2 min read

US Forest Industry, Manufacturing off to Strong Start in 2021

Joe Clark

:

February 24, 2021

Joe Clark

:

February 24, 2021

US forest industry performance in December and January was recently reported by both the US government and the Institute for Supply Management.

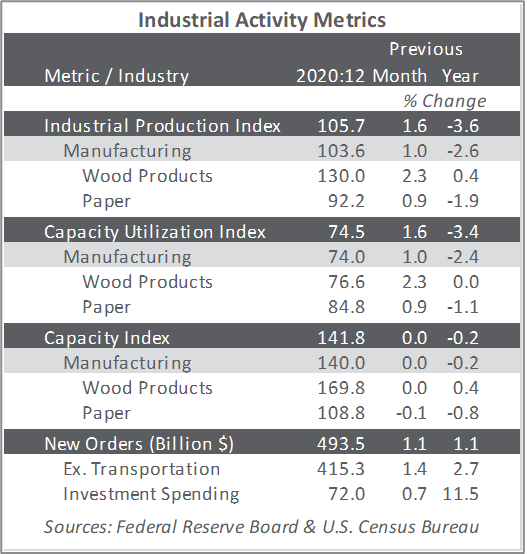

Total industrial production (IP) advanced 1.6 percent in December, with gains of 1.0 percent for manufacturing, 1.6 percent for mining, and 6.2 percent for utilities. For 4Q as a whole, total IP rose at an annual rate of 8.4 percent. At 105.7 percent of its 2012 average, total IP in December was 3.6 percent lower YoY and 3.3 percent below its pre-pandemic February reading.

The pandemic squelched what had been an accelerating expansion of wood products manufacturing capacity—braking from +4.1 percent YoY in December 2019 to just +0.4 percent YoY in December 2020. In contrast, paper capacity contracted more quickly: from -0.3 percent at year-end 2019 to -0.8 percent a year later—despite the ecommerce-driven meteoric rise in demand for packaging.

New orders increased 1.1 percent in December; excluding transportation, new orders rose by 1.4 percent (+2.7 percent YoY). Business investment spending advanced by 0.7 percent (+11.5 percent YoY). “This report shows firm upward momentum for business investment as the longest year ever came to an end,” said BMO Capital Markets’ Jennifer Lee.

Findings of IHS Markit’s January survey results were upbeat. The manufacturing PMI hit a record high, and services saw a “sharp upturn in business activity amid stronger client demand.”

“A strong start to the year for manufacturing was accompanied by a marked upturn in the service sector, driving business activity growth to the fastest rate for almost six years during January,” wrote Markit’s Chris Williamson. “The improving data set the scene for a strong 1Q, and a rise in business expectations for the year ahead bodes well for the recovery to gain traction as the year proceeds. Companies have become increasingly upbeat amid news of vaccine roll-outs and hopes of further stimulus.

“The downside is that prices have risen sharply. Rising costs have fed through to higher prices charged for goods and services, which rose in January at a rate not seen since at least 2009. Inflation therefore looks likely to be pushed higher in the near-term. However, some of these price pressures reflect short-term supply constraints, which should ease in coming months as the recovery builds and more capacity comes online.” We would also add that any YoY metrics reported during the next 12 months must be interpreted in the context of 2020’s virus-induced declines—which will amplify the magnitude of YoY comparisons.

The consumer price index (CPI) increased 0.4 percent in December (+1.4 percent YoY). The MoM increase in the all-items index was driven by an 8.4 percent hop in the gasoline index, which accounted for more than 60 percent of the overall increase; the other components of the energy index were mixed, resulting in an increase of 4.0 percent for the month (but -7.0 percent YoY). The food index also rose (+0.4 percent MoM; +3.9 percent YoY).

The producer price index (PPI) increased 0.3 percent (+0.8 percent YoY), more than one-third of which was attributed to a 16.1 percent jump in gasoline prices. In the forest products sector, index performance included: