2 min read

Two Key Ingredients for Successful Lumber Price Negotiations

Forest2Market

:

September 28, 2011

Imagine two trading partners. One is a lumber manufacturer (seller) and one is a remanufacturer or builder (buyer). The two are preparing to negotiate the sale/purchase of a load of lumber. How well armed these trading partners are as they enter negotiations depends on two things: 1) the quality of the market information available to them and 2) the negotiating skills they possess.

Traditionally in these types of negotiations, the agreed price is a function of market price and any additional added value that the producer provides to the consumer. In an ideal situation, the market price would come from a credible source of market data, a source that both parties trusted to accurately describe the market. The additional added value component could result from great service, high quality, mill specialization, increased demand in the micro-region or other market-related factors.

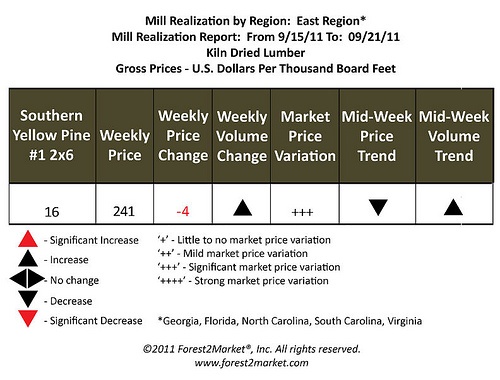

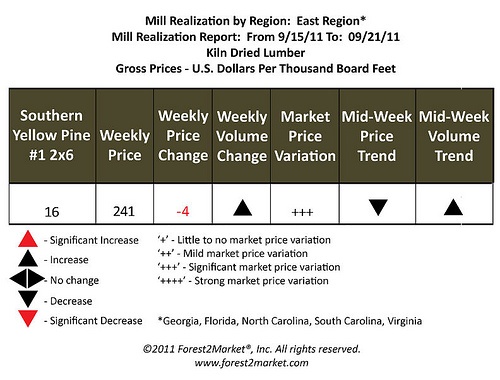

To return to our example, let’s imagine the buyer is purchasing 23,040 board feet (23.04 MBF) of #1 grade 2X6x16’ southern yellow pine in North Carolina. If their source of pricing information reports that market price for that material is $241/MBF and the supplier provides good service worth a 5 percent price premium, you could expect both parties to agree on the final price of $253/MBF.

If that is all the information the trading partners have, then it would likely be the end of the transaction. What if both parties had additional data? Would the sale happen the same way? What if the buyer, the seller or both had the following additional market profile information?

Using this additional information, a broader picture of the market is possible.

Prices are trending downward; the price of #1 2x6x16’s fell by $4/MBF week over week.

Weekly volume change is significantly higher than the previous week, as denoted by the black upward arrow; this indicator suggests that the market is accepting lower prices in order to move inventory.

Market price variation is significant in the region for this product, denoted by the three pluses, indicating that there is a good bit of play in pricing within the region. This information would indicate that an offer that is either significantly higher or lower may be entertained in the current market.

The mid-week price trend shows that end-of-week prices were lower than start-of-week prices; this suggests that low prices could continue into the start of next week.

The mid-week volume trend shows an increase; this suggests that the mid-week price reductions may have played a part in the increase in volume being traded in the market at the end of the week.

Having this additional information about the market can help trading partners fine tune their strategies to compensate for negatives and accentuate the positives. The seller’s strategy could involve focusing not so much on average price, which is lower, but on price variability, increased demand (as indicated by the end-of-week volume) and added value. Formulating a strategy around these things will improve the seller’s position in the negotiations. The seller can say to the buyer: “Look, I know average prices are down, but there is a significant difference between the high and the low price. I have the volume to move now, and I can save you money on freight.”

On the other side of the table, the buyer’s strategy could involve focusing on the fact that prices are falling, not only week over week but during the week as well. The buyer can say to the seller: “Look, average prices are down and the high level of variability in price means that #1 2x6x16’s are going for even lower prices. Give me average average price minus $5 and I’ll take 46,080 board feet off your hands.”

Once these strategies are on the table, the negotiating skills of the trading partners will take over and determine whose interpretation of the market takes precedence. When based on market profile information that is accurate and detailed, however, both parties are able to fashion a strategy that meets their specific needs rather than basing the outcome on a single price point.

For more information about Mill2Market, visit our website.