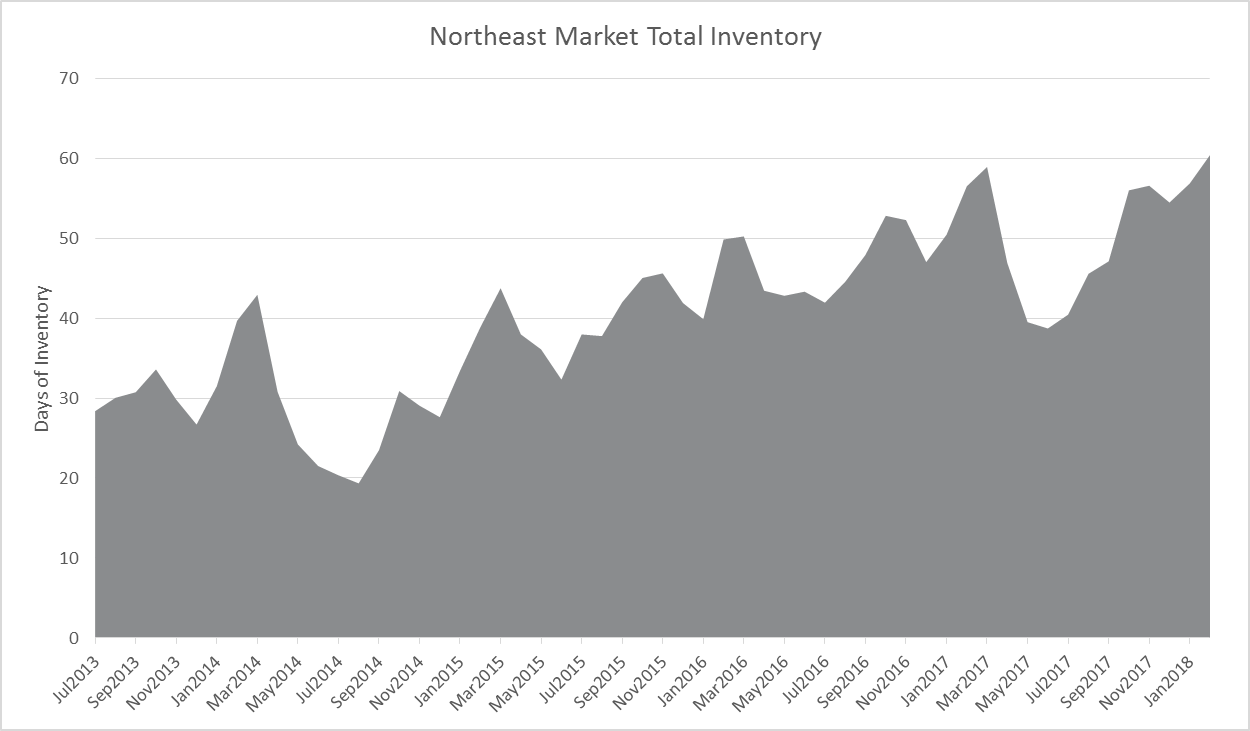

Winter fiber inventories in the Northeast are at noticeably higher levels than in years past. Average regional inventory during February was approximately 60 days, which mirrors 2017 inventory for the same time period. However, these levels are well above the average levels maintained during January 2013 through 2016.

Low inventories starting in 2013 and lasting throughout 2014 led to surging demand and record high prices in 2015. However, overall prices have dropped by nearly 20 percent since the 2015 peak. But all pricing adjustments are relative; while prices have dropped significantly, wood fiber prices in the Northeast are still some of the highest in the world.

The softwood and hardwood inventory trends followed similar patterns but the softwood inventory low actually occurred about a year earlier. Inventories have been steadily rising since their lows to peak winter inventories of nearly 60 days in February 2018.

What Drove the 2015 Price Surge?

Forest2Market data collected over the last 5 years indicates that low summer/fall inventories seem to be the actual driver of the high prices seen in 2015. Due to the seasonality of wood and fiber inventories in the Northeast, a logging production surge is needed to obtain peak winter inventories. The winter season is variable but typically runs from the middle of December to the middle of March and, depending on conditions, can be shorter by up to four weeks. The logging surge capacity must not only be sufficient to maintain mill consumption, but also to build inventories that will last through the spring season when logging is typically limited.

If late summer/fall is wetter than normal or rainfall events happen at inopportune times, fiber inventories will drop below plan; thus, the logging capacity may not be sufficient to build the necessary winter peak inventory. If this is the case, inventory recovery is at least a year away and thus, pricing tends to spike as competition for wood escalates.

Until recently, high energy prices have also been an issue for many of the mills in Maine, particularly during peak winter months. Fiber and energy prices are two of the highest cost components for pulp and paper mill facilities, and the convergence of the two has driven up overall costs, reduced profitability and forced the closure of many longstanding mills in the region in recent years.

The pulp and paper sector in the Northeast continues to adapt to a changing global marketplace. Demand for traditional writing papers is decreasing around the world but particularly in North America and Europe, while demand for products like containerboard and tissue are increasing. This is due in part to the boom in ecommerce and technological advancements in specialty fibers.

With the decreased demand for fiber (particularly softwood), sawmills throughout the Northeast are struggling to move residual chips. As housing starts continue to increase nationally, this inability to move sawmill residues could result in limiting sawmill expansions, which would impact overall lumber production and the ability to meet domestic demand for the housing industry.

A significant loss of consumption over the last 12 years (particularly softwood consumption) in Maine is changing the inventory management dynamic now. As a result, it is time to reevaluate previous best practices about inventory strategies. Forest2Market’s unique pricing data and analytics can help to initiate a reanalysis of inventory management strategy by comparing your specific mill’s inventory to the market, independently assessing the risk of running out of wood in your procurement basin, and assessing the risk of a price surge due to supply volatility in the market.

Pete Coutu

Pete Coutu