4 min read

Will Structural Freight Changes in the Lake States Alter the Future of Wood Deliveries?

Jeremy Kessinger

:

August 30, 2022

Jeremy Kessinger

:

August 30, 2022

Delivered wood fiber prices in the Lake States have been depressed for the better part of two years – a period which saw a significant drop off in demand due to the closure of two large regional paper mills. In an unexpected twist, however, prices turned markedly higher in March. Delivered fiber prices in 2Q2022 were up 13% quarter-over-quarter (QoQ) and while they have recently tapered, prices are still at their highest point in more than three years.

The Lake States normally experiences an increase in total delivered price in April/May as woodyards are emptied and a secondary freight charge is realized on wood deliveries. However, Forest2Market data indicates that mills in the Lake States have been holding noticeably less offsite inventory over the last two winters compared to historical trends. This suggests that the recent increase in price is driven less by seasonal factors, i.e., emptying of regional woodyards, and more by market supply issues and increasing costs.

As we reported in the wake of the devastating economic impacts caused by COVID-induced lockdowns in 2020, wood fiber consumption dropped off significantly in every wood basket across North America. But as the economy picked up steam in 3Q and 4Q2020, some regions experienced structural changes in fiber demand that continue to impact their respective wood supply chains.

Despite decreasing prices over the last two years, the Lake States forest industry has been testing the limits of the wood production and transportation systems over the last few quarters. The regional market is now close to experiencing a repeat of a supply/demand scenario in 2014 that saw wood fiber prices skyrocket.

What Happened in 2014?

The seasonality of timber harvesting is a significant driver of price in the Lake States. Deliveries typically peak in late winter. As a result, regional mills fill their log inventories during 1Q to include as much as 80 days’ worth of system-wide inventory designed to last through the spring season. It is equally important for the system to maintain a minimum of 30 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

There is little flexibility in these numbers, as spring “break up” is traditionally the low point for wood deliveries because the rainy climate from March - May results in difficult forest and road conditions. It is far better to carry excess inventory during break up than it is to risk running out of wood or paying exorbitant spot prices in an effort to play catch-up. When inventories dipped below 30 days in 2Q2014, prices spiked over 20% during the following year before finally leveling off in late 2016, as noted in the chart below.

What’s driving prices higher now?

When analyzing days of inventory and price over the last several months, a trend is developing that is similar to what occurred in 2014: market onsite days of inventory have been in the low 30s or below since 3Q2021. Market offsite days of inventory have been equally thin. We’re now beginning to see a price increase in combination with low inventory levels, which is a situation that is only exacerbated by rising supply chain costs.

There are a few drivers applying upward price pressure in the current market:

- Increasing Prices/Tighter Supply: As we have demonstrated in the past, the supply and demand of logs and wood fiber is ultimately what drives the price of these products on the market, which is independent of fuel price. However, the cost of producing logs and fiber is not independent of fuel price, or the price of any other input that goes into generating these products; steel, labor, tires, oil, etc. all affect the cost of producing forest products. Ongoing supply chain issues have driven costs +30% higher in some cases. For example, commercial truck tires have increased by ~35% since 2020… if they’re even available. Maintenance parts for logging equipment are following the same pattern, and are simply hard to come by in this market.

- Oil/Diesel Prices: While oil and diesel prices are ticking down now, average pump diesel price is still close to $5.00/gallon, a 58% year-over-year increase. This added cost is compounded by the fact that the average haul distance in the region is ~80 miles.

- Logging Capacity: A look at the inventory data above demonstrates that levels are the lowest they have been in possibly decades. While some mills are operating on little to no standing inventory, the larger challenge facing the regional industry is the shrinking logging force and logging capacity. Many loggers have taken such a margin hit due to rising costs that they have begun tapering production and reducing capacity. There are reports that some of the logging/trucking force has transitioned into higher-profit work (construction/grading, etc.), and it is likely that some portion of this group will not return to the logging sector anytime soon.

Structural Freight Changes

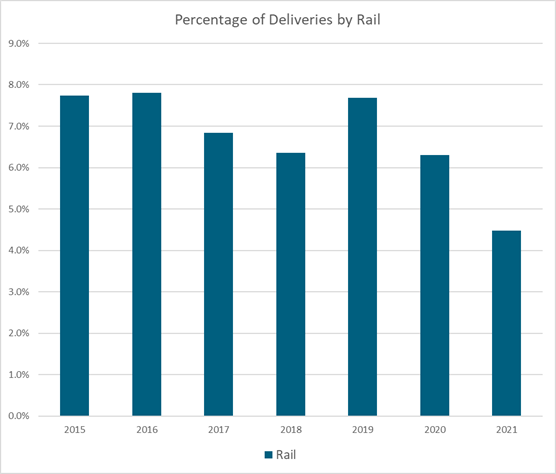

The chart below shows hardwood total fiber delivered by rail across the Lake States, which declined from nearly 8% in 2015 to 4.5% of total deliveries in 2021. At the same time, average freight distance has also declined from 105 miles in 2015 to 77 miles in 2021 (decrease of ~27%). Due to the changing structure of raw material deliveries, one would assume that logging capacity would decline over time as raw material consumption has declined.

Wood demand uncertainties due to mill closures and woodyard shutterings has disrupted a reliable supply chain of forest raw materials. In addition to this disruption, the largest factors likely driving increased delivered prices in the Lake States are the spike in fuel costs and rising costs associated with supply chain issues for maintaining equipment and/or purchasing new equipment.

Are rising delivered costs causing mills to hold back on building summer inventory in hopes of improving cost conditions later in the year? Delivered costs have declined in June by ~8% from May’s high. Do the remaining mills feel confident Spring needs can be met strictly from winter build-up alone? Or will we see a spike in delivered prices in 1Q2023?

Access to transactional data can help plan for future opportunities or help reduce the impact of risks that may arise in the wood supply chain by being proactive to changing conditions.