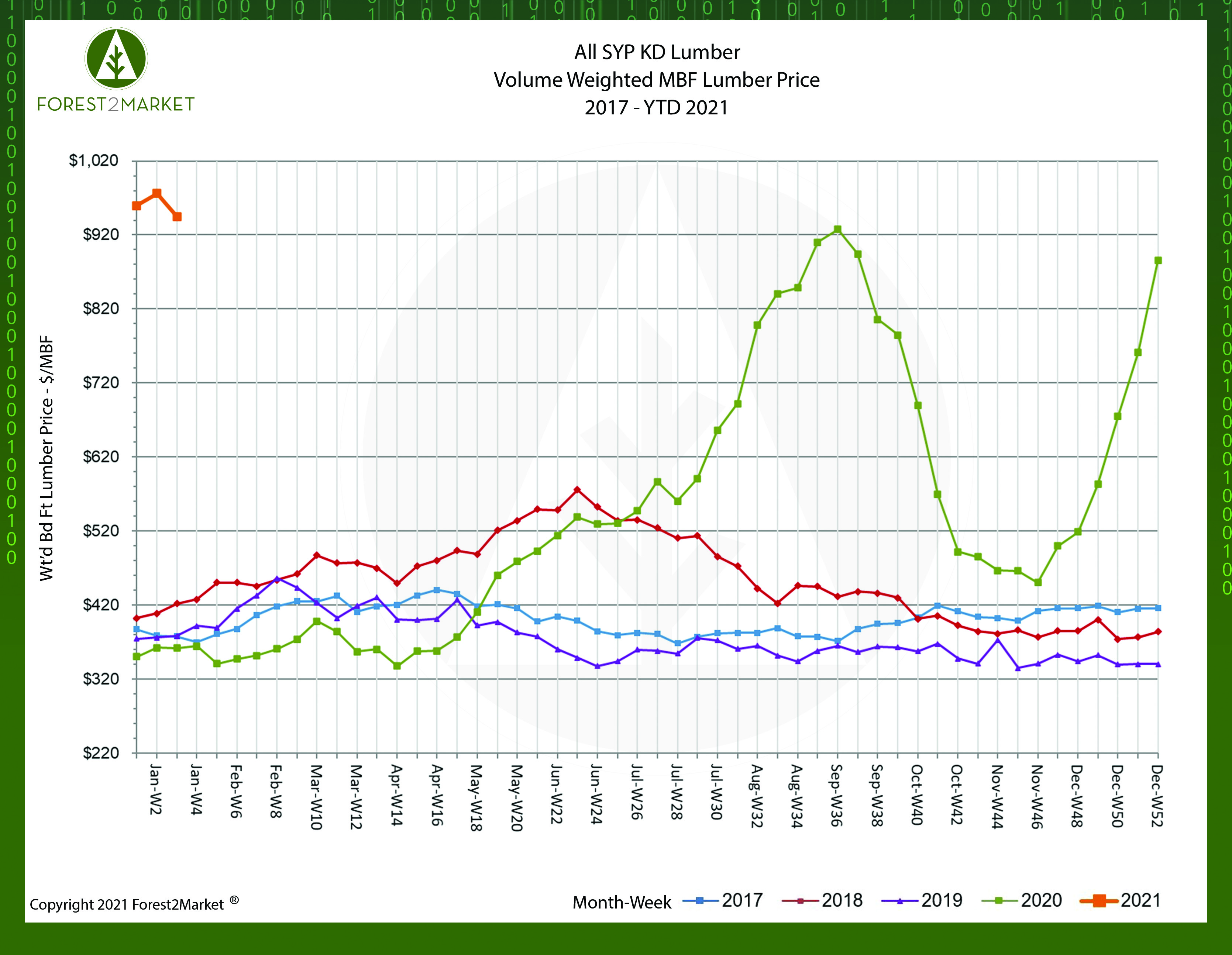

We’re just a few weeks into a new year (and only a few days into a new administration in Washington) but in the North American softwood lumber market, 2021 is beginning to feel a lot like 2020. Southern yellow pine (SYP) lumber prices set new records last fall before finishing the year with a tremendous rally thanks to strong demand driven by late-season mild weather, and prices have moved even higher in the new year.

Forest2Market’s composite SYP lumber price for the week ending January 22 (week 3) was $945/MBF, a 3.2% decrease from the previous week’s price of $976/MBF, but an amazing 161% increase over the same week last year. While prices decreased in week 3, they are still 2% higher than the peak achieved in 2020 ($927/MBF).

A look back at 2020 price trends illustrates the incredible surge that developed in 2Q before peaking in 3Q:

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- 4Q2020 Average Price: $580/MBF

Record-high lumber prices have now begun to impact builder confidence levels, which dropped 3 points in mid-January to 83 according to the NAHB/Wells Fargo Housing Market Index (anything above 50 is considered positive). For reference, the index hit a record high of 90 last November; in January 2020 (before impacts from COVID-19), it was 75.

“Despite robust housing demand and low mortgage rates, buyers are facing a dearth of new homes on the market, which is exacerbating affordability problems,” said NAHB Chairman Chuck Fowke. “Builders are grappling with supply-side constraints related to lumber and other material costs, a lack of affordable lots and labor shortages that delay delivery times and put upward pressure on home prices. They are also concerned about a changing regulatory environment.”

An old saying in economics states that “the cure for high prices is... high prices.” Which is to say, in a market relatively free of regulatory and other barriers to entry, record profits will attract more supply—which, in turn, lowers prices. The US housing market could hardly be regarded as regulation-free, however, the COVID-19 pandemic (to cite just one example) has made starting new construction firms—not to mention staffing existing firms—much more challenging.

Pent-up housing demand could continue outstripping available supply in the near term, which will keep upward pressure on lumber prices. Housing starts were up 5.8% in December and 2020 starts were up 7.0% over 2019 starts, which suggests there is momentum behind the trend. Given the backlog of sold-but-not-started units (since January 2020, an average of 28% of new homes had not been started when sold), it is safe to conclude the ongoing building boom is likely to continue for several more months, which should be good news for prospective home buyers and lumber manufacturers alike.