4 min read

PNW Challenges for 2016: Tightening Margins Require Crisp Reactions, Laser Focus

Greg Frohn : February 3, 2016

During the latter part of 2015, we wrote extensively about the regional challenges that were unique to the PNW timber industry and log markets. From the expiration of the Softwood Lumber Agreement and its impact on import/export markets, to the high number of mill sales/closures, to the protracted effects of an intense and costly fire season, the PNW has experienced a period of drastic change. But the beat goes on.

Economic uncertainties abound in the current business climate, and many of these conditions will be exacerbated over the next year as the presidential election process plays out. Regardless of the conditions, timber operations will continue in the region and those visionary organizations that are willing to embrace change will be rewarded with new opportunities.

Softwood Lumber Markets

- Challenge: US housing starts finished 2015 on forecast, and most predictions are calling for a similar performance in 2016 (roughly 1.1 million units, though our own forecast calls for fewer units). With the expiration of the SLA, untaxed shipments of softwood lumber from Canada are now free to move across the border as inventory building takes shape for the construction season. Per an SLA stipulation, both the US and Canada are in the one-year period during which both countries are prohibited from taking unilateral action, so the market is “open” for now.

- Opportunity: US lumber producers in low log cost regions are undoubtedly advantaged in the current economic environment and trade situation. As the US housing market develops in the coming months, West Coast producers have the opportunity to offer distinct market access and value. Lumber producers that are also taking advantage of cost-saving operating procedures and efficiencies, as well as optimizing their supply chains, can afford to be more competitive in the market without sacrificing already-thin margins.

PNW Domestic Log Supply

- Challenge: Wildfire season in the PNW was devastating in 2015; estimated total acreage burned by state include:

- Washington: 990,000 acres

- California: 600,000 acres

- Oregon: 1 million acres

- Montana: 334,000 acres

- Idaho: 720,000 acres

- Fire suppression costs from the US Forest Service were over $1.5 billion nationwide. With well over a billion board feet of burnt timber requiring salvage on private and agency timberlands, it looks as if regional sawmills will be utilizing this damaged resource well in to 2016. Fire salvage efforts (recently known as “Post Disturbance Remediation”) have been robust in some areas, and lackluster for other areas that have delayed recovery. The good news in the near term is that the region is experiencing above-average snowpack across its mountain ranges compared to last year’s record-low snowpack levels. The January 1st snowpack this year was greater than the snowpack at any time last year. Thus far, winter 2016 has not only brought heavy snowfall to the high country, but also heavy Westside rainfall levels.

- Opportunity: Public timber is an increasingly important source of logs and other resources from the forest. Due to the sheer amount of lower-value fiber to be removed in remediation and/or salvage, marketable sawlog availability is in short supply in some areas. Collaboration with all stakeholders—both public and private–will be a valuable endeavor going forward. While federal agencies will likely continue to drag their feet, state and local agencies are typically well-positioned to react to market need and salvage/reclamation opportunities.

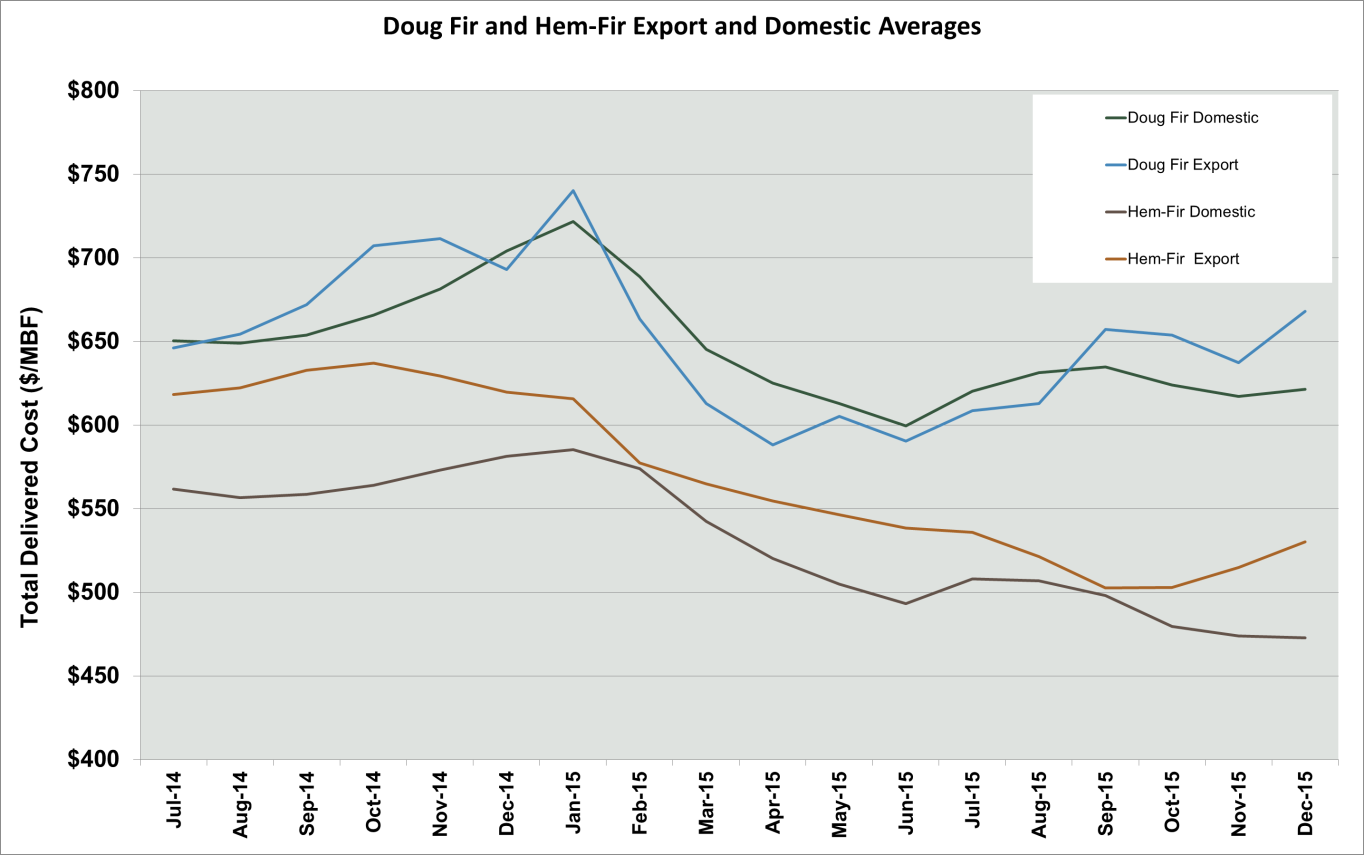

Export Markets

- Challenge: In 2015, China’s $10 trillion economy grew by 6.9 percent, which was slower than in previous years. While this kind of growth would seem favorable to most, the slowdown and the strengthening US dollar have created a tough situation for US producers to compete with other global forest product suppliers. Due to the strength of the greenback, Canadian, European and New Zealand producers have distinct currency and freight advantages as exporters to China. These same global competitors now view US domestic growth—modest as it may be—as a lucrative export opportunity as well. Until the global economy begins to demonstrate real strength and some degree of certainty for the future, the near-term outlook for virtually all commodity-based products will be subdued.

- Opportunity: Though the markets are smaller and more niche than the massive Chinese market, Japan and Korea continue to provide opportunities for West Coast exporters. These markets have a steady demand for higher grades of Douglas Fir and Hemlock. India, while further away from West Coast ports, also continues to show promise for these products, as its economic growth currently outshines China’s.

Oil Prices

- Challenge: While TV talking heads continue to pontificate the proposition that we have reached the bottom for oil prices, the rest of the world sees these low prices as a sign of an anemic global economy. Consider the data from the Bakken oil fields of North Dakota alone, which were once the great hope for “energy independence” from skyrocketing costs controlled largely by Middle Eastern producers. In February of 2012, there were 203 active rigs in the Bakken fields; as of February 1, 2016, there were 45 active rigs—a 78 percent decrease in just four years. With oil currently trading below $30/barrel, only the most productive wells are in play.

- Opportunity: A key (and often overlooked) benefit of the current low oil prices is lower operating costs across all sectors. As of this writing, the average nationwide prices for gasoline and diesel fuel are $1.79/gallon and $2.04, respectively. However, low energy costs also have the temporary effect of making bioenergy less attractive as a fuel source. But with impending energy changes on the horizon due to the Clean Power Plan (CPP), the nation’s energy portfolio will be expanding by law and bioenergy will have an important role to play in that expansion. Forward-thinking landowners and forest products companies in the PNW should begin planning for the implementation of the CPP, as opportunities for bioenergy will abound throughout the region.

While further regional mill consolidations may occur in the near-term, forestry and the forest products industry continue to be a substantial economic contributor in the PNW. With some favorable legislative changes on the horizon that will potentially lead to an increase in thinnings on federal lands, a solid US housing market and a long-term increased interest in biomass as a fuel source, there are opportunities available to those organizations that are willing to seek out and pursue them. Market and timber supply dynamics in the region have shifted drastically over the last 25 years (since the spotted owl controversy began); successful forest products companies in the coming decades will need to exhibit patience, preparation and continued laser focus on developing profitable opportunities.

Click to edit your new post...