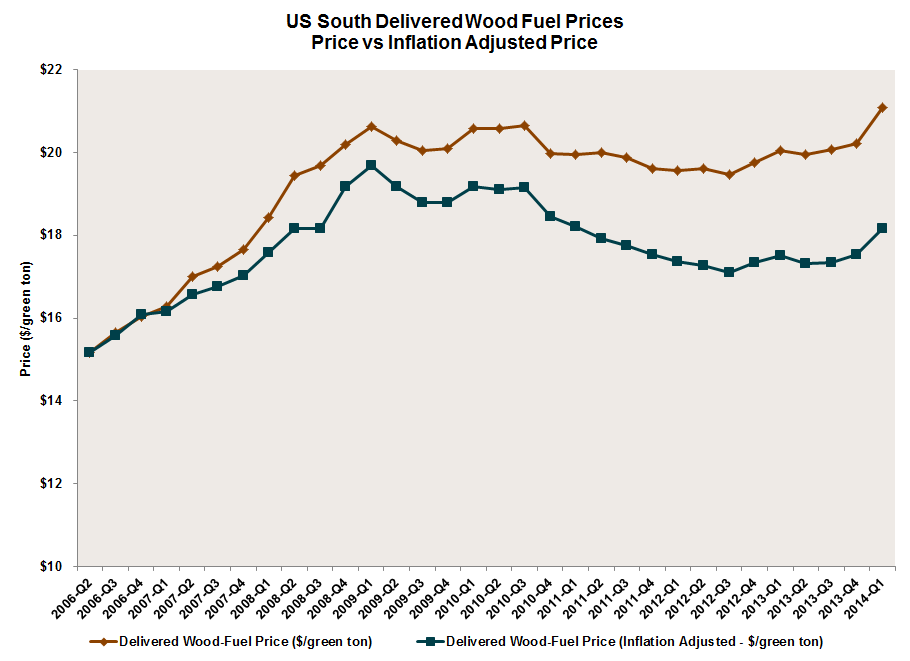

Wood fuel delivered prices in the first quarter of 2014 increased $1.04 per ton, or 5.2 percent, from the first quarter 2013 average price of $20.05 per ton. Since fourth quarter 2013, prices increased $0.88 per ton to an average price of $21.09 per ton.

In August 2013, I predicted wood fuel price would fall. So, why have prices increased? Three market factors should have exerted downward price pressure on wood fuel delivered prices over the past year (1Q2013-1Q2014):

- Pine pulpwood (minus bark) purchases increased by 4.9 percent. This means an additional supply of bark was available for energy production.

- Housing starts vacillated on a quarterly basis since the first quarter of 2013, but overall starts have increased since 2012. As a result, lumber production was higher, and purchase volumes for pine secondary chips (sawmill residues) increased 2.6 percent in the first quarter of 2014. Increased lumber production also contributes to the supply of bark and in-woods wood fuel.

- Diesel costs have decreased by 3.4 percent during the period. This has caused delivered wood fuel freight costs to remain relatively flat, resulting in a meager 0.4 percent change over the period.

If supply has increased and diesel costs have decreased over the period, then why has the delivered cost of wood fuel gone up?

Breaking out individual price components from the total delivered price into wood raw material and freight costs makes it clear that wood raw material costs are the main cause of the upturn. In 1Q2014, freights costs increased an average of $0.03 per ton, but wood raw material costs increased $1.01 per ton.

The reason for the increase in wood raw material costs is two-fold:

- Demand for wood fuel increased, as total purchases by volume were 9 percent higher in the first quarter of 2014. The increase in demand has been driven primarily by dedicated biomass power facilities opening and pulp and paper mills converting from coal-fired to biomass boilers in response to electricity and natural gas prices increases of 6.1 percent and 31.1 percent, respectively.

- A total of 571 inches of rain fell in 2013, which was the second largest amount of rainfall across the South over the last decade. Southwide rainfall amounts increased 22.2 percent from 2012 to 2013, and this caused delayed effects of constrained supply due to a shortage of available inventory during the first quarter of 2014. Our data supports a correlation between increases in rainfall and increases in wood raw material costs.

The combination of increased demand and heavy rainfall influenced the escalation in wood fuel delivered price.

Over the remainder of 2014, lumber production will remain steady in response to housing starts, and this will generate wood fuel supply. Pulpwood demand will continue to increase, creating additional supply. Despite the added supply, we expect wood fuel prices will continue on an inclining trend as dedicated biomass power facilities and pulp and paper mills increase wood fuel consumption.

Comments

06-03-2014

What impact will press release below have on swing to biomass power:

AF&PA; voices concern over new EPA source performance standard for existing electric generating units

WASHINGTON, DC, June 3, 2014 (Press Release) - American Forest & Paper Association President and CEO Donna Harman issued the following statement following the U.S. Environmental Protection Agency’s release of New Source Performance Standards (NSPS) for Existing Electric Generating Units (EGUs).

“While we are still reviewing what has just been released, we are disappointed that EPA decided, in the interim, to effectively treat these emissions the same as fossil fuel emissions.”