2 min read

More Construction = More Lumber = More Sawtimber = Lower Sawtimber Prices?

Daniel Stuber

:

August 22, 2012

Daniel Stuber

:

August 22, 2012

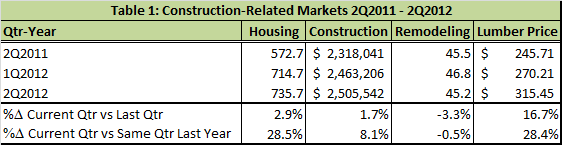

Construction-related markets continued to show strength in the second quarter of 2012 (Table 1). Housing starts increased 28.5% compared to the same period last year, and construction spending was up 8.1%. Remodeling dipped just half a percent, down 3.3% from last quarter. As a result, sawmills were able to sell lumber at higher prices, with a 16.7% increase quarter over quarter and almost matching the year-over-year percent change that housing starts experienced (28.5% for housing starts and 28.4% for lumber prices). With this increased demand for lumber over the last year, sawmills have increased production and stepped up purchases of sawtimber. (While these numbers look good, the price increase observed in lumber has not trickled down through the sawtimber supply chain, however.)

2012 Forest2Market®, Inc.All rights reserved.

According to Forest2Mill and Mill2Market data from first half 2012, sawmills are on pace to purchase 6.5% more sawtimber volume this year compared to 2011; they are likely to surpass 2007’s volume by almost 4 million tons (Figure 1: click on the image to view full screen).

2012 Forest2Market®, Inc. All rights reserved.

This is a staggering number considering that in 2007 housing starts were almost double what they are today. What is even more staggering is that sawtimber delivered prices currently average $39.52 per ton, almost the same price as 2011 (they have fallen sequentially since 2010 even though sawmills have increased purchases). So what is behind this seeming anomaly?

While an extra 4 million tons appears to point to overzealousness on the part of sawmills, it is important to keep in mind that in 2007 the market was undergoing a large correction from the highs experienced in 2005-2006. Sawmills were cutting production and reducing log purchases as housing starts declined by 26% that year. In addition, mills currently have lower log inventories than they did in 2007. In 2007, sawmills purchased roughly 130 million tons of sawtimber and on average held 5.5 million tons in inventory, roughly 4% of purchases (Figure 2). In today’s market, sawmills are only holding about 3.4 million tons in inventory, a decrease of 2.1 million tons. In short, today’s sawmills are leaner and operating on a just-in-time inventory basis than they have in the past. As a result, any run-up in the lumber market like we’ve witnessed lately is going to cause sawmills to significantly step up purchases of sawlogs to make sure they can match production to demand.

2012 Forest2Market®, Inc. All rights reserved.

If sawmills are operating lean and just-in-time, shouldn’t heightened demand translate to higher prices?

The answer is no. The reason: an oversupply of sawlogs in the market (Figure 3).

Comparing the trend from 2007 to 2011, sawtimber inventory in forests in the US South has increased 12.1%, or 2.9% compounded annually over the period. What’s even more telling is that this 2.9% is not evenly distributed. In fact, each year since 2007, the rate has gone up and has been even more dramatic in the last 2 years. Year-by-year, the increase has been:

- 2008 over 2007 – 2.0%

- 2009 over 2008 – 2.2%

- 2010 over 2009 – 3.4%

- 2011 over 2010 – 4.2%

So bluntly put, while sawmills may need more logs, with the surplus of supply, they have plenty to choose from. As a result, we expect current price to be the norm until supply adjusts.

Comments

09-03-2012

i’M NOT SURPRISED BY THIS, AS THE DOWNTURN HAS PUT A GLUT OF SAWTIMBER ON HOLD, SINCE LANDOWNERS HAVE BEEN ‘HOLDING BACK’. THIS WILL TAKE SOME TIME TO LEVEL OUT. F.E.BETZ

Comments

More Construction = More Lumber = More Sawtimber =

09-11-2012

[...] More Construction = More Lumber = More Sawtimber = Lower Sawtimber Prices? | F2M Market Watch. Share this:ShareTwitterFacebookLinkedInTumblrStumbleUponPinterestLike this:LikeBe the first to like this. [...]