2 min read

Southern Yellow Pine Lumber Prices: A Trend Toward Commoditization

Daniel Stuber

:

September 14, 2011

Daniel Stuber

:

September 14, 2011

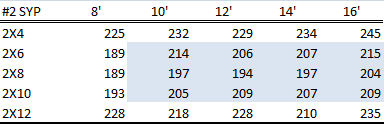

Over the last few weeks, weekly lumber prices for 2x6's, 2x8's and 2x10's have shown little variation between the dimensions and even less so between lengths (8-foot boards are the exception). While individual grades have maintained their separation from each other, within the #2, #3 and #4 grade classes, little difference in pricing is apparent for these lengths. (See Table 1, which contains the Southwide #2 grade prices for southern yellow pine (SYP) lumber, the bellwether grade for the market. The source of this data is Forest2Market’s Mill2Market, a weekly lumber price report and quarterly benchmark service).

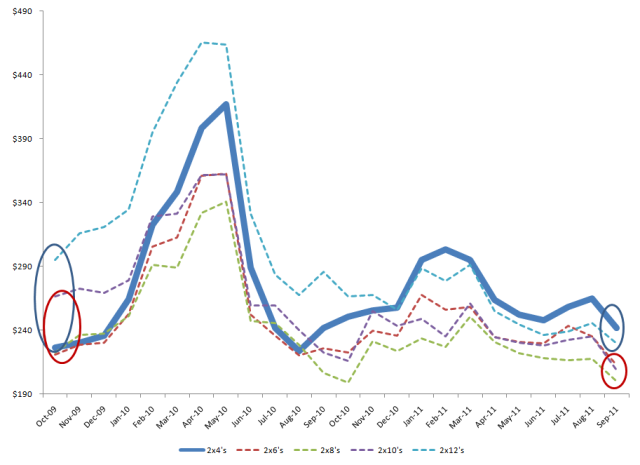

An analysis of the #2 SYP trend series reveals a further, interesting pattern in pricing. Figure 1 shows that prior to the run-up in prices in 2010, 2x10’s and 2x12’s commanded a premium in the market compared to 2x4’s, 2x6’s and 2x8’s. As the housing tax credit in 2010 stimulated the market, the more common framing dimensions – 2x4’s and 2x12’s – escalated more quickly. In fact, 2x4’s eclipsed 2x10’s, which converged with 2x6 pricing. As the housing credit ran its course, 2x4’s and 2x12’s quickly dropped in price. Then, as the market adjusted, 2x12’s further eroded in price; beginning in December 2010, they reached equilibrium with 2x4’s. This convergence continued until April 2011, when 2x4’s became the premium dimension in the market. (To read about the effect this has had on timber markets, read Pete Stewart’s blog Sawtimber vs. Chip-n-Saw) Meanwhile, beginning in the fall of 2010, 2x8’s became the lowest value dimension in the market.

"Figure 1: SYP #2 Lumber Prices October 2009 - September 2011 (Source: Forest2Market's Mill2Market lumber pricing service)"

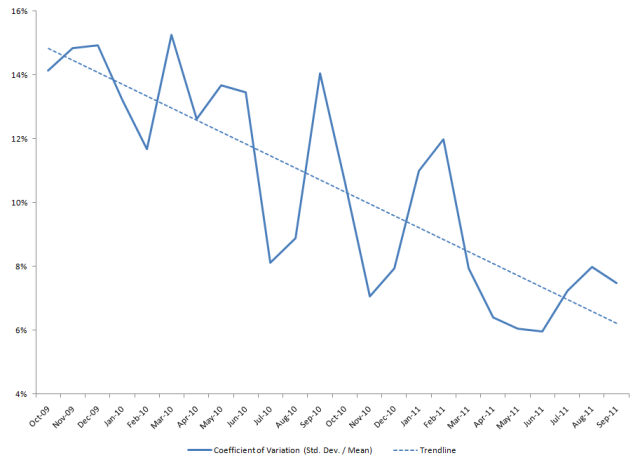

Measuring this variability statistically over time reveals an interesting trend. Figure 2 shows the amount and direction of price variability in the market for #2 SYP dimensions and lengths (8’ to 16’). (For other statisticians out there, this figure was developed using the coefficient of variation, the standard deviation divided by the mean.) What the figure shows is that, even with its ups and downs, a steady downward trend can be observed from the start of 2010 until current month.

"Figure 2: SYP #2 Price Variability Trend October 2009 - September 2011"

For the last month, though, these two figures suggest that a commoditization of pricing between 2x6's, 2x8's and 2x10’s is taking shape. As shown in Figure 1, prices are decreasing and converging for these dimensions. Even 2x4’s and 2x12’s show signs of convergence, as 2x4’s have been losing their premium (compare the two blue ovals to each other and the two red ovals to each other in order to get a sense of this movement). Figure 2 further supports this interpretation of the trend, as the variation in price has decreased over the last month.

Mill2Market data also shows an increase in volume sales over the last two weeks. The combination of the decrease in price averages and price variability with the increase in volume sales suggests sellers in the market are concentrating less on price and more on moving volume. Even with declining demand in the construction market, buyers are not backing away from the ability to purchase cheaper lumber.

On the other side, Forest2Market’s most recent production data (from our Forest2Mill delivered price database) shows that sawmills are reducing production and moving more to just-in-time inventory levels. This adjustment may provide balance soon, leading to a new baseline in lumber prices. Unfortunately, when this baseline is reached, only the low-cost producers will be able to compete, which could be the beginning of the next wave of sawmill closures in the industry.

Comments

Plywood Plants Close – More Evidence Structural Ch

09-16-2011

[...] Continuing commoditization of lumber where 2x4s sell for the same price as 2x12s, providing no incentive to pay a premium for large trees. See Daniel Stuber’s blog on southern yellow pine lumber prices. [...]