1 min read

UPDATE: Southern Yellow Pine Lumber Prices Break Previous Record

John Greene

:

July 30, 2020

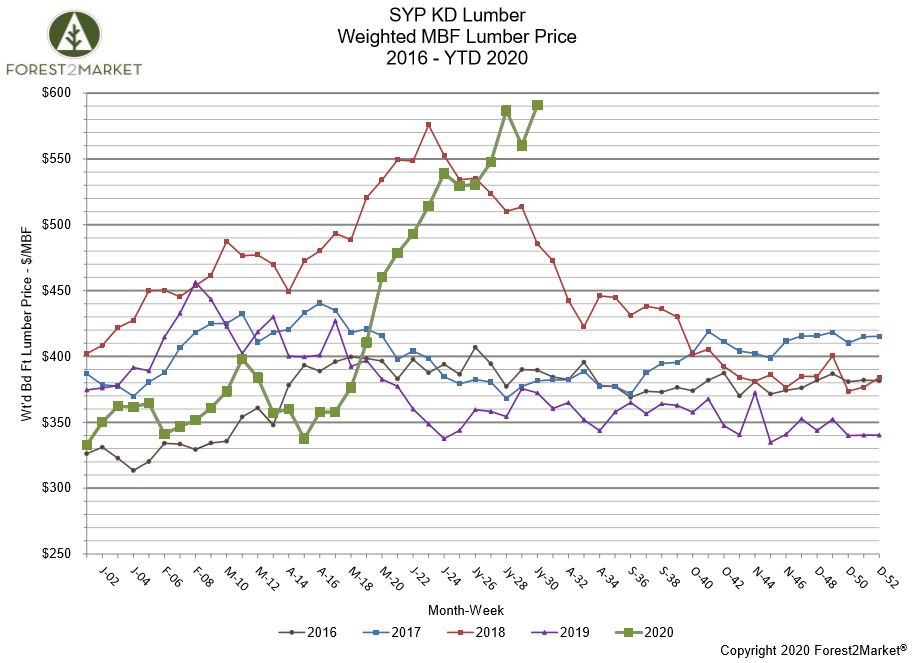

In 1Q2020, the lumber market was showing signs of stability as the housing market seemed to catch its stride. As a result, lumber prices demonstrated minimal volatility on a weekly basis; Forest2Market’s composite southern yellow pine (SYP) lumber price for 1Q averaged $360/MBF, with volatility over the quarter in the range of +/-15%.

However, as the effects of the induced financial shutdown due to COVID-19 really gutted the economy, prices jumped in mid-April as supply began to run tight due to curtailments. Prices have since soared ever higher and have only briefly corrected course twice during a more than 3-month period stretching back to early April.

Over the last three weeks, prices for southern yellow pine lumber have pushed past the all-time highs of mid-2018. Now, 15 weeks after bottoming during the peak of the pandemic, SYP lumber prices have soared an astounding 75% and have broken the previous record achieved during 2018.

Forest2Market’s composite SYP lumber price for the week ending July 24 (week 30) was $591/MBF, a 5.5% increase from the previous week’s price of $560/MBF, and a 58.9% increase from the same week in 2019. This also represents a 2.6% increase over the previous record of $576/MBF achieved in July 2018.

Additional price trends observed thus far in 2020 include:

- Q1 Average Price: $360/MBF

- Q2 Average Price: $429/MBF

- Q3 (to date) Average Price: $571/MBF

- YTD Average Price: $424/MBF

How High Can Prices Go?

Demand for finished lumber among US homebuilders remains voracious. While SYP prices of $600—or even $650/MBF—seemed unimaginable just a few months ago, there doesn’t appear to be any end in sight as we push into new record territory.

Greg Kuta, President of lumber broker Westline Capital Strategies notes that “The housing metrics coming out of the first wave of the virus show an insatiable need for housing and have exposed the major issues that existed pre-Covid that still exist today—a shortage of existing-home inventory, a finite housing labor pool to actually build new homes, and a shortage of entry-level homes to satisfy the entry-level home buyer.”

Citing Kuta, a recent article in Barron’s says “… the trend for lumber prices is still up, until demand begins to ‘show signs of slowing and production catches up with existing demand.’” While prices may continue to move incrementally higher through the remainder of the summer, “the ability to maintain these numbers and not see a bigger correction into the back half of the year is questionable, at best, especially heading into the November election,” added Kuta.