4 min read

Wood Chip Supplies Diminish and Prices Soar in the Pacific Northwest

Matt Elhardt

:

September 28, 2022

Matt Elhardt

:

September 28, 2022

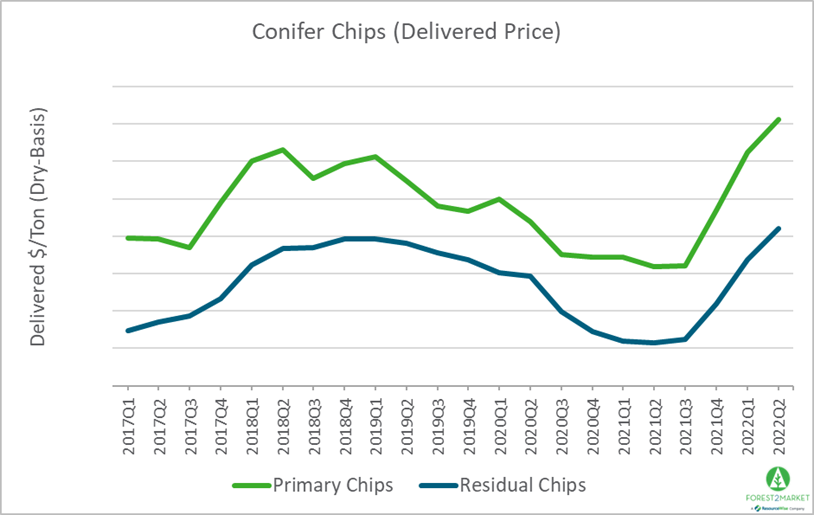

Labor union strikes and industry developments that have pinched the supply of conifer wood chips in the Pacific Northwest (PNW) now have a number of regional chip consumers on edge. Prices bottomed in 2020 in response to the pandemic, but they reversed course sharply in 3Q2021 and have been climbing ever higher since. Conifer chipmill (primary) and residual chip prices are now at a 10-year high in the region and are poised to go higher.

The PNW is a unique market with unique drivers of supply and demand.

As basic economic theory commands, the equilibrium between supply and demand ultimately drives price and when one of these elements falls out of balance, price will respond accordingly. In the case of wood chips, the PNW is generally more sensitive to supply side drivers for two primary reasons:

- Consumers of wood fiber have two options: chips and/or pulpwood (small-diameter logs), and most typically utilize some combination of the two based on price and availability. The PNW has historically been a chip market unlike other regions such as the US South, which has lots of demand (and capacity) for both chips and pulpwood. This lack of pulpwood availability can make the PNW fiber market dependent on, and sensitive to, chip supply.

- Timber supplies in the PNW remain stressed due to lack of harvesting on federal lands, and the region continues to experience devastating effects from seasonal wildfires. Based on the current legislative environment, there is simply no opportunity for expansion; the regional market for public timber is virtually non-existent, and the supply of private timber is largely maxed out. Unless more public timber becomes available to the market in the near term, regional fiber prices will reflect available supply.

Conifer chip supply and prices are more captive to end markets and, as noted above, conifer chip price increases are driven by supply and demand. Currently, the market is characterized by a steady demand for chips, low inventories, mounting economic headwinds, and a looming winter season that will limit harvesting. Together, these events are raising concern about future supply; competition and prices are increasing as a result.

In the near-term, there are three converging factors placing additional price pressure on regional chip supplies.

- The recent Weyerhaeuser strike in the PNW will have some immediate influence. The company operates 4 large sawmills in the region - 2 in southeast Washington and 2 in Oregon – which provide a steady stream of residual chips to the market. Depending on how long they last, the strikes/temporary shutdowns will pull a significant supply of residual chips and pulpwood out of the regional market. Small log consumers are struggling to secure their share of pulpwood and are even forced to buy CNS, as a decline in sawlog harvests will also decrease the pulpwood output. Thus, the price point for chips has to increase to compensate for the higher price of CNS.

- Based on softening demand in the homebuilding sector, there have been recent announcements of sawmill curtailments in British Columbia (BC). Due to rising inflation and interest rates, Canfor said it is making moves to reduce about 200 million board feet (MMBF) of production capacity at its solid wood facilities in BC. This will also severely limit the availability of conifer chips on the market. If curtailments also begin to take shape on the US side of the border, the primary chip market will be under even more pressure as BC pulp mills inevitably try to dip into the PNW for chip imports.

But as noted above, the available pulpwood supply is driven by sawtimber harvests, so the chip cost is going to go up in the region regardless. BC pulp producers are particularly disadvantaged in this scenario; regional sawmills are curtailing production while it is getting tougher and tougher for them to locate chips in the US PNW – which is already lean on supplies. - Log trucks are in short supply and loggers are struggling to keep all their production moving once a logging site is finished and crews are ready to move on. If truck supply is limited, small logs may get left behind as crews seek to maximize harvest values via sawtimber. When prices rise, there is more emphasis to recover all the pulpwood.

Acute Challenges for Regional Chip Consumers

Rapidly changing market dynamics like those currently developing in the PNW are challenging, but not without precedent. While the converging events noted above are unlikely to impact the regional pulp and paper manufacturing segment in the long term, maintaining profitability in periods of extreme stress still requires that manufacturers and their suppliers rationalize production during the stress while sensibly planning for the future. This is the time when preparation and forecasting pay dividends.

Forecasting

Forecasting with a high degree of accuracy is a complex procedure, but a reliable forecasting model must take both global and local events—and the interplay between the two—into consideration. To build such a model, Forest2Market and Fisher International have developed unique approaches that account for a comprehensive view of the market forces that influence price performance.

This allows us to uncover statistically significant correlations between pricing data, the economic indicators that affect demand (GDP, housing starts, etc.) and events that affect supply of forest raw materials. We incorporate the future supply/demand scenarios and other applicable macroeconomic factors in order to develop the most likely outcome. The model accounts for all of these factors—including global and local dynamics—to determine how and when prices will respond to changing influences.

A business forecast built on our robust, price-based datasets and business intelligence allows for greater accuracy because it is designed from a reliable, precise starting point. Rigorous, mathematical models are the tools needed to gain strategic advantage, operate efficiently, and increase profits, and we leverage these tools to provide the most comprehensive price-based forecasts in the forest products value chain.

At the procurement level, our forecasts enable customers to:

- Better optimize raw material procurement – both volume and price

- Manage inventory more effectively

- Align feedstock and output with raw material price trends

At the manufacturing level, our forecasts are designed to:

- Predict price turning points - not just price levels

- Perform sensitivity analysis, testing proposed strategic plans against real market dynamics

- Explain market movements in verifiable, fact-based, common-sense terms

At the operational and strategic levels, our forecasts are used to assist:

- Purchasing & planning (buy now or await market developments?)

- Sales strategy (maximize now or hold back for a market upturn?)

- Production planning to optimize the gap between price vs. cost

- Inventory management to properly time drawdowns or build ups

- Budgeting (monthly and yearly)

- Optimizing cash flows and balancing future input costs vs. revenues

These forecasts enable participants in the forest supply chains to respond confidently to market changes while assuming a comfortable level of risk. Using a forecast model that can maximize return and minimize risk is simply smart business, especially during times of market stress and uncertainty.