4 min read

US Housing Starts, Global Economic Uncertainty Increase in June

John Greene

:

July 22, 2016

Housing starts rebounded in June, mirroring the continued strong, if unexpected, performance of US markets; the Dow Jones Industrial Average (DJIA) closed at an all-time high earlier this week. Oddly enough, this strong performance seems to have politicians and pundits alike scratching their heads. From the Federal Reserve, to European Commission (EU) officials and all the talking heads in between, global economic “uncertainty” seems to be all anyone can talk about. Despite the recent Brexit vote and the upcoming US presidential election, US markets are, incomprehensibly, responding positively to economic uncertainty on a global scale.

Long(er)-Term Considerations: Investment

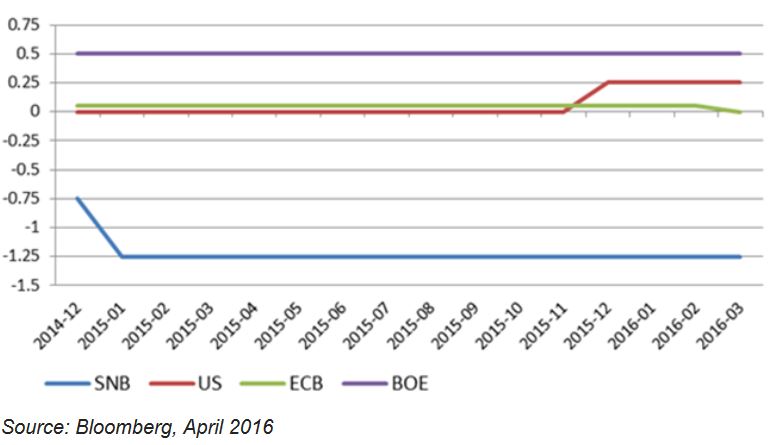

One explanation for this phenomenon that seems most plausible is the continued flow of foreign money into US markets. As limited investment opportunities and Zero/Negative Interest Rate Policies (ZIRP/NIRP) continue to plague much of the developed world, the slow, slight growth within the US economy is viewed as a preferable alternative. For a snapshot of just how low some of these rates are, the chart below details changes in official rates of the Swiss National Bank (SNB), US Federal Reserve, European Central Bank (ECB) and Bank of England (BOE) for the period between December, 2014 and March, 2016.

For now, global money is betting on the US leading the way out of this pervasive sense of economic uncertainty, and the US housing market seems like a logical place to start. Thanks to this influx of capital into safe-haven assets like US mortgage-backed securities, mortgage rates in America have ticked down even farther, making homeownership and/or refinancing quite attractive.

Some analysts posit that Britain’s exit from the EU could lead to added demand for American real estate, especially in major cities like New York and Los Angeles. KC Sanjay, Senior Real Estate Economist with Axiometrics, noted that “International investors have been increasing their holdings in the U.S. over the past several years, as they have gained a better understanding of the American apartment market and appreciation of the sector’s profitability.”

With more uncertainty over what the rules will be regarding foreign investment in a post-Brexit global economy, many of these international investors will be looking to reduce their exposure in the United Kingdom and the US market will benefit. Not only might British investors seek safety in the US, but investors from other nations could also look to shift capital from Britain to the US real estate market.

June Housing Starts Details

June 2016 housing starts were at a seasonally adjusted annual rate (SAAR) of 1,189,000, or 4.8 percent above the revised May estimate of 1,135,000. However, this number is 2.0 percent below the June 2015 rate of 1,213,000. Single-family housing starts were at a rate of 778,000, which is 4.4 percent above the revised May figure of 745,000.

Building permits increased slightly in June; privately-owned housing unit permits were at a SAAR of 1,153,000, or 1.5 percent above the revised May rate of 1,136,000. Single-family authorizations were at a rate of 738,000, 1.0 percent above the revised May figure of 731,000.

The gap in regional disparities widened in June, as confirmed by the US Census Bureau report. The data out of the Northeast is in stark contrast to the -33 percent total drop seen last month, however. Seasonally-adjusted housing starts by region for June included:

- Northeast: +46.3 percent

- South: -3.4 percent

- Midwest: -5.2 percent

- West: +17.4 percent

After hitting a four-month high in May, The National Association of Home Builders’ (NAHB) sentiment index dropped one point in June to 59. Anything above 50 is considered positive sentiment, but the index has been stuck in a very narrow range since the beginning of the year. "We are still hearing reports from our members of scattered softness in some markets, due largely to regulatory constraints and shortages of lots and labor," said association Chairman Ed Brady, a homebuilder and developer from Bloomington, Illinois. The 30-year fixed mortgage rate ticked down from 3.60 to 3.57, its lowest point of the year.

Near-Term Considerations: Supply & Labor

The housing market got off to a slow start in 2016, but overall steady housing demand in the past year has driven up home prices in many markets amid a shortage of inventory. We have touched on this issue in the past, and just last month noted the dwindling supply of new, affordable building lots—particularly in the Western US. Builders in some of these tighter housing markets have been facing increasing regulatory constraints, which prevents them from developing and building on as much land as they might like.

For example, TRI Pointe homes, which operates in Western US markets, has only been able to increase production and sales because the company owns and controls thousands of lots—especially in densely-populated and heavily-regulated California. TRI Point CEO Doug Bauer says that this gives the company a significant advantage in the market. Labor, however, is another story.

"The reason labor has been a constraint is in some of our markets, for example, in Phoenix a year ago building permits went up 15-20 percent. As building permits go up, labor doesn't go up with building permits, so there's kind of a lag effect," said Bauer. "I think housing in general is going to be in a very elongated cycle, because if you look at the demand variables, jobs and household formations—especially millennials that are forming households later—are going to be a huge demand driver, but one of the supply constraints has been land and labor."

Payrolls for domestic construction workers were unchanged in June according to the Bureau of Labor Statistics. But construction employment fell in April and May, which hadn't happened in consecutive months since mid-2012. "This may be an indication that as other segments of the US economy continue to add jobs, a growing number of construction workers and construction jobseekers are shifting to other industries," Anirban Basu, chief economist at the Associated Builders and Contractors trade association, said in a statement earlier this month. He also noted that "the size of the construction industry labor force shrank" in recent months.

At month’s end, June was at least a welcomed step into positive territory following what has thus far been an uninspiring year for home construction. Despite the monthly improvement, housing starts are still down 2 percent over the year and building permits are down 13.6 percent from June 2015. "June's data release shows monthly starts are still about 20 percent below historical averages," noted Ralph McLaughlin, chief economist at Trulia, an online marketplace serving the real estate industry. "Nationally, new housing supply relative to demand is about 15 percent below the historical average."