Wood fuel prices have decreased over the last three quarters to an average of $20.74 per ton in 1Q2016. The market is on a declining trend as prices for substitute energy sources (i.e. natural gas and electricity) have declined and recent supplies of wood fuel have increased. Purchasers have reacted opportunistically by decreasing delivered prices.

Supply Side

Supplies of sawmill-produced residues have slowly increased since 1Q2015 as the lumber market has improved. This has also resulted in more harvest activity and an increase in the available supply of harvest residues. In addition, our data reveals a large inventory build for pulpwood that occurred in 3Q2015, which has increased the internal supply of debarked boiler fuel.

Demand Side

Prices for alternative fuel sources continued to decrease. Natural gas prices fell 6.6 percent over 4Q2015 and 1Q2016 (compared to 2Q and 3Q2015), while industrial electricity prices decreased 7.3 percent.

The Result of This Supply-Demand Relationship

When compared to 2Q and 3Q2015, purchasers made the most of the available supply by increasing their open market purchases by 4.2 percent in 4Q2015 and 1Q2016. When compared to 3Q2015, wood fuel prices fell $0.51 per ton to an average of $20.80 per ton in 4Q2015 and then dropped a subsequent $0.06 per ton to an average of $20.74 per ton in 1Q2016.

Figure 1 shows the trends in wood fuel demand and price. Demand is indexed to wood fuel purchases made in 2Q2006.

Figure 1: US South Wood Fuel Purchase Trends

A deeper look at the data behind this chart shows four distinct trends. These trends are enumerated in Table 1. Demand for wood fuel was significantly lower during the recession and post-recession years, and the price for wood fuel fell as low as $1.90 per million BTUs. During the last three quarters, as demand has weakened, prices have fallen to an average of $1.98 per million BTUs.

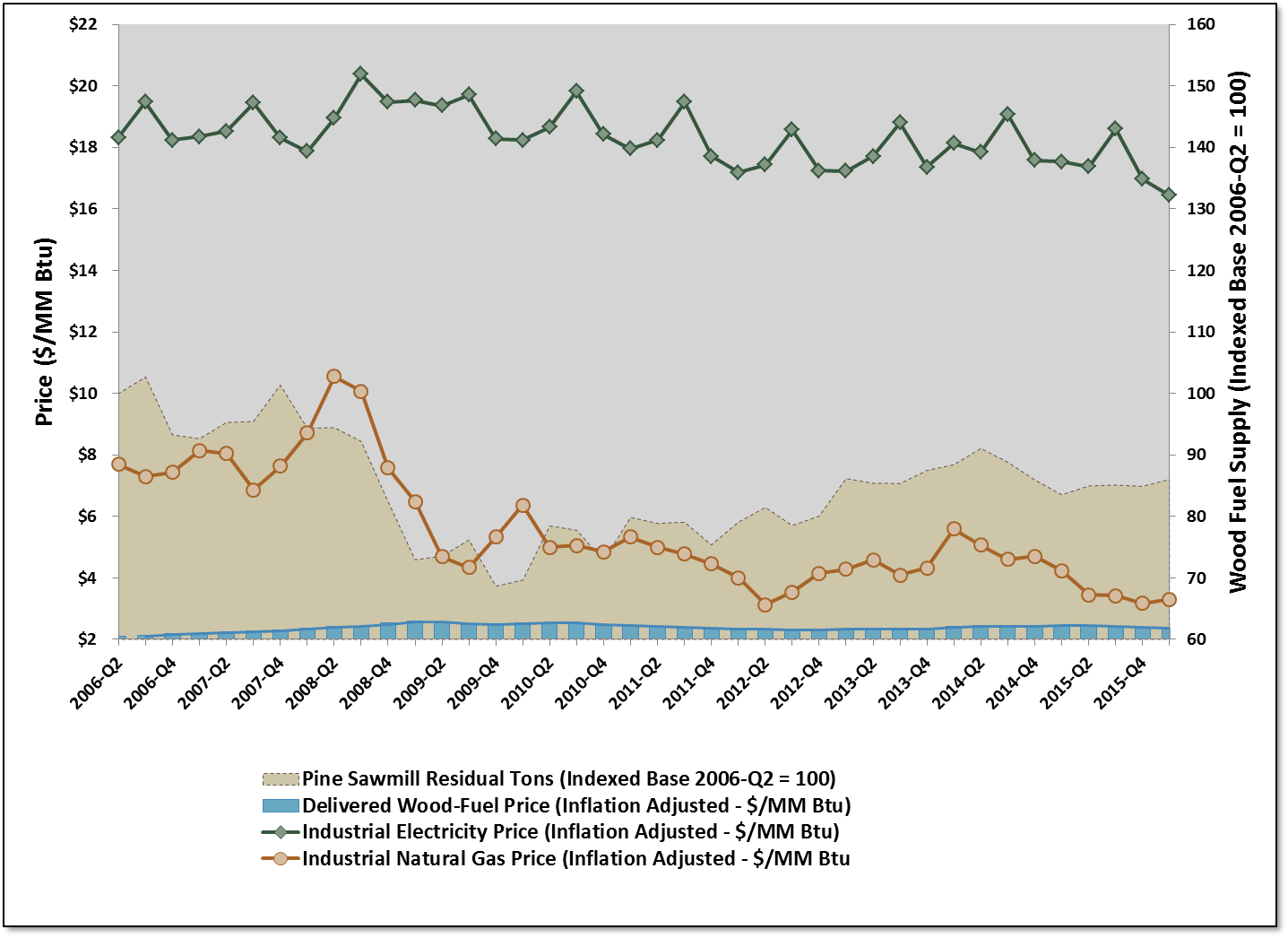

How does this compare to other energy prices? Figure 2 shows the price fluctuations in natural gas and electricity prices during the same four time periods. Supply in this chart is indexed to the supply of sawmill residuals in 2Q2006.

Figure 2: US South Wood Fuel vs. Alternative Energy Price Trends

Table 2 highlights the trends in wood fuel supply and energy prices for the same four time periods. The trend for the period between 2Q2009 and 4Q2013 reflects the fact that production at sawmills was dramatically lower than the historical norm, a result of anemic housing start activity. By the last half of 2015, prices for both natural gas and electricity continued to fall. Natural gas prices were very near delivered wood fuel prices.

It’s a truism affecting every market at present—especially as we near the final leg of the US presidential election process—but the future does indeed remain uncertain. Global economic events and recent US housing start figures suggest that the sawmilling market may weaken in the near term. Additionally, the relative strength of the dollar appears to be affecting US manufacturers.

These events may put downward pressure on the supply of wood fuel and have the effect of driving prices higher. Should prices for alternative energy sources remain low or continue to decrease, however, reduced demand for wood fuel may trump the price effects of decreased supply. The trend over the last two quarters suggests that the latter has the higher probability of occurring.

Daniel Stuber

Daniel Stuber