2 min read

What’s Driving Delivered Prices Higher in the Northeast?

Joel Swanton : September 23, 2019

Several factors have combined in the US Northeast over the last decade to negatively impact the region’s forest products industry. Most importantly, demand for one of the region’s pivotal products—printing and writing papers manufactured from hardwood and softwood pulp—continues to decline rapidly; production of printing and writing papers has declined by 6% annually since 2009. The secondary market for harvest residue and mill residual hog fuel—biomass chips used to generate electricity—has also been hard hit and is on life support throughout much of the region.

However, the news is not all negative for the forest industry in the Northeast, as certain products are gaining ground in the pulp and paper segment. While the digital revolution has undoubtedly changed the way we consume media, paper production is not disappearing altogether, but demand is shifting between various types of paper products. As a result of this increase in demand, softwood and hardwood fiber prices are also increasing throughout the region.

Southern mills are primarily capitalizing on the growth of the boxboard segment, but mills in the Northeast are using softwood resources to support robust tissues and specialty papers segments, which include toilet, facial, napkin, towels, wipes and special sanitary papers as well as various release and food packaging grades. A number of regional manufacturers have completed conversions or transitions to make products that are in higher demand globally: Verso, SAPPI and Woodland Pulp have all made adjustments to meet the new demands of the marketplace. Nine Dragons also recently converted and restarted the shuttered Old Town, ME paper mill and as a result, softwood fiber prices have crept up over the last two years.

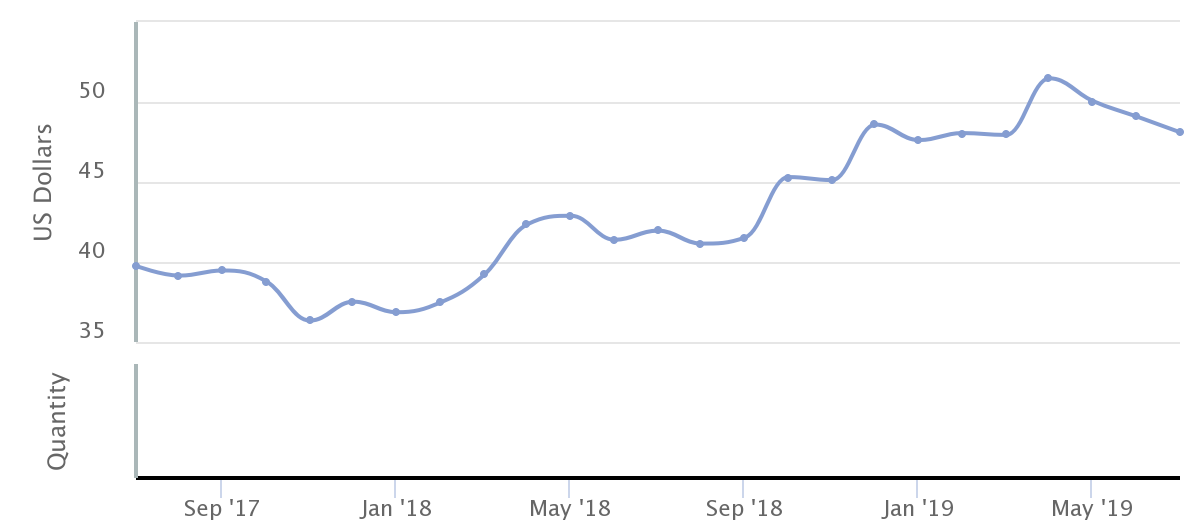

Increased demand for spruce-fir sawlogs has also increased as the lumber market has rebounded. While the regional lumber output is a fraction of the South’s output, there is nevertheless demand for conifer logs in the Northeast—primarily small-diameter logs that pulp mills and sawmills compete for in periods of strong demand. As a result of this additional demand, delivered conifer (total fiber) prices have increased 24% over the last two years.

Delivered Conifer Prices

Hardwood pulp demand remains strong in the Northeast, though not to the levels once experienced in the region. Like any wood-producing region, certain geographic pockets have seen harvest activity ramp up while others have seen it decline but, overall, demand is stable enough to drive prices higher. Delivered hardwood (total fiber) prices have increased 6% over the last two years.

Delivered Hardwood Prices

While the basics of supply and demand ultimately determine the direction of timber prices, there are a number of factors that also contribute to the impact of those prices. There are two independent dynamics unique to the Northeast that are germane to the analysis.

- As softwood demand has recently increased after several years of reduced demand, some timberland owners may be shifting harvest emphasis towards softwood, resulting in less hardwood production. While the market hasn’t yet realized the full impacts of this shift, it could nevertheless create additional uncertainty in the future.

- Harvest and trucking capacity in the Northeast declined significantly in the wake of the Great Recession of 2008 as a number of regional mills closed and consumption decreased. Now, with a slow uptick in the markets and an increase in fiber demand, there is insufficient harvest and trucking capacity to meet that demand, which is placing upward pressure on delivered prices.

The Northeast is home to world-class forest resources and some of the longstanding sectors within the North American forest products industry. As these regional sectors evolve to meet the demands of the modern market, its forest supply chain is finding ways to add value, demonstrate incremental growth and compete in a truly global market.