4 min read

Russian Sawmilling Sector: Factors Influencing Investment and Business Outlook

Jarno Seppälä

:

July 11, 2019

Jarno Seppälä

:

July 11, 2019

The Russian sawmilling sector is characterized by fragmentation, a division between large export-oriented companies and smaller companies relying on the domestic market, labor intensity and advantages in stumpage and labor costs. However, the industry is facing serious pressure brought on by inflation and other factors driving up the prices of delivered logs, and the necessity to invest in new infrastructure and equipment to maintain competitiveness.

The Russian Sawmilling Sector at a Glance

Russian sawnwood production has nearly doubled since 2000. The overall production level and industry development is heavily driven by exports. However, both production and domestic demand for sawn softwood is expected to be higher than the official statistics indicate.

The sawmilling industry in Russia is still very fragmented and is characterized by relatively small sawmills with an annual capacity of less than 100,000 cubic meters (m3). A significant share of these mills will likely be missing from the official (production) statistics resulting in a misleading supply/demand balance in the country.

Most of the small- and medium-sized mills focus their sales on serving the domestic market with local clients. However, there are also sawmills that focus solely on export markets; in fact, the largest Russian sawmills sell nearly all of their output on the export markets.

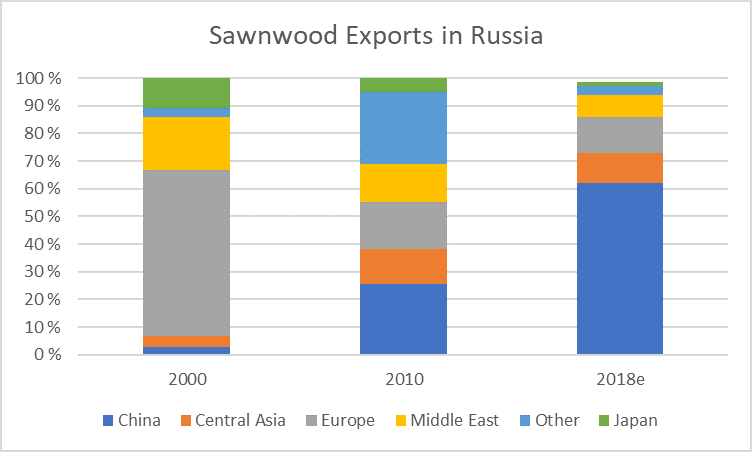

China has become the primary export destination for Russian sawnwood—its share of all exports rising from a humble 3 percent in 2000 to over 60 percent in the last couple of years. Exports to Central Asia have increased as well, though at a much more modest pace. Together with the Middle East, the share of these core export markets accounts for over 80 percent of total export volume. Lower quality requirements in these markets have enabled Russian sawmills to meet their demand with the current level of production technology.

Source: Indufor

Source: Indufor

Competitiveness of Russian Producers

Costs and productivity form a cornerstone of competitiveness within any industry, which in turn drives investment. In the sawmilling business, costs consist of:

- Raw Material

- Energy

- Labour

- Capital

- Other Costs

Differences in product mix, raw material base, input prices, machinery and logistics result in distinct cost structures between industry players.

Raw Materials

Raw material costs make up a majority of the sawmilling cost structure regardless of geographic location. Russia, however, has a distinct advantage in the cost of raw materials; its cost of delivered logs is among the lowest in comparison to competing suppliers. Within the country, there are naturally regional differences in the price volatility of domestic logs, with prices in the northwest and far East increasing sharply in recent months. In other regions, prices have been relatively stable, following a moderate increasing trend. Due to the weakening of the Ruble, Euro-based prices have even decreased.

In many cases, the Russian sawmill industry continues to lag behind in product sales values relative to its competitors in several markets. While log quality is good and sometimes even higher in comparison to many competitors, the disadvantaged position is primarily due to perceived product quality issues resulting mainly from outdated technologies and differences in service levels (timeliness, ease of payments, claim handling, etc.). These service issues are in part due to the lack of a local presence; Russian companies have fewer sales offices or terminals in the key export markets. In addition, many of the smaller producers lack experience and skills in export sales.

Labor

For Russian sawmills, labor costs are significantly lower than in competing countries; the cost level has even decreased in Euro terms but has increased annually in the local currency. Favorable exchange rates have enabled this development. Despite this cost advantage, the Russian sawmilling industry is still heavily labor intensive.

Although productivity has increased somewhat faster than in the competing countries, it has not been able to offset the price increase and therefore unit costs have increased. At most mills, significant labor productivity improvement opportunities exist.

Current Investment Trends

Currently, there are over ten planned, near-term investment projects in the pipeline in the Russian sawmilling industry. The total planned new capacity amounts to over 2.5 million m3 per year, which represents an increase of over 5 percent compared to the current level of production. These investment plans are located mainly in Siberia and in Russia’s far East. An important issue impacting investment appeal relates to the sales opportunities of residual products and unmerchantable wood (i.e. pulpwood), which has an impact on the financial feasibility of the projects. However, there are also several greenfield pulpmill projects in both regions.

Business Outlook and Opportunities

Competition for Russian raw materials will increase over the next several years. Unlike many competing areas, stumpage prices in Russia are low and delivered costs are more impacted by harvesting and transport costs. Thus, market-driven influences that drive stumpage price levels are far less significant than in competing countries. Furthermore, inflation will increase input costs for harvesting and logistics, and transportation infrastructure will continue to pose a challenge as capital investments in forest infrastructure are desperately needed.

Source: Indufor

Source: Indufor

Log Cost Breakdown

The final gate price for logs depends on each mills’ ability to utilize their annual allowable cut (AAC) efficiently. High AAC utilization rates should be pursued particularly in areas that require major infrastructure investments. Other costs such as sawmill labor are increasing rapidly with inflation, which also deteriorates the cost advantage that Russian sawmills have been enjoying.

For the industry to maintain and/or improve competitiveness, it must aim towards improving labor productivity, invest in forest infrastructure, increase the value of its products and utilize by-products more efficiently. These goals can only be achieved via substantial investment in the industry.

Future mills will require:

- More automated systems (e.g. grading, moisture control)

- More employee independence – flexibility to change tasks, learn new skills

- More high-skilled labor (e.g. electronics specialists)

- Attractive salaries to retain skilled people in remote locations

However, since log transport costs are considerable and infrastructure is limited, the ideal mill size must be carefully considered. Log cost per m3 increases with mill size, and other cost savings become marginal once a certain size has been reached. Since the raw material quality is high, it allows for the production of higher-value specialty products such as planed, MSR and modified/treated lumber. Investments in grading optimization technology can also increase sales values, especially in northwest Russia.

The demand for wood products in high rise construction is increasing globally. Russian building codes also accounted for this new demand earlier in the year, opening the market for more widespread use of wood-based construction products. Segheza Group and ThermoHoltz have announced plans to build cross-laminated timber (CLT) manufacturing facilities in Russia, and it is likely that others will follow suit in the near future. Hasslacher Group announced new glulam capacity at its facility in the Novgorod oblast, and Segheza is planning a new glulam plant in Sakhalin.

CLT Expansion

Despite several greenfield pulp mill plans in Russia, major expansion of pulp capacity is not expected to occur in the foreseeable future and other options to increase by-product value must be developed. Sawmills in Nordic countries and in North America are actively exploring higher-value processing options for by-products, including:

- Biocrude / pyrolysis oil

- Activated carbon

- Biodiesel

- Bioplastic composites

- Wood/plastic composites

- Bioethanol / biobutanol

Active investment in product and market research, as well as expanded sales and marketing efforts, will drive the Russian sawmilling sector to maximize its value potential and increase production and profitability.

Jarno Seppälä is Head of Forest Industry and Biosolutions Consulting at Indufor Group in Helsinki, Finland.