3 min read

US Housing Starts: Affordability Crunch Impacting Performance

John Greene

:

April 24, 2018

While housing demand remains strong, labor shortages, rising materials costs and a scarcity of lots are preventing steady gains in US housing starts. Borrowing costs also continue to rise month-over-month and affordability is becoming ever more challenging as property values outpace income growth. Despite these headwinds, the upbeat sense of economic optimism is driving consumer confidence, which is keeping construction growth afloat.

Housing Starts, Permits & Completions

After tumbling 7 percent to a seasonally adjusted annual rate (SAAR) of 1,236,000 units in February, US housing starts increased 1.9 percent in March to a SAAR of 1,319,000. Single-family starts accounted for 867,000 units, which is 3.7 percent below the revised February figure of 900,000. Starts for the volatile multi-family segment surged 14.4 percent to a rate of 452,000 units in March.

Privately-owned housing authorizations rose 2.5 percent to a rate of 1,354,000 units in March. Single-family authorizations dropped to 840,000, which is 5.5 percent below the revised February figure.

Privately-owned housing completions increased to a SAAR of 1,217,000 million in March, down 5.1 percent from February’s revised estimate of 1,282,000, but 1.9 percent above March 2017. Regional performance in March was generally positive, as confirmed by the US Census Bureau report. Seasonally-adjusted total housing starts by region included:

- Northeast: +0.8 percent (-3.5 percent last month)

- South: -0.6 percent (-7.3 percent last month)

- Midwest: +22.4 percent (+7.6 percent last month)

- West: -1.5 percent (-12.9 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -9.4 percent (+6.7 percent last month)

- South: -9.8 percent (+4.1 percent last month)

- Midwest: +37.7percent (-14.9 percent last month)

- West: -8.7 percent (+8.8 percent last month)

The 30-year fixed mortgage rate increased from 4.33 to 4.44 percent in March, its highest level since August 2013. The National Association of Home Builders (NAHB)/Wells Fargo builder sentiment index slipped 1 point to 69 in early April.

Niraj Shah and Carl Riccadonna of Bloomberg Economics said “The overall strength in March housing starts is all the more encouraging given that the colder-than-average weather is likely to have curtailed gains. Fundamentals appear to support a positive outlook for the construction sector, despite labor constraints and rising material costs. Demand should also be supported by a tight labor market and steady pay gains.”

A Growing Affordability Problem

After a years-long boom in new multi-family housing, builders have been pulling back due to an excess of supply in many of the major urban markets. Economists had been expecting multi-family construction to be flat in 2018 as builders have slowly increased their share of single-family homes. “If there is one surprise, it’s just the length of this multifamily cycle,” said Jay Parsons, vice president at real estate software and analytics firm RealPage. “While supply is outpacing demand, there’s still an awful lot of demand.”

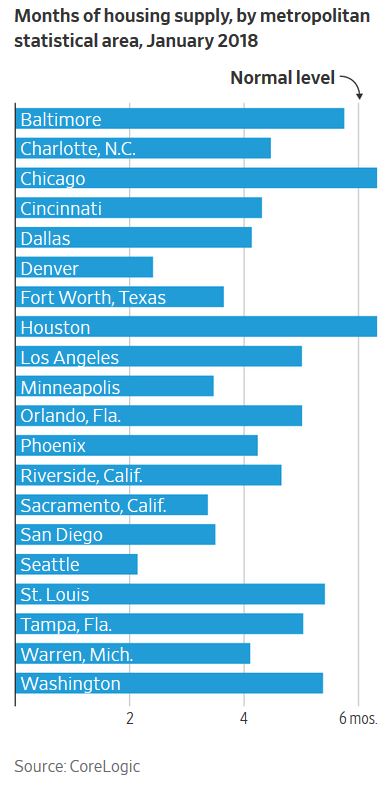

The steady rise in interest rates and home prices and the recent stock market volatility has also combined to price many prospective homebuyers out of their desired markets. Affordability has been a growing concern for the last year as builders cite soaring land, lumber and materials costs, as well as labor shortages as major obstacles.

This combination has driven builders to the “safe” areas of multi-family units or the expensive end of the single-family market, which negatively impacts young and first-time homebuyers. “If you think about an entry-level home builder who is now entering that space, that’s going to be a big factor,” said Rob Dietz, chief economist at the NAHB.

As a result, single-family construction is about half of what it was at the peak of the bubble in 2006 and 30 percent below normal levels. “The change toward multifamily could be the initial signs that affordability is starting to impact the mix of construction,” said Tendayi Kapfidze, chief economist at LendingTree.

ATTOM Data Solutions’ US Home Affordability Report indicated that median home prices in 1Q2018 were not affordable for average wage earners in 68 percent of the US counties analyzed. “Coastal markets are the epicenter of the US home affordability crisis, but affordability aftershocks are now being felt further inland as housing refugees migrate from the high-cost coastal markets to lower-priced markets in the middle of the country where good jobs are available,” said Daren Blomquist, ATTOM’s senior VP. “That in turn is pushing home prices above historically normal affordability limits in those middle-America markets.”

Building activity will likely not return to historical levels anytime in the near term. “It’s hard for me to see on single-family [activity] how you can build your way out of this,” WSJ quoted Jordan Rappaport, an economist at the Kansas City Fed, as saying. “Even with… heroic efforts” to overcome barriers to building new housing, Jordan continued, there is little chance “that you’re going to get a new stream of single-family homes that can relieve demand.”