Global consumer trends and demands continue to shift at an increasing rate, and many markets for wood fiber are reflecting these changes. In particular, pulpwood and residuals markets have undergone both structural and incremental changes over the last decade, though some of these trends have intensified in response to the events of 2020.

When analyzing some of the changes occurring in these markets, Forest2Market’s 2017 report on this topic evaluated the relationship between the supply and demand of wood residual materials over a 10-year period from 2007-2017 in the US South and the Pacific Northwest (PNW). The study found that there are four underlying trends defining markets in these regions:

- There has been a structural decline in printing and writing papers and the production of other end products derived from hardwood fiber.

- Buoyant demand for softwood fiber has been driven by strong pulp markets and bioenergy in the form of pellets.

- Renewed softwood lumber demand and announced capacity in the US South present challenges, though more for landowners than producers of residuals.

- Wood Fiber constraints in the PNW have hindered growth and led to stagnant, but stable markets.

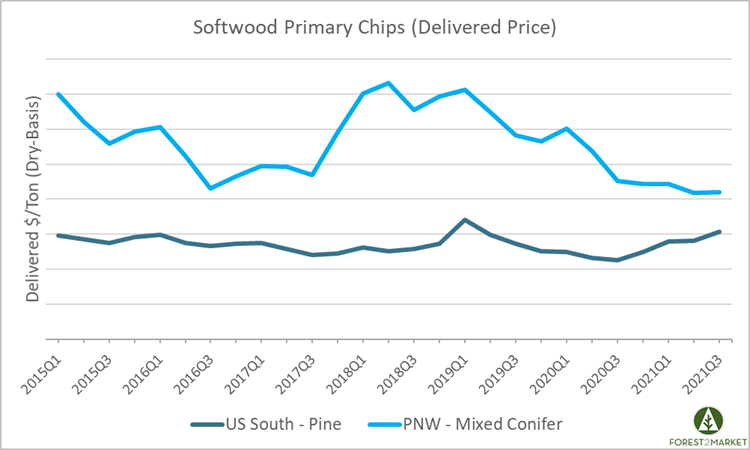

Over the last decade, chip and pulpwood prices in the PNW have demonstrated significant levels of volatility when compared to the relatively flat performance in the US South. More recently — and as the economy continues to evolve in response to the COVID-19 pandemic — prices for most of these products have varied widely between the two regions.

Primary & Residual Chips

Timber supplies in the PNW remain stressed due to lack of harvesting on federal lands, and the region continues to experience devastating effects from seasonal wildfires. So much regional forestland has been damaged over the last 18 months that crews are still cutting to salvage fire-killed timber. Despite the fires, lumber production in the PNW during 1H2021 was up over 9% vs. 1H2020; in BC, production was up over 20%%.

While lumber manufacturers ramped up production to take advantage of record prices for finished softwood lumber in 2021, pulp and paper production in the PNW has remained flat. This led to unchanged chip demand while supply, particularly for residuals, has increased. This combination of factors has driven the price point down, which has also impacted the pulpwood market.

Although the PNW has a vibrant solid wood industry, the US South currently has more active mills producing large volumes of lumber, and capacity increases and greenfield mill projects are coming online every quarter. This steady supply of sawmill chips has kept prices lower in the South, where pine sawtimber prices have also remained low.

Outlook

The housing/remodel markets that have driven record prices for finished softwood lumber over the last year has kept lumber production strong and increased residual chip availability is expected in both regions for the near term. However, the lack of demand in the PNW suggests that chip markets will remain soft; prices for both primary and residual chips are at 10-year lows. Based on its abundant sawmill activity and continued chip demand, the US South will not see much price volatility in the near term.

Softwood & Hardwood Pulpwood

The western sawlog market has softened about as much as it can on the heels of a very wet winter and active fire season that tightened supply, and prices are now heading higher. Domestic Douglas fir log prices are the highest they have been since November 2020, and Hem/fir prices have followed a similar trend. Export prices are also moving higher as Asian demand begins to pick back up. However, as more chip supply becomes readily available and demand for both residuals and pulpwood remains flat in the West, prices for both of these products will reflect this dynamic. Delivered softwood pulpwood prices in the PNW are now markedly below those in the South.

Pulpwood prices in the South have remained relatively flat over the last several years and have typically only experienced minimal seasonal effects (most notably in 1Q2019). However, pulpwood demand has surged in the region in 2021, which pushed southwide stumpage prices to a 14-year high in 3Q. In one particular region – the north Florida/south Georgia market – 3Q pine pulpwood stumpage prices jumped 71% QoQ and CNS prices were up 41%. Year-over-year (YoY) increases were even more extreme; prices were up 105%, and CNS prices were up 57% YoY.

Outlook

When it comes to fiber preferences among these products, the PNW is largely a chip market when compared to the US South, which has lots of demand for both chips and pulpwood. In the PNW, demand for pulpwood will continue to be flat as supply remains plentiful. However, pine pulpwood consumption - and the wood markets that drive it – will remain very strong throughout the US South. While prices for hardwood pulpwood in the South have been volatile over the last year, this has largely been driven by short-term supply constraints from weather related events. Overall, we look for southern pulpwood prices to level off in the near term.

Sellers of timber resources and pulpwood consuming mills in both regions can closely monitor and analyze fiber and log costs through SilvaStat360 to uncover opportunities for improved planning and cost management.

Joe Clark

Joe Clark