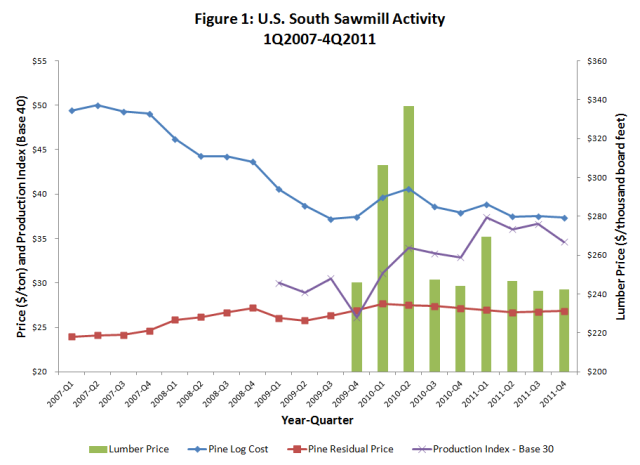

Compared to 3Q2011, sawmill profitability increased slightly in the US South during 4Q2011 as mills continued to focus on cutting production in order to reduce lumber inventories and prop up lumber prices (Figure 1).

Sawmill Production

According to Forest2Market’s benchmark services (Forest2Mill and Mill2Market), sawmills sold 2.8% less lumber in 4Q2011 than they did in 3Q2011. This was despite an increase in housing starts of 6.7% during the same period. Sawmills reacted to the decline in demand by reducing production. Production was down 5.4% from 3Q2011, but remained 5.3% above 4Q2010. As a result, lumber prices were up $0.70/mbf to average $242.50 in 4Q2011, while sawmill residual chip prices were up $0.08/ton to average $26.85/ton.

Sawmill Log Costs

As sawmills were focused on reducing production, their demand for sawlogs obviously decreased. Sawlog demand was down 3.0% from 3Q2011. As a result, delivered sawlog prices fell $0.17/ton to average $37.35/ton. This marked the third quarter in a row that sawlog prices have fallen, part of a continuing declining trend in prices since a high of $40.59/ton in 2Q2010.

Expectations for 1Q2012

Our economic forecast is calling for a slight reduction in housing starts during 1Q2012, down 0.4%. Sawmills will continue to cut production to reduce any excess lumber supply in the market and continue to ship out of inventory as much as possible. As a result, lumber prices should remain on their upward tilt, as should sawmill residual prices. As for sawlogs, prices will remain flat, as winter seasonality will help to elevate prices in spite of reduced production at the mills.

Read Stuber's post on 3Q2011 Sawmill Activity.

Daniel Stuber

Daniel Stuber