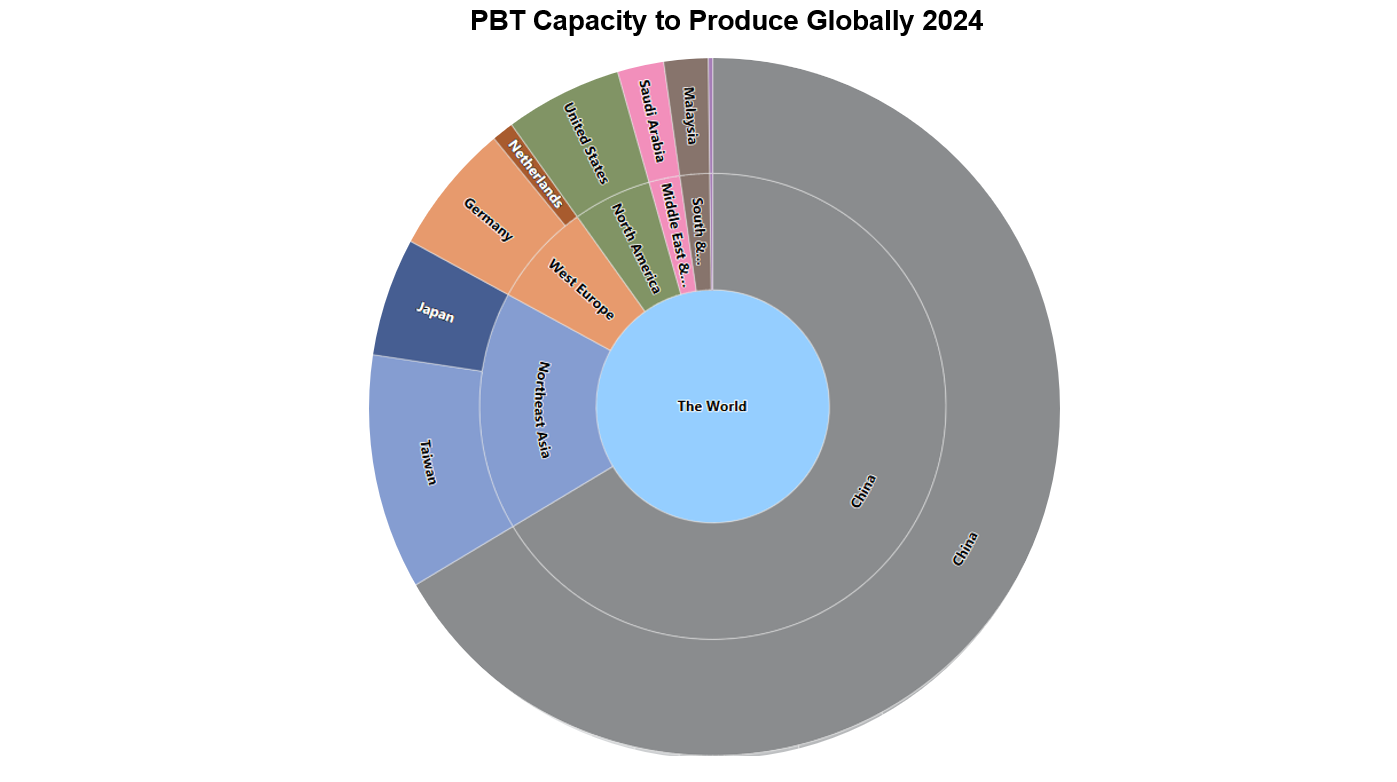

Almost two-thirds of the world's PBT production capacity is concentrated in China. Its price in the country—Domestic Virgin DDP exc. VAT—is almost 45% what it was in 2014. The high of 2014 was toppled by its increasing availability thereafter. China's output capacity increased by 150 ktpa (from 780ktpa) between 2014 and 2016.

Our eBook, Understanding Automotive Sector Supply Chain Dynamics, explores the dynamics impacting engineered plastics value chains from an automotive angle.

It includes price forecast graphics that indicate whether the cost of raw materials— including acrylonitrile, butadiene, and styrene—will rise, fall, or remain flat from now to 2026.

The product's highest price today is almost three times higher than in China. That high is in West Europe. The trading bloc's three producers are able to deliver around 210ktpa in the region, according to nameplate capacity as of 2024. It represents less than one-tenth of China's overall PBT output capacity in 2024. North American output capacity is even lower than West Europe's at around 160 ktpa.

Long-held and established buying and selling relationships and patterns are evolving to swapping, switching and moving in markets with agility

Raw Materials Volatility

Purified terephthalic acid (PTA) and 1,4 butanediol (BDO) are the key feedstocks for PBT. The market for PTA feedstock paraxylene is currently disrupted due to the increased demand – and deep pockets – of gasoline blenders.

It is a subject our PET and polyester-focused expert Javier Rivera, Business Manager, ResourceWise Chemicals, explores in the eBook. You can access the eBook via the blog post, Paraxylene Price Points: Forecasts From Firm Foundations.

In recent years, prices for PTA produced in Asia rose by around 50% and dropped by 50% compared to the price settled in 2018. Meanwhile, the price of BDO has doubled or more than doubled in most of the world since 2018. In China, PTA prices have been subject to intense volatility over the past six years. it shows how vulnerable the PBT market can be to disruptions that occur in downstream environment.

As experienced in many chemical sectors, raw material prices were volatile. Fluctuating prices disrupted engineering thermoplastics markets in 2020 and 2021. Underlying causes were often not directly related to the pandemic.

Cracker operating rates were dialed down as COVID-19 restrictions caused jet fuel and gasoline demand to drop. Additionally, the US Gulf Coast’s extreme weather conditions prompted several engineering thermoplastic producers to declare force majeure in 2021. Dubbed The Deep Freeze, ResourceWise company Tecnon OrbiChem explored its impact in an earlier blog post, Texas Deep Freeze: More Strain on Supply.

Compounders and converters faced further complication when certain reinforced grades could not be produced due to a glass fiber shortage. Supply chains can take months to rebuild following such disruptions.

Source: ResourceWise

PBT Capacities

As the pie chart above shows, China's share of the world’s total PBT output is the biggest. The ResourceWise chemicals intelligence and data platform OrbiChem360 shows that the country almost tripled its output in under five years last decade. The platform also shows that Northeast Asian output is in second place followed by West Europe, then the US. Although both these western regions' respective outputs dwarf that of the Middle East & Africa region, their combined output more than doubled in the two-year period to 2016.

OrbiChem360 subscribers can see each region and country's total output in kilotons simply by hovering their mouse cursor across the chart. The platform also includes a breakdown of outputs by producers within each country. The platform's Plants & Projects dashboard is updated with new and/or additional capacity confirmations. Past, current, and forecast prices for PBT (and its feedstocks) are also available.

Matteo Baldi, Global Sales Manager ResourceWise Chemicals, says: 'We provide insight that allows procurement teams to shop around what can be volatile and changing marketplaces."

Baldi sees the era of long-established and steadfast buying and selling relationships and patterns evolving. "The new generation is one in which buying and selling teams swap, switch and move in markets with agility to get the best deal at the time.

'OrbiChem360 provides the visibility needed to make this strategy work,' Baldi adds.

Multifunctional in Electromobility

BASF produces structural car parts using PBT. Used in inner and outer shells of the BMW i3 carbon body, it is offers a load-bearing function in the event of a crash and keeps the two body shells apart. A unique product, according to BASF.

Similarly, Spanish automaker Grupo Antolin has replaced some key steel structural elements with BASF PBT, reducing the weight of its panoramic sunroofing panels by up to 60%.

Underpinning Connectivity

EV connectors risk irreversible damage and degradation of the insulative material's surface. Such breakdown can create a conductive path. The issue pivots on a material’s dielectric strength versus the maximum voltage required to trigger degradation.

German specialty chemicals company Lanxess offers a new halogen-free flame retardant compound capable of withstanding temperatures up to 150 °C. The firm is targeting electromobility applications, including connectors with its PBT and glass fiber combination product.

Meanwhile, Japanese engineering plastics and polymers manufacturer Polyplastics Group offers 30 percent glass-filled PBT compound. Targeting the same applications as Lanxess, Polyplastics claims its PBT connectors absorb less moisture than PA 66-molded alternatives.

Download our automotive sector eBook to see our price forecasts for raw materials including acrylonitrile, butadiene, and styrene. Will chemical prices rise, fall, or remain flat from now to 2026? Find out now.

![[Video] Molecules to Markets Episode 2: Electrification, Interest Rates, and Emerging Chemical Market Upside](https://www.resourcewise.com/hubfs/images-and-graphics/blog/chemicals/2026/weekly-video-series-molecules-to-markets/CHEM-Weekly-Video-Series-Molecules-to-Markets-2-CHEMICAL%20PRODUCTS%20SOCIAL%20SPEAKER%20HIGHLIGHT.png)