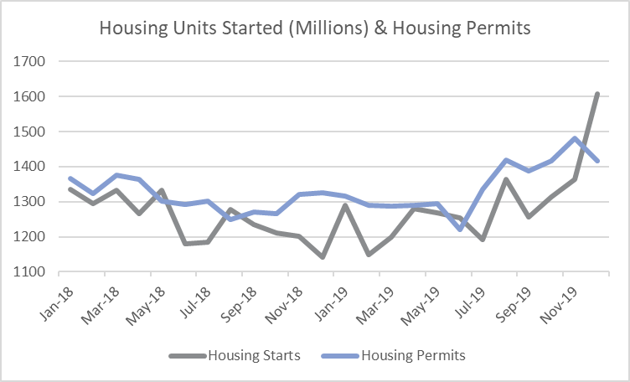

Talk about a well-timed (if late) Christmas gift for the US economy. Housing starts skyrocketed to a 13-year high in December as building activity increased across the board; both single-family and multi-family building was up significantly.

Housing Starts, Permits & Completions

Privately-owned housing starts were up 16.9 percent in December to a seasonally adjusted annual rate (SAAR) of 1.608 million units. Single-family starts increased 11.2 percent to a rate of 1.055 million units; starts for the volatile multi-family housing segment jumped 32 percent to a rate of 536,000 units.

Privately-owned housing authorizations decreased 3.9 percent to a rate of 1.416 million units in December. Single-family authorizations were down 0.5 percent to a pace of 916,000 units. Privately-owned housing completions were up 5.1 percent to a SAAR of 1.277 million units. Per the US Census Bureau Report, seasonally-adjusted total housing starts by region included:

- Northeast: +25.5 percent (-21.9 percent last month)

- South: +9.3 percent (+0.7 percent last month)

- Midwest: +37.3 percent (+8.7 percent last month)

- West: +19.8 percent (17.9 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -7.7 percent (-32.8 percent last month)

- South: +11.3 percent (+3.2 percent last month)

- Midwest: +56.6 percent (+0.8 percent last month)

- West: -5.2 percent (+9.3 percent last month)

2020 Outlook

Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction. The commentary below is from the latest issue of the publication.

Homebuilder sentiment soared over the course of 2019 and jumped in December to a 20-year high amid stronger sales and a surge in foot traffic from prospective buyers. Analysts at Bloomberg think the heightened sentiment could signal a further strengthening in housing permits (which hit their fastest pace since 2007 in October) and thus starts.

A rise in starts would reduce the likelihood of a recession and help to alleviate the shortage of both new and (in the longer term) existing homes. Inventory of new homes fell to 5.4 months in November, down from 6.5 months a year earlier. Existing-home inventory was an even tighter 3.7 months, down from 4.0 months in November 2018.

In addition to the lack of activity by homebuilders, analyst Rick Sharga indicated the most obvious reason for low inventory is that “homeowners, by and large, are staying put much longer than they used to.” In fact, the average length of time a homeowner has stayed in the same home has more than doubled over the past 20 years—from a little under five years in 2000 to almost 12 years in 2019—according to findings from DataTree.

Sharga listed numerous theories to explain this phenomenon, including: Baby Boomers opting to age in place rather than move into a retirement community; the formation of multi-generational households as elderly parents join their adult children (and/or their grandchildren); record levels of young adults “boomeranging” home after college; and homeowners opting not to sell because they either believe there is nothing available to buy or have insufficient equity to handle both the costs of selling their present home and a purchase down payment.

Despite homebuilders’ optimism, the high cost of materials, labor and land keep pressuring their profit margins. As a result, many builders have remained focused on the top end of the market in terms of price, even though demand is strongest (and supply is tightest) for entry-level homes. That realization has dampened enthusiasm among some industry experts. For example, “I don’t think we will ever get back to historical levels of construction starts unless something changes,” said Meyers Research’s Ali Wolf. “High construction costs and limited land availability are holding back the housing market from reaching full potential.”

Nonetheless, Millennials are entering the market in ever-larger numbers and are now being joined by the older members of the Gen Z (born after 1995) cohort; hence, household formation is poised to accelerate, creating more demand for both owner and renter-occupied properties. “The most likely scenario is that inventory will return to normal levels gradually, as increasing home prices improve the financial outlook for equity-challenged homeowners, Baby Boomers ultimately downsize as their Millennial children move out, and builders continue to slowly ramp up their output,” Sharga concluded.

The challenges mentioned above represent hurdles to a traditional recovery path for the housing industry sector still languishing well below its historical average despite the Great Recession having ended over a decade ago. For the industry to “shift into the next higher gear” over the long run, it will need to develop new cost-effective methods of providing shelter within the context of limited land (more difficult to solve) and limited labor (solvable over tine). One solution that appears to be gaining traction combines mass-timber products with pre-fabrication building techniques.

The bearish view of William Emmons, assistant VP at the Federal Reserve Bank of St. Louis, may temper some of the optimism engendered by heightened year-end 2019 housing activity. He wrote that the behavior of four indicators (30-year mortgage rates, existing home sales, real home prices, and the momentum of residential investment) during the past year was consistent with patterns seen before three previous recessions. Emmons is hopeful, however, that the FOMC’s loosening of monetary policy will ultimately prove to have been enough to avoid a recession in the 2019 - 2020 timeframe.