The Bureau of Labor Statistics’ (BLS) establishment survey showed non-farm employers shed 140,000 jobs in December (instead of the +100,000 expected). In the process of revising data back to January 2016, October and November 2020 employment changes were bumped up by a combined 135,000.

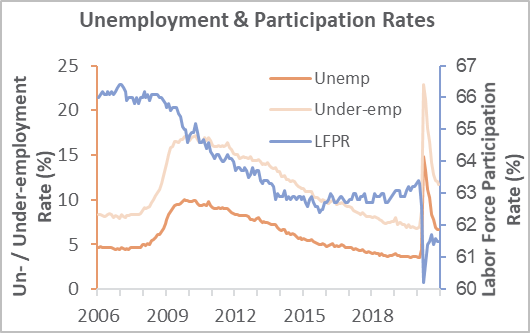

Meanwhile, the unemployment rate (based upon the BLS’s household survey) was unchanged at 6.7 percent as most (re)entrants to the labor force (+31,000) apparently found employment (+21,000). The number of employment-age persons not in the labor force rose (115,000) to 100.7 million. Also, the labor force participation rate was unchanged at 61.5 percent.

Full-time jobs rose (+397,000) to 124.7 million. Workers employed part time for economic reasons dropped by 471,000, whereas those working part time for non-economic reasons fell by 343,000; multiple-job holders retreated by 99,000.

Goods-producing industries gained 93,000 jobs, while service-providing employment lost a much greater 233,000 jobs. Leisure and hospitality (-498,000), and educational services (-62,500) bore the brunt of the downturn; those were partially offset by gains in professional and business services (+161,000), retail trade (+120,500), and construction (+51,000). Employment in government declined (-45,000), especially among state education workers (-19,900) and local government excluding education (-31,500).

Manufacturing expanded by 38,000 jobs. That result is consistent with ISM’s manufacturing employment sub-index, which expanded in December. Wood products employment ticked up by 1,700 (ISM was unchanged); paper and paper products: +700 (ISM was unchanged); construction: +51,000 (ISM decreased).

As a related point, all manufacturing-job gains since February 2010 were erased during March and April 2020. Although 820,000 of those nearly 1.4 million jobs have been refilled since then, the recovery has slowed in recent months. More remarkably, employment in food services & drinking places (i.e., wait staff and bartenders) plunged by 6.1 million jobs during those two months—to a level below the earliest data (January 1990) for that industry. Nearly 4.0 million of those jobs subsequently reappeared, but erosion is again occurring because of renewed lockdowns.

Reflecting the disproportionate number of lower-paid leisure and hospitality workers who went off payrolls in December, average hourly earnings of all private employees jumped by $0.23, to $29.81 (+5.1 percent YoY). The average workweek declined by 0.1 hour, resulting in average weekly earnings increasing on net by $5.03, to $1,034.41 (+4.6 percent YoY).

December’s employment report “is a major setback for the labor market and the economy,” said BMO Capital Markets’ Sal Guatieri, “but the narrow concentration of losses due to restrictions keeps a positive light on the eventual... recovery.”

Looking Ahead

Though details of President Joe Biden’s $1.9 trillion stimulus plan are not yet final, speculation is that the package will include a third stimulus payment, a longer extension to the eviction moratorium, funds for more vaccines and $400 bonus unemployment payments. Until that stimulus plan makes its way through Congress, many unemployed workers will have to depend on $300 weekly checks.

CNET notes: “The bonus weekly checks and the second stimulus checks for $600 were part of a $900 billion COVID-19 relief package signed by President Donald Trump in late December. 28 states have sent the $300 unemployment checks, according to a report from Yahoo Finance Monday. More states will begin processing the bonus payments later starting next week. The US Labor Department said Thursday 965,000 people applied for unemployment benefits last week (PDF), which was the highest number since last August.”

In a recent pivot, NY governor Andrew Cuomo stated that “We simply cannot stay closed until the vaccine hits critical mass. The cost is too high. We will have nothing left to open. We must reopen the economy, but we must do it smartly and safely.” While better late than never, this is a hopeful sign that those major American cities so devastated by the COVID pandemic might begin reopening in 1Q.

It's still too early in the year - and under the leadership of a new administration - to really get a good read on which way the arrow is pointing for the economy, including the US labor market. FED Chairman Jerome Powell recently noted that the economy and job market have a long road ahead, adding “The economy is far from our goals.” However, if urban economies can indeed begin reopening “smartly and safely” while skirting near-term economic destruction, the labor market may be poised to recover in 2021.