4 min read

Proposed Biorefinery Would Represent Largest Industrial Investment in Estonia

Vasylysa Hänninen : February 8, 2017

A cutting edge, commercial scale biorefinery that will also create green energy may become a reality if a group of Estonian investors have their way. While the ambitious project is still in its infancy, the vision is to establish the most modern biorefinery in Europe via a €1 billion investment, making it the single largest industry investment in Estonia. This type of forward-thinking commitment to forest products technology and manufacturing will one day be the norm but for now (as the world appears reluctant to abandon its dependence on fossil energy), a pair of seasoned forest-industry veterans are leading the charge.

The investment group, Est-For Invest OU (Est-For), was established last fall and its owners include forest and wood-processing companies AS Lemeks, Caspar Re OU, Ivard OU, Kaamos Group OU, OU Combiwood and OU Tristafan. Margus Kohava, a forest industry expert, and Aadu Polli, who has extensive international forest industry experience, are leading the biorefinery project. As board members of Est-For Invest OU, they will manage the interests of the investor group and the project details.

Once operational, the facility would become a cutting-edge mill in Estonia that would manufacture bioproducts from wood raw materials in an environmentally-sound way. These products would include market pulp, cellulose, hemicellulose and lignin used to manufacture other bioproducts, as well as green energy. The plant would consistently produce 25 percent more renewable energy for the larger market than it uses for its own production processes, which would increase the production of electricity from renewable energy in Estonia by 34-45 percent.

According to initial projections, the biorefinery would launch production in 2022 and the planned production capacity would be up to 700,000 tons of market pulp annually. The mill would consume approximately three million cubic meters of pulpwood and wood chips annually, a volume that is currently being exported out of Estonia at a much lower value. The wood raw materials would primarily come from Estonia, but would also come from Latvia or Lithuania if necessary.

Snapshot of the Current Pulpwood Market in the Baltics

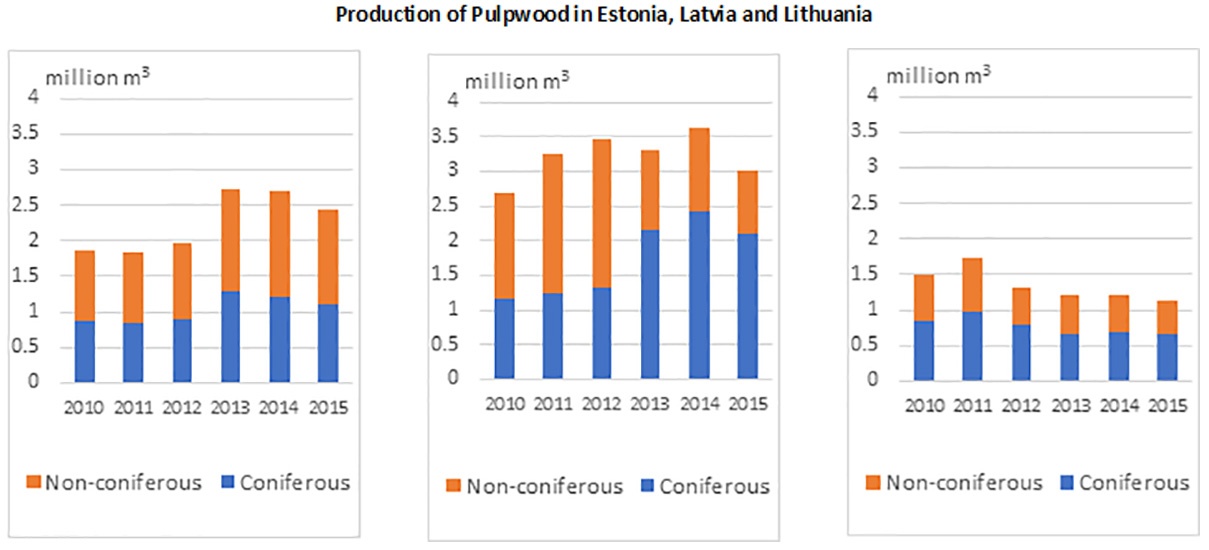

In total, around 6.5 million m3 of pulpwood was produced in the Baltics in 2015. Latvia accounted for almost half of this volume, Estonia accounted for nearly 40 percent and Lithuania added 1.1 million m3 to the total. While coniferous pulpwood has dominated the market in Latvia and Lithuania in recent years, Estonian production is centered on hardwood pulpwood—mainly birch and aspen.

Pulpwood Consumption in the Baltics

While the Baltic region has a vibrant sawmilling and plywood industry, opportunities for pulpwood processing are limited. Major pulpwood consumers in Estonia include two small-sized pulp mills, pellet producers and energy utilities.

- Horizon Pulp & Paper (P&P) mill processes 350,000 m3 of virgin fiber (coniferous pulpwood and chips) annually in the production of unbleached sackkraft paper. Estonian Pulp, involved in Bleached-Chemi-Thermo-Mechanical pulp (BCTMP), has an annual capacity of 160,000 tons and an annual raw material consumption of 400,000 m3 (solely aspen).

- Roughly 2.9 million tons of wood pellets were produced in the Baltics in 2015, mainly in Estonia and Latvia. These pellet mills utilize pulpwood and occasionally residual chips from the sawmilling industry. The largest Baltic pellet producer is Graanul Invest, who operates 11 mills with a total capacity 1.8 million tons. In addition, the company operates five combined heat and power plants (CHP plants).

- The largest energy utility consumer of wood biomass is Fortum Jelgava CHP, with an annual capacity of 380,000 MWh. Timber harvest residues are typically processed in the woods for heat and energy use in biomass boiler houses and CHPs.

Pulpwood Exports from the Baltics

Due to a lack of the demand in the local market, a significant amount of pulpwood for pulp production is currently exported from the Baltics to Finland and Sweden. A number of large wood consumers from Scandinavia operate wood procurement operations in both Estonia and Latvia (Stora Enso, Metsäwood, Holmen, Sveaskog and Södra just to name a few). Some of this volume is also sold by local traders.

In 2015, out of 9.6 million m3 of roundwood imported into Finland, 15 percent originated from the Baltics. In Sweden, the volumes are significantly higher as Baltic exports account for 40-50 percent of this volume (depending on the year). Baltic pulpwood exporters to Scandinavia often claim that current price levels are low and that Finnish and Swedish buyers consider the Baltics as a backup buffer to be used in case of a market disturbances.

Based on the current demand for pulpwood in the Baltics and the amount of pulpwood these countries export each year, the Est-For development decision makes sense. If the project moves forward, it will have a profound effect on the Estonian economy.

Est-For’s Potential Impact

Per Est-For, the annual value added by the mill would be €210 to €270 million, which was approximately 1-1.4 percent of Estonia’s entire GDP in 2015. It would also increase Estonia's exports by up to €350 million annually, and the export value of Estonian products would grow by 3 percent. The mill would create 200 qualified new direct jobs outside the capital region, as well as 500-700 new jobs in the value chain servicing the mill.

Margus Kohava stated that establishing the biorefinery would have a positive impact on the Baltic forestry sector, as well as the Estonian economy. “The biorefinery would annually increase Estonian exports by €250-350 million; meanwhile the value of overall exports of Estonian products would grow by two to three percent. As a result of building the mill, Estonian’s manufacturing industry sector’s average added value would increase by seven to nine percent per employee,” Kohava said.

Various locations throughout Estonia are currently being analyzed as the potential site for constructing the mill. Site prerequisites include 100 hectares (247 acres) of land, a location close to wood raw materials with an operating network of roads and rail, access to a sustainable river water resource and local qualified labor force.

While the economic impact would be a boon to the Estonian and regional economies, a thorough analysis of the wood supply must be completed before the Est-For biorefinery can be constructed, as the facility will have a large bearing on the regional market and will force the reorganization of trade flows in the Baltics. Less volume would be available for export to Finland and Sweden, which will apply added pressure on Russian suppliers.

Compared to other similar and ongoing investment projects in Finland, Estonia has advantages in wood costs, energy costs and labor costs. While the Est-For project is indeed visionary, its development could really go a long way in establishing the Baltics not only as a source of quality wood raw materials, but as an exporter of higher-valued forest products. This type of proactive, forward-thinking development could make the Baltics a valuable regional forest products hub well into the future.