2 min read

Southern Yellow Pine Lumber Prices Skyrocket; Will History Repeat?

John Greene

:

February 28, 2019

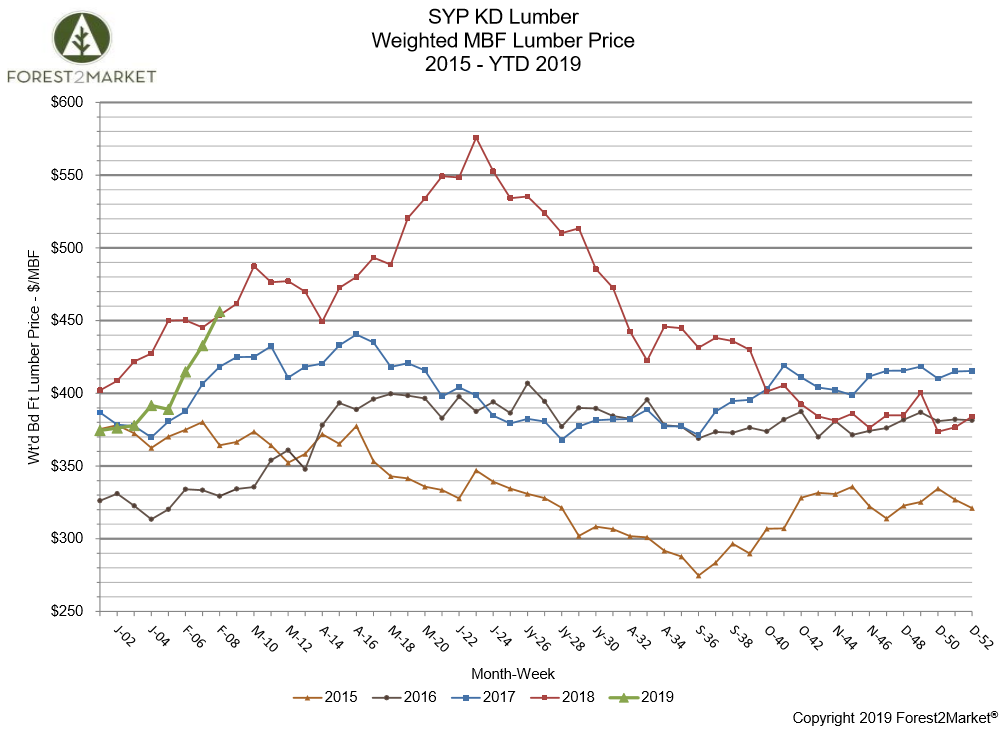

Southern yellow pine (SYP) lumber prices surged once again in week 8 as they eclipsed year-over-year (YoY) weekly prices for the first time in 2019. Forest2Market’s composite southern yellow pine lumber price for the week ending February 22 (week 8) was $456/MBF, a 5.3% increase from the previous week’s price of $433/MBF and a 0.44% increase from the same week in 2018. YTD average price from Forest2Market’s SYP index: $402/MBF.

While last year’s price run seemed to be an anomaly driven in part by transportation issues in Canada during 1Q, we may be seeing a repeat of similar market dynamics as we head into early spring. The recent government furlough delayed the release of lots of critical data by nearly two months, but the current price surge may be representative of increased speculation rather than data-driven economics. That said, there are two dynamics to watch closely in the coming weeks:

- Weather-Related Transportation and Harvesting Delays: As Keta Kosman noted last week, severe weather has stymied operations in many parts of Canada and the US, which has caused delays of shipments from softwood lumber suppliers. “Customers, already low on inventory as they had been waiting for prices to come down, have been forced to buy specific items for immediate fill-in needs. Sawmills have responded by raising prices and going off-the-market on the most popular items because they didn’t want to quote too far into the future in the event that prices rise even higher.”

The southern US has been drenched with higher-than-normal rainfall for the last several months, which is impacting harvesting activity throughout the region. Official data from NOAA is also on hiatus due to the government shutdown, however quarterly rainfall for the US South during 4Q2018 was up over 14 percent compared to the prior year, and both January and February are shaping up to be equally wet in certain spots. Stumpage prices have been rising as a result.

- Delay of Official Data Causing Uncertainty: As of this writing, official housing starts data has just been released after a nearly two-month delay, which has driven speculation about both the general health of the new-construction market and, more importantly, the direction it is heading, i.e. new permits. The data is largely disappointing: For December, 2018, privately-owned housing starts fell 11.2 percent to a seasonally adjusted annual rate of 1.078 million units, and privately-owned housing authorizations ticked up just 0.3 percent to a rate of 1.322 million units.

Likewise, the most recent housing sales data is equally disappointing. January was the sixth consecutive month of declining home sales, which contributed to the largest YoY inventory increase in at least 10 years, according to the recently-published RE/MAX National Housing Report. “While year-over-year home sales dropped 11% – extending a streak that began in August – inventory grew year-over-year by an average of 6.4% across the report’s 54 U.S. metro areas. January marked the fourth consecutive month of year-over-year inventory growth – further reversing a decade-long trend of shrinking inventory. December 2018’s year-over-year inventory growth of 4.7% was the previous record in the report’s 10-year history.”

A lot of lumber market momentum has been hinging on the latest housing starts data, though many of the other concerns are simply uncontrollable. We suspect that the market will react accordingly, albeit on a delayed basis. The weather-related problems, however, will continue to present supply-side challenges for mills and delivery issues for distributors and retailers in the near term. Will these challenges be enough to cause a repeat of the record-high pricing we saw in 2018? Let us know your thoughts in the comments below.