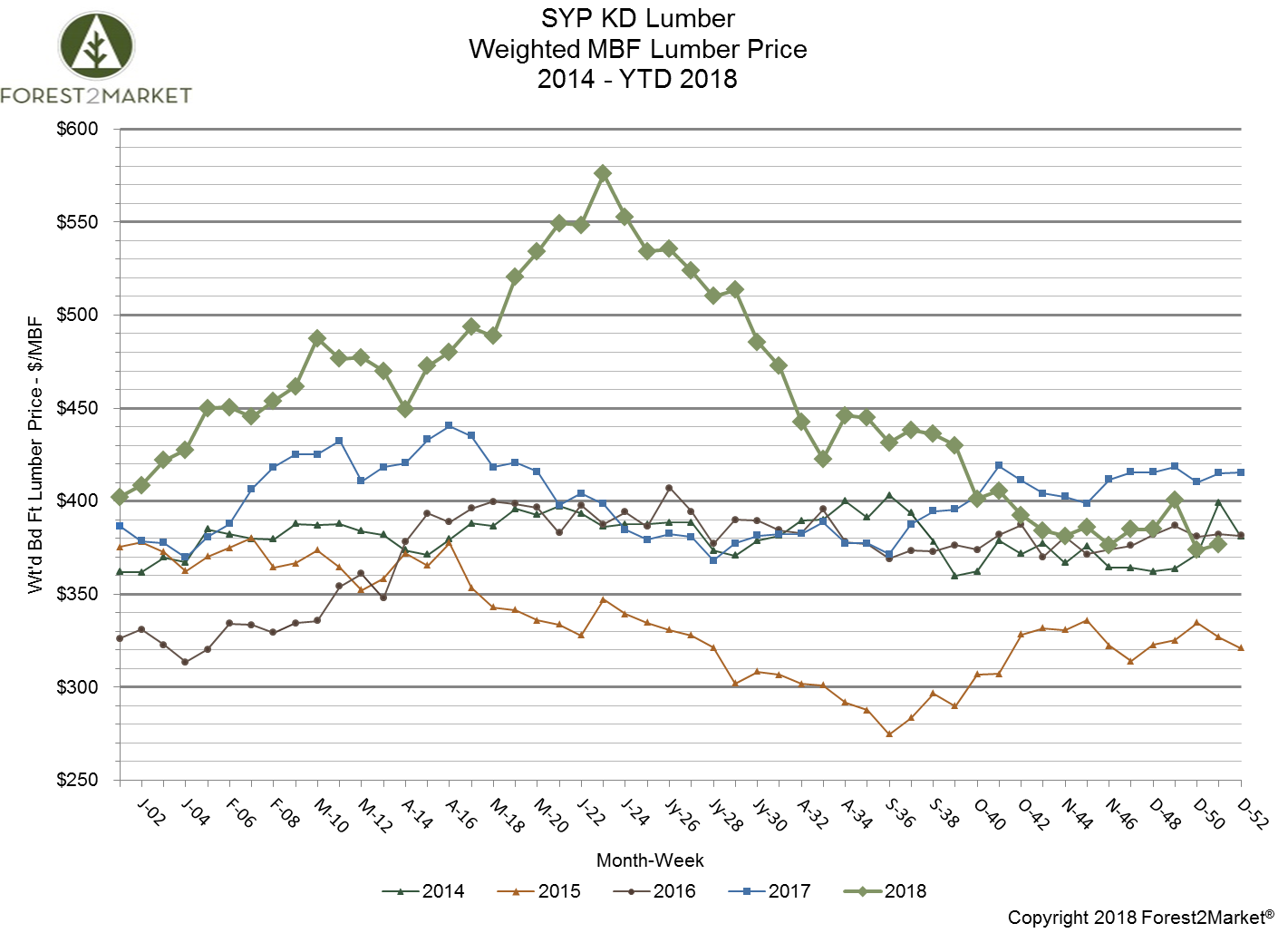

At the tail end of 2018, southern yellow pine (SYP) lumber prices barely inched up from their lowest level of the year during the prior week, which was also the lowest level since June 2017. Forest2Market’s composite southern yellow pine lumber price for the week ending December 14 (week 51) was $377/MBF, a 0.8% increase from week 50’s price of $374/MBF, but a 9.2% decrease from the same week in 2017.

A closer look at some of the price trends in 2018:

- 1Q2018 Average Price: $449/MBF

- 2Q2018 Average Price: $523/MBF

- 3Q2018 Average Price: $486/MBF

- 4Q2018 Average Price: $386/MBF

- 2018 Average Price: $454/MBF

As of December 19, the price of SYP lumber had declined by 35% from its May high of $576/MBF. While the price volatility in 2018 was certainly more pronounced than in recent years, lumber is, after all, a seasonal commodity; price movement is to be expected. The typical inventory building that began in early 1Q2018 in preparation for building season was briefly interrupted by supply and trade concerns that created a speculative bubble, which resulted in a price run that lasted throughout the summer.

Outlook for 2019

US markets finished out the year on a sour note; as of this writing, the Dow Jones Industrial Average (DJAI) has lost over 3,000 points in just the last four weeks—steep losses that coincided with yet another interest Federal Reserve rate hike (two or three more are expected in 2019). With developments like these, any expansion in homeownership in the new year seems unlikely, which means housing starts will fail to meet expectations. As a result, we’re forecasting fewer housing starts this year—1.232 million units (-2.3% relative to 2018)—and we expect lumber prices to flatten as well.

However, opportunities still exist in the South due to the region’s steady supply of low-cost logs. The impacts of Hurricanes Florence and Michael were focused in local markets where salvage operations will continue to influence log prices into 2019, but the trend will not ripple outward to affect the US South region as a whole. With an additional 1 billion board feet (BBF) of lumber production coming online in next year, the South will consume 2-3 million more tons of sawtimber, but there will not be any appreciable movement in log price.

A new article by Andrew Hecht, a commodity and futures trader and analyst, notes that “If rates stabilize around the current levels, buyers could come back to the housing market. While mortgage rates have moved higher compared to levels witnessed over recent years, they remain at historically low levels.” Though the trend seems overly optimistic, Hecht takes a different view of the lumber price volatility we witnessed in 2018: “The bottom line is that the price of wood crashed since May and the current level could represent an overextension on the downside in a highly illiquid market.”

Hecht’s point is a valid one, and in such a market, the US South is clearly the advantaged region.