It’s difficult to overstate the uniqueness of the current global health (and economic) crisis we find ourselves in. Families, businesses and entire communities are having to make important decisions on the fly because these times are without precedent; we have no historical blueprint from which to draw parallels.

Maximizing liquidity is a natural instinct during times of extreme uncertainty. Manufacturers are now trying to align their outputs to a rapidly changing market and are faced with a number of new questions:

- How long is the current situation likely to last?

- How will it affect raw material costs in the near and long terms?

- What impact will the changing value of the US dollar have on the future business environment?

- When the Federal Reserve slashed interest rates, what effect will it have on business?

The modern forest supply chain doesn’t have a blueprint for operating in the current environment, but we do have the next best thing: Historical data.

SilvaStat360: Millions of Rows of On-Demand Data. One Platform.

SilvaStat360 is designed to be a convenient, one-stop repository of the datasets and analytical tools that are most important to the forest supply chain, including pricing, macroeconomic, forest inventory, precipitation data and much more. The platform also provides instantaneous conversions to units, grade scales and currencies to enable strategic and tactical decision-making, as well as regional datasets that allow for international indexing and global benchmarking so industry participants can compare their performance to peers worldwide.

Using SilvaStat360, what can the data from recent history tell us about wood raw material prices in the current business environment, and what we might expect over the course of the next several quarters?

Though the drivers were completely different, the Great Recession of 2008 is the closest example we have for reference based on the current economic downturn we find ourselves navigating today. In the US South, for example, stumpage prices plummeted in tandem with housing starts, which dropped to just 500,000 units in 2009.

Housing Starts from 2007 to 2011

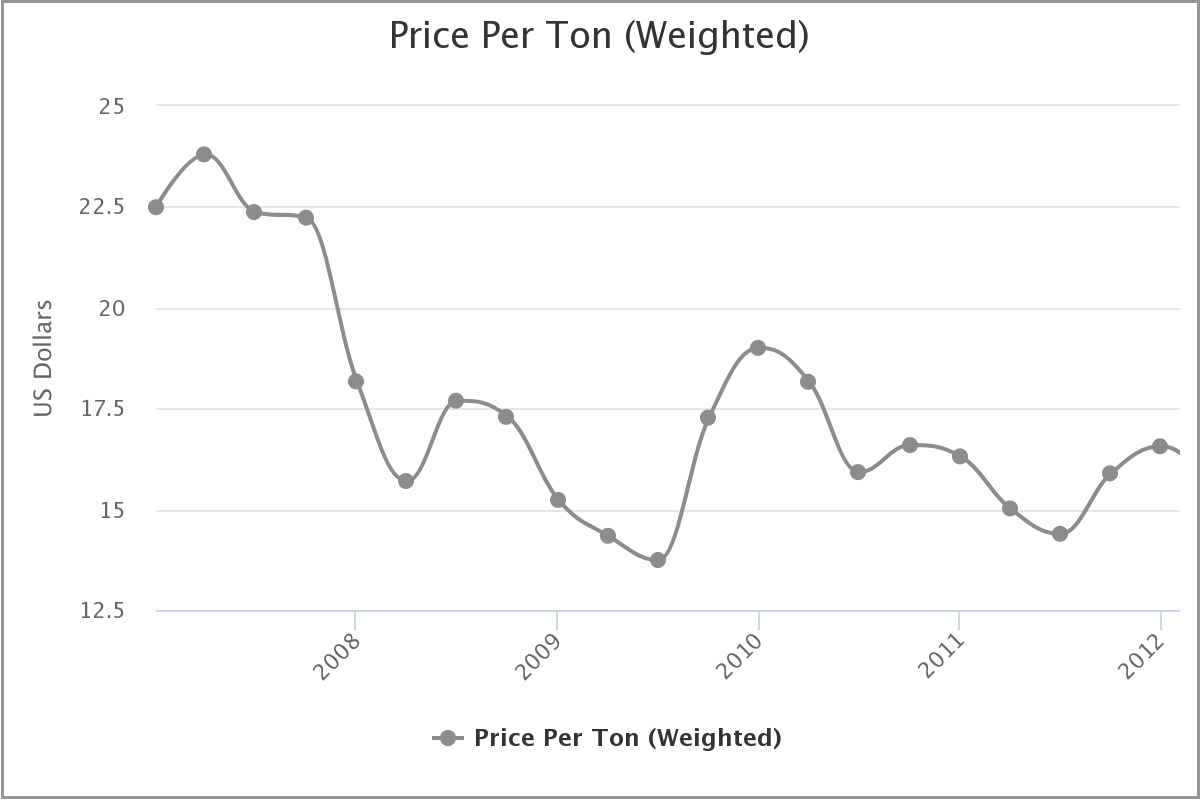

As a result of dried up demand for finished lumber and panels, the weighted average price of southern timber fell a whopping 43 percent from 2Q2007 to 3Q2009, with a bulk of the decrease taking place in the quarters immediately following the initial shock to the market – a delayed reaction as the economic data trickled out and confirmed the severity of the situation.

While the weighted average price of southern timber dropped in the wake of 2008, individual products performed very differently based on supply/demand dynamics. The global market was undergoing a number of structural changes at the time, i.e. a digital revolution that suppressed demand for newsprint and other paper products. Over the last decade, production of printing and writing papers has declined by 6 percent annually.

Using SilvaStat360, users can also isolate specific time periods and view the performance of the DJIA, GDP, US Dollar (USD) compared to other currencies and much more. For instance, the chart below details the significant volatility of the USD vs. the Canadian dollar during the height of the Great Recession.

And what about oil prices, which are now testing 20-year lows? Manufacturers will surely be looking for freight cost savings based on these low prices but as history demonstrates, normal price fluctuations are typically built in to hauling costs. As we have demonstrated, the supply and demand of logs and wood fiber is ultimately what drives the price of wood products on the market, which is always independent of fuel price. However, the current economic climate may present other energy-saving prospects or opportunities to secure new contracts at improved price points.

The kind of volatility we are now witnessing across global markets wreaks havoc on traditional supply chain planning. The most effective way to survive downturns and plan for long-term gains in an uncertain market is with robust, accurate datasets that are reflective of true market experiences.

Joe Clark

Joe Clark