The China Paper Association published its "14th Five-Year Plan" along with the medium- and long-term development outline of the paper industry at the end of 2021. Within this publication, there was mention that in the next five years, one of China’s main goals is to increase industry concentration and encourage large-scale pulp and paper enterprises to grow through mergers and acquisitions (M&A), joint ventures, and other forms of cooperation in order to develop a comprehensive group with international competitiveness.

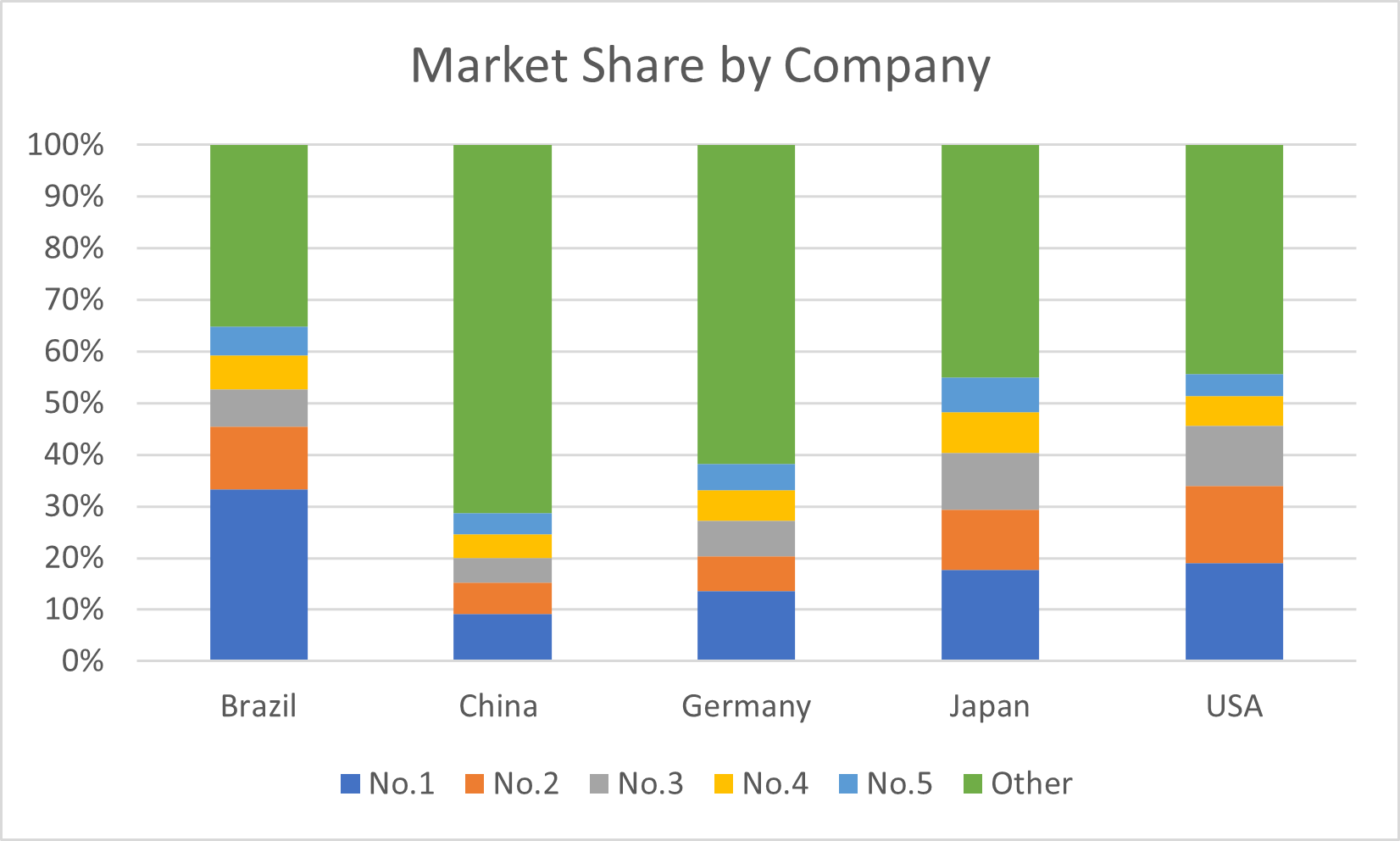

China has become the largest producer since 2011, with far more capacity than most other countries. However, the industry in China is much more fragmented than in other countries. When we take a close look at the top 5 companies’ market share in the top 5 countries, as illustrated below, we can see that in China, the top 5 players only account for less than 30% of total market share – which is much lower in comparison to other countries. It’s obvious there is room for the industry to consolidate, but the question is which grade has the most potential for consolidation?

Source: FisherSolve

Source: FisherSolve

While packaging has consistently been the biggest segment, there has been significant growth occurring quickly in the tissue segment. The CAGR between 2007 to 2025 is 18.4%. Meanwhile, with expanded capacity, we’ve seen a lot of new players enter the tissue market since 2021, which seems to make this segment appear more fragmental.

Source: FisherSolve

However, the ranking of the ”top players” seems to be always changing. In 2025, Lee & Man is expected to become the number one producer in China, bypassing the top four players – APP, Hengan, Vinda and C&S – in the market. Taison’s market share is also expected to exceed C&S and replace it as the fifth top player. Both Lee & Man and Taison entered the market through inorganic growth and different strategies from the other Big 4. For instance, they have integrated bamboo pulp into their portfolios and both companies have launched its first tissue mill in southwest China.

Does this indicate that companies with integrated pulp will have more potential in the tissue market? Will we see an uptick in other similar players entering the market?

With China now being the largest paper producer, the industry heavily relies on raw fiber material imports, including wood chips and wood pulp. Considering the investment cycle, capital required, and the gap between pulping lines and tissue machine capacity, companies with sufficient pulp resources clearly have a long-term advantage by determining the market pulp price variation.

The top 20 market pulp producers can be categorized into two groups, companies who already have plant assets in China and can expand by acquiring non-integrated tissue mills, and companies with no plant assets in China. From here, important questions to ask include:

- Do companies with no plant assets in China have the intention to expand their business footprints?

- Will companies with multiple pulp grades have more of an advantage than those with a single pulp grade?

- How can pulp suppliers balance the role of being an upstream supplier for non-integrated tissue mills while being a tissue producer? How can they compete with current players in the finished product and sales channel?

- Who will be the primary candidate to enter the tissue market or keep expanding capacity?

As some companies have already started working on expansion plans, we expect to see a new dynamic shift soon. In such a volatile industry, it’s important to always address questions such as the ones above in order to anticipate market shifts. Fisher International offers unparalleled data services and insights that allow innovative and forward-looking companies to identify new opportunities that drive business success. Talk with one of our experts today.

Amy Chu

Amy Chu