Southern timber prices surged during 1Q2019, as all products demonstrated significant increases across the board. Overall, pulpwood products increased at a higher rate than did pine log products, but the general trend of timber prices was on a considerable upward trajectory in the first quarter as prices increased +18.5 percent.

It is worth noting that the higher-than-normal rainfall totals that the South experienced during 2H2018 and 1Q2019 had a significant impact on timber prices, as timberlands were simply inaccessible or unworkable in many areas.

Pulpwood

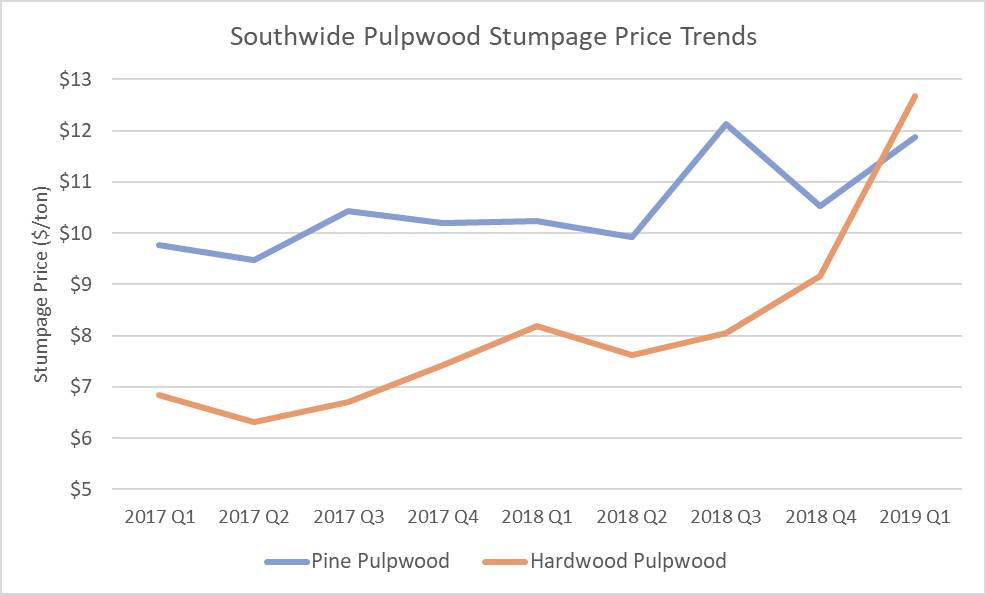

On a Southwide basis, pine pulpwood prices increased 12.8 percent to $11.88/ton during 1Q2019, and two out of three regions saw prices increase for this product. The West-South experienced the largest increase of +45.0 percent to $13.43/ton followed by the Mid-South, which increased +4.11 percent to $8.36/ton. Pine pulpwood prices in the East-South dropped -7.5 percent to $14.27/ton.

Hardwood pulpwood prices Southwide experienced the largest increase of all products, rising +38.3 percent during 1Q to $12.67/ton. The East-South region experienced the largest increase, a whopping +166.8 percent jump to $11.98/ton; the West-South increased +21.2 percent to $13.03/ton; and the Mid-South rose by +13.4 percent to $12.98/ton.

Pine Log

Pine chip-n-saw prices also experienced a significant increase to $20.07/ton on a Southwide basis, a jump of +15.7 percent. The Mid-South experienced the largest increase of +19.3 percent to $19.29/ton. The East-South region rose +8.5 percent to $22.07/ton, and the West-South region inched up +0.1 percent to $14.94/ton.

Pine sawtimber prices increased at a lower rate than did the other products, increasing +7.2 percent to a Southwide average of $28.70/ton. All three regions experienced increases in price. The Mid-South rose +11.1 percent to $28.01/ton, the East-South was up +4.5 percent to $27.81/ton, and prices in the West-South were up +3.9 percent to $30.62/ton.

Outlook

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in 1Q2019 according to the "advance" estimate released by the Bureau of Economic Analysis. After revisions for 4Q2018, real GDP increased 2.2 percent. US housing starts fell unexpectedly in March, coming off a poor performance in February when single-family builds dropped to an 18-month low. Despite lower mortgage rates, higher wage growth and other economic indicators holding steady, there hasn’t been enough buyer activity to ignite a new wave of housing starts activity in recent months.

We believe the sudden upsurge in southern timber prices during 1Q2019 was driven primarily by prolonged and excessively wet weather throughout the region. The huge fluctuation in pulpwood prices (+26 percent), which are generally more sensitive to supply/demand imbalances than are sawtimber prices in the current market, suggests that the increase is reactive and temporary. We look for prices to correct downward in 2Q2019, especially if housing starts fail to gain any clear momentum through the early part of the summer.