Compared to 2010, US South stumpage prices for pine pulpwood, hardwood pulpwood, pine chip-n-saw and pine sawtimber fell in 2011. The reasons for the price declines varied by product. Pulpwood prices decreased as a result of softened demand in the pulp/paper industry, which fell by 2.8 percent. Even though the solid wood industry saw a slight increase in demand—1.9 percent—chip-n-saw and sawtimber prices also decreased. It should come as no surprise that landowners reacted to these declining prices by restricting supply through a combination of reduced timber sales and delayed harvests. In total, supply decreased by 6.8 percent.

Forest2Market has been tracking stumpage prices for more than 10 years, and for much of that time we have also produced a stumpage price forecast. Because these forecasts are built on transaction data—in this case, timber sales agreements—the forecasts have proven to be highly accurate. For this post, I have taken both our historical stumpage price data (which we gather in 39 wood basins in the South) and our 4Q2011 stumpage price forecasts (which we model for 22 wood basins in the South) and aggregated that data.

Note: as reporting on stumpage prices in this many wood basins would be difficult in a blog post, I have aggregated this data into the Southwide numbers that are reported here. Follow these links for more information on wood basin specific stumpage prices and timber price forecasts.

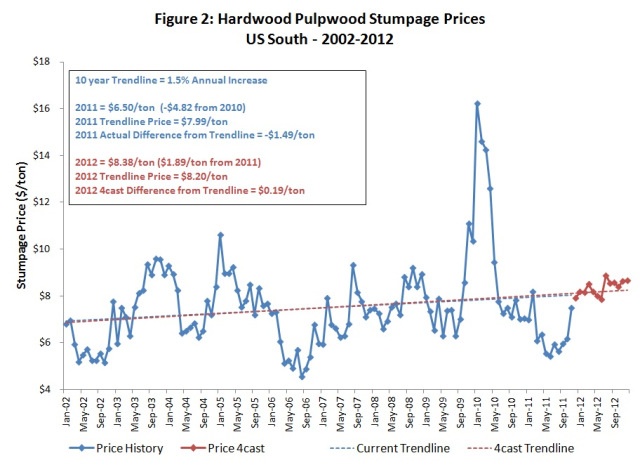

In 2011, pine pulpwood prices averaged $8.96/ton, a decrease of $1.75/ton from 2010. The 10-year trend (2002-2011) in nominal pine pulpwood prices reflects an increase of 3.2 percent annually. According to the Producer’s Price Index of Intermediate Materials, inflation for this time period was 4.7 percent annually; in real terms (adjusted for inflation), pine pulpwood prices have declined 1.5 percent annually (Figure 1).

Compared to the 10-year trendline, pine pulpwood prices were down $0.93/ton. Prices began the year at trendline, but this quickly dissipated through the third quarter. In September, prices began to increase and approach trendline again, in response to seasonal buying patterns. According to Forest2Market’s forecast for 2012, prices are expected to decline after the winter subsides, reaching levels slightly above those seen in 2011. For 2012, prices are forecasted to increase $0.16/ton over 2011’s average, but remain $0.71/ton below the forecasted 11-year trendline.

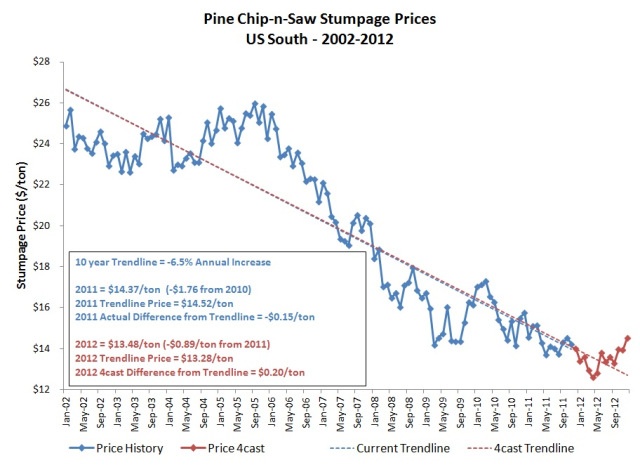

Since averaging over $16.00/ton in January 2010, hardwood pulpwood prices have continued their rapid decline. In 2011, hardwood pulpwood prices averaged $6.50/ton, down $4.82/ton from 2010’s record high. Like pine pulpwood, prices for hardwood started 2011 slightly above trendline, then declined through the second quarter. Beginning in July, prices increased steadily, and they are now approaching trendline. For 2012, Forest2Market’s stumpage price forecast expects hardwood prices to increase. Prices in 2012 are projected to average $8.90/ton, an increase of $1.89/ton over 2011 and $0.19/ton over the 11-year forecasted trendline (Figure 2).

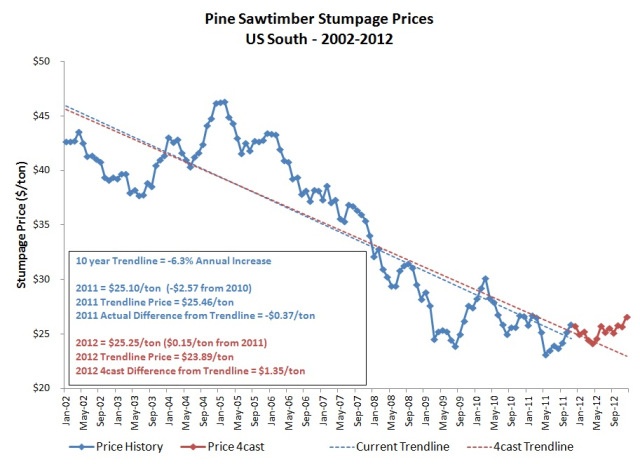

The trendline for pine chip-n-saw continued its downward trend in 2011. Prices have decreased 6.5 percent annually over the last 10 years. In real terms, prices have decreased 11.2 percent.

For 2011, chip-n-saw prices averaged $14.37/ton. This reflected a $1.76 decline from 2010’s average and a $0.15/ton difference under the 10-year trendline. For 2012, Forest2Market expects chip-n-saw prices to average $13.48/ton, a decrease of $0.89/ton from 2011. The downside here is that prices will continue to decline and bottom out in the second quarter as conditions adjust in the housing market. The upside is that the housing market is expected to gradually improve in the second half of the year and with it, chip-n-saw prices. Compared to the forecasted trendline, chip-n-saw prices are expected to reverse course and end $0.20/ton over trendline (Figure 3).

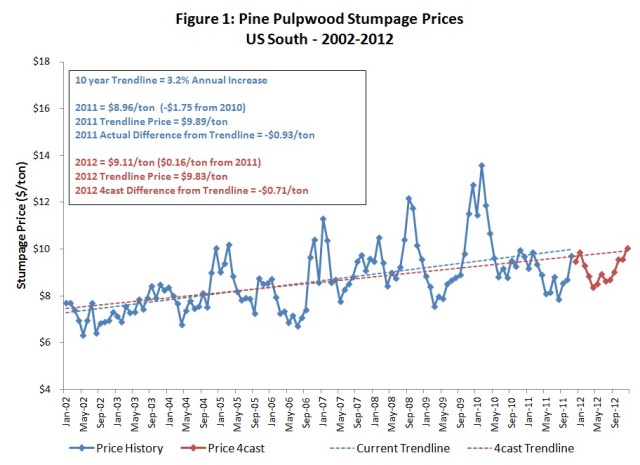

Like chip-n-saw, pine sawtimber prices have declined 6.3 percent annually over the last 10 years, 11.0 percent in real terms. For 2011, prices averaged $25.10/ton, down $2.57/ton from 2010 and $0.37/ton under the 10-year trendline.

Even though prices bottomed out in May this year and surpassed the trendline in October, the first half of 2012’s forecasted decline in the housing market is expected to dampen prices. But overall, Forest2Market’s forecast projects that 2012 prices will average $25.25/ton, an increase of $0.15/ton over 2011 and $1.35/ton increase over the forecasted trendline (Figure 4).

While stumpage prices in the South were under their 10-year trendlines in 2011, we expect all but pine pulpwood prices to begin pushing the right end of the trendlines upwards in 2012 (with pine pulpwood only slightly below trend). For sawtimber and chip-n-saw, a slow recovery in the housing market which will be more apparent in 2Q2012 will support the higher prices. Soft demand for pulpwood will continue to affect prices throughout 2012; though pulpwood prices will strengthen somewhat, no significant changes are expected.

Comments

01-04-2012

Daniel:

My name is Gregory Jones. I am 3 years into the planning Stage for construction of a Commercial Grade Wood Pellet Plant in Northeast Pennsylvania 18360-2646 zip code. I have a customer requiring 400K Metric Tons of Pellets annually. I have been searching for information on Market trends for Green Wood Chips, Feed Stock pricing per ton in NorthEast Pa. region. Unfortunately independent studies are all over the map. No one has a ten trend report as you have provided in the aforementiona article. Do you have data to support the Northeast Pa. market area on Green Wood Chips/Whole tree chips all species?

Thank you

Comments

When Will the Recovery in Sawtimber Prices Start i

01-13-2012

[...] more on the sawtimber pricing trend line for the US South, see Daniel Stuber’s post on stumpage price trend lines.) Share this:PrintEmailTwitterLinkedInDiggRedditStumbleUponFacebookLike this:LikeBe the first to [...]

Daniel Stuber

Daniel Stuber