3 min read

October Housing Starts Down; Will Legislative Proposals Burst the Bubble?

John Greene

:

November 22, 2021

For the second month in a row, total US housing starts decreased in October as the single-family sector continued to struggle with availability, affordability, labor and building materials challenges. Christopher Rupkey, Chief Economist at FWDBONDS wrote, “There are zoning problems, higher land costs, a lack of labor, and inflation has inflated the cost of raw building materials."

Housing Starts, Permits & Completions

Privately-owned housing starts decreased 0.7 percent in October to a seasonally adjusted annual rate (SAAR) of 1.520 million units. Single-family starts were down 3.9 percent to a rate of 1.039 million units. Starts for the volatile multi-family segment were up 6.8 percent to a rate of 470,000 in October.

Privately-owned housing authorizations were up 4.0 percent to a rate of 1.650 million units in October, and single-family authorizations were up 2.7 percent to a pace of 1.069 million units. Privately-owned housing completions were unchanged at a SAAR of 1.242 million units. Per the US Census Bureau Report, seasonally-adjusted MoM total housing starts by region included:

- Northeast: -0.8 percent (-27.3 percent last month)

- South: -1.0 percent (-6.3 percent last month)

- Midwest: +5.6 percent (+6.9 percent last month)

- West: -3.3 percent (+19.3 percent last month)

Seasonally-adjusted MoM single-family housing starts by region included:

- Northeast: -15.2 percent (-1.5 percent last month)

- South: -1.8 percent (-6.6 percent last month)

- Midwest: -7.5 percent (+7.0 percent last month)

- West: -4.2 percent (+17.8 percent last month)

The 30-year fixed mortgage rate jumped in October from 2.90 to 3.07, and the NAHB/Wells Fargo Housing Market Index (HMI) increased three points in mid-November to 83.

Market Trends

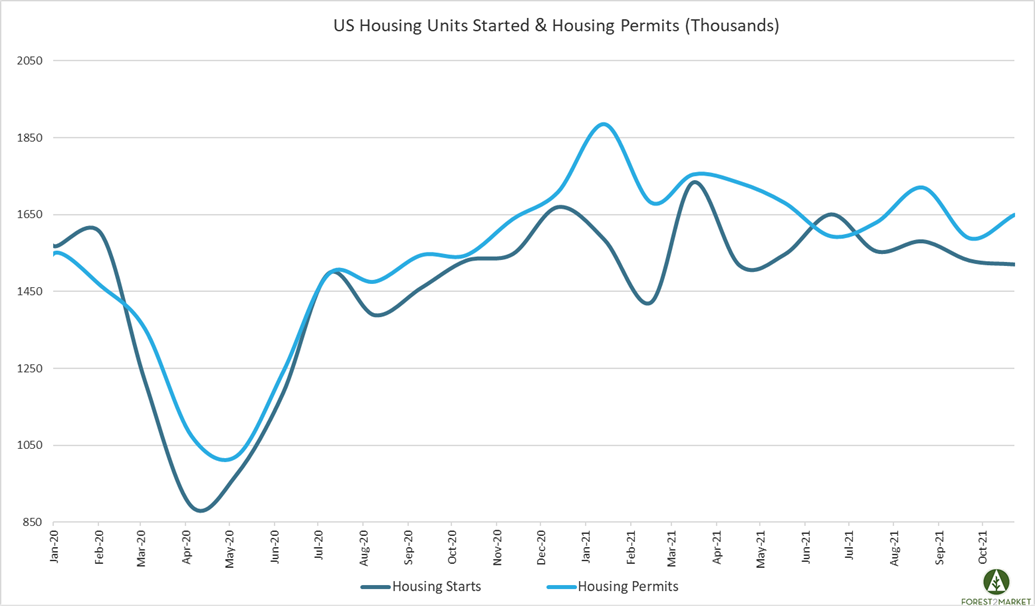

Looking more specifically at the single-family metric, after bottoming during the peak of the pandemic lockdowns in April 2020, single-family starts bounced back quickly before cresting in December. Since then, however, single-family starts have been on a steady downward trend as illustrated in the chart below.

Even though new construction is trending lower, builders are proceeding with caution as new homebuilding remains supported by a significant shortage of previously-owned homes on the market. Per fresh housing market insights published in our most recent issue of the Economic Outlook, as an indication of how shortages of building materials and labor are making it tough for builders to finish projects, the number of completions in October was unchanged MoM, which is stuck at the lowest seasonally-adjusted level in over a year.

However, home sales remain strong despite higher prices. “Noticeably, the cost of lumber bounced off the August bottom of around $400, moving into the mid-$600s per thousand board feet,” said Realtor.com’s George Ratiu. “The increase ensured that homebuilders kept higher prices, pushing the median new home sale price up… from a year ago [+18.7% to a new record of $408,800].”

But rising mortgage rates could become a headwind for the market in the coming months if some home buyers are priced out at the margin. The National Association of Realtors’ Lawrence Yun attempted to paint the outcome in brighter hues by saying, “Rents have been mounting solidly of late, with falling rental vacancy rates. This could lead to more renters seeking homeownership in order to avoid the rising inflation.”

Legislative Headwinds on the Horizon?

Longer term, a provision in the budget-reconciliation bill presently being considered by Congress has the potential to dramatically curtail real estate investment. “Real estate is a long-term, risky and labor-intensive investment compared with stocks and bonds,” wrote analysts Dan Palmer and David Williams.“Without tax incentives, real estate can’t compete with other investments for essential capital” since the proverbial investment “playing field” is not level.

In short, under the House bill, taxation of real-estate operating profit (i.e., ordinary income) would soar above current rates, and real estate capital gains would also spike above current levels. Concurrently, new limitations would be phased in to reduce mortgage-interest deductions and depreciation.

Moreover, the Biden administration proposes to tax generational property transfers when the owner dies at either the higher ordinary-income or capital-gains rates—and to layer on an additional proposed death tax; and that is before state taxes. The huge aggregate tax bill on death will force estates to sell properties to cover what they owe. As similar policy changes in 1986 and 2008 showed, forced selling in real-property markets creates havoc in financial markets.

For the time being, setting aside the uncertainty over whether the above-mentioned policy proposals might be implemented, the housing market has plenty of near-term challenges to sort out. "Supply-chain bottlenecks will likely limit construction activity in the short term, but the supply picture should look better in 2022," said Abbey Omodunbi, a Senior Economist at PNC Financial. "Declining affordability and rising mortgage rates will soften demand in the next year."