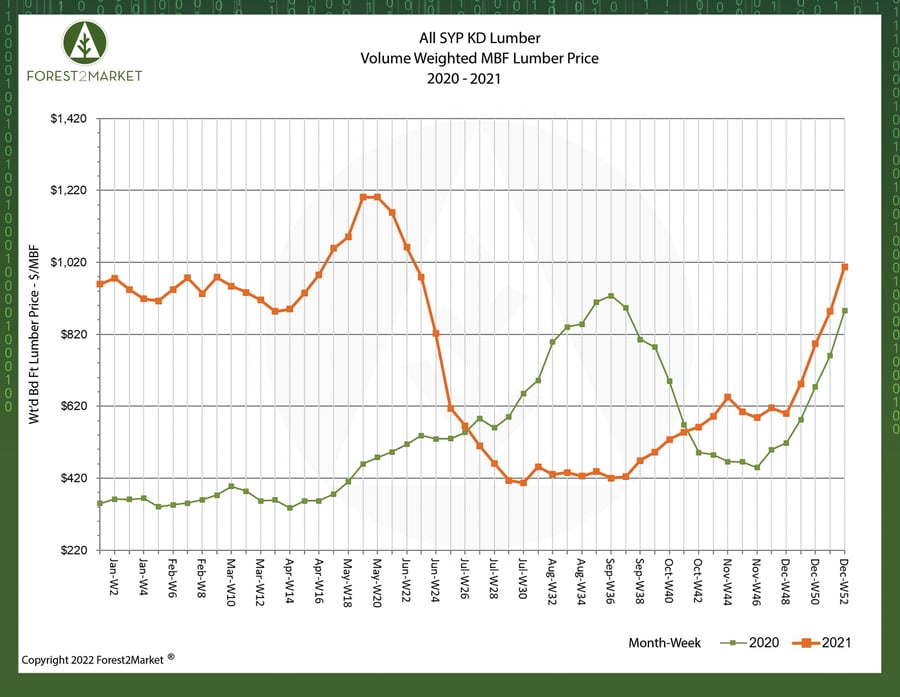

While we largely avoided a repeat of the tissue and towel hoarding behavior that came to exemplify pandemic life in 2020, 2021 was not without its share of forest industry peculiarities. Last year’s big surprise came in the form of skyrocketing softwood lumber prices, which rose to over $1,200/MBF—a new all-time high by a considerable margin.

Forest2Market’s southern yellow pine (SYP) lumber composite illustrates the wild price volatility the market experienced over the last two years. Even the week-over-week (WoW) price performance has shown periods of stark contrast, especially in late 4Q2020 and 4Q2021 in which we saw double-digit WoW increases.

What’s Behind the Ongoing Instability?

For those unfamiliar with the forest products industry as a whole—and lumber manufacturing specifically—it’s important to understand the delicate relationship that exists between demand for finished solid wood products and the capacity to manufacture them. Lumber producers incur tremendous operating costs; wood costs alone can comprise over 70% of these costs annually.

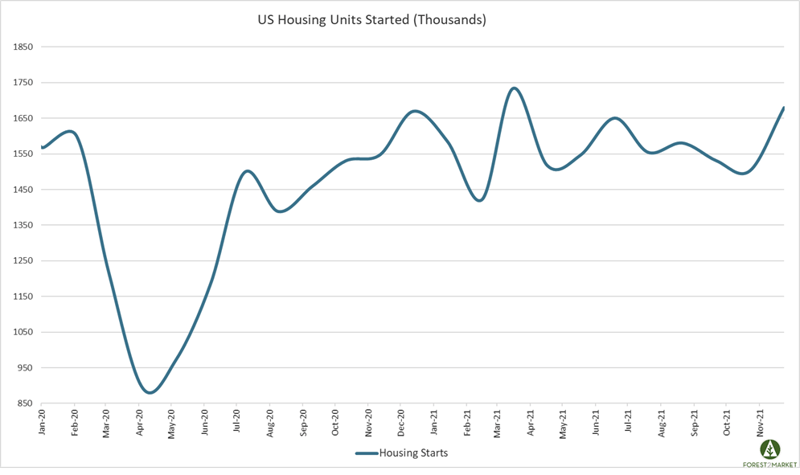

Finding the right balance between the flow of wood into a sawmill vs. lumber output is a bit of a guessing game, as demand for finished lumber via the homebuilding and remodel sectors is unpredictable and oftentimes experiences significant fluctuations. US housing starts data over the last two years illustrates the volatile month-over-month (MoM) demand from builders. Most recently, October 2021 housing starts were down -2% MoM before jumping nearly +12% in November.

Tremendous operating costs in combination with inconsistent demand from homebuilders has forced the lumber industry to follow a “build-to-suit” business model. Manufacturers simply cannot afford to maintain “slack” in the system, so they must match production to demand as closely as possible to effectively manage risk. There is little surge capacity in the value chain because historically, the market does not allow it.

But when demand signals begin flashing “green,” it takes much more than a simple flip of a switch to produce and deliver more finished lumber to the market. It is a process that requires adjustments throughout the entire supply chain, which can take several weeks to resolve.

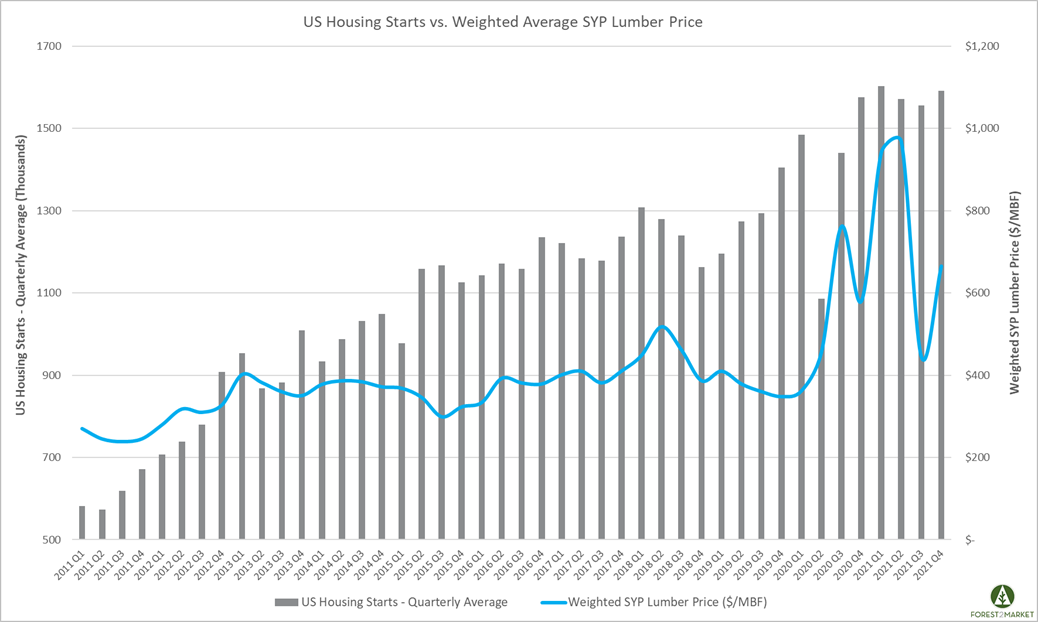

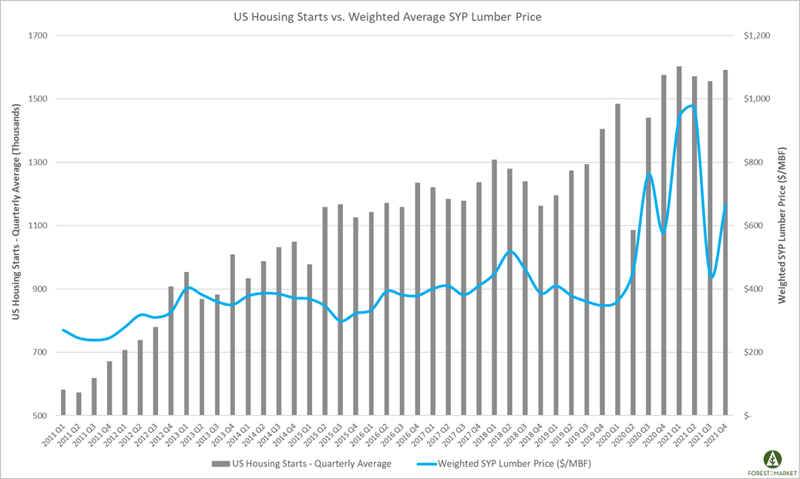

Once lumber inventories began to catch up in late 2Q2021, prices plummeted by over 60% despite steady demand from the homebuilding sector. The graph below demonstrates how a major upset in the supply/demand balance (caused by 2Q2020 lockdowns) resulted in cascading impacts to the softwood lumber market that are still being felt today.

What to Expect in 2022?

Offering predictions with any kind of assurance is a fool’s errand in the current environment. If we have learned anything over the last two years, it’s that *asterisks* serve an important function in most forward-looking analyses. But there are a few developments worth watching that have the potential to impact the NA softwood lumber market in 2022.

- Transportation/Supply Chain Pressures

Affordability, labor and materials challenges affecting the construction sector are being further exacerbated by supply chain and inflationary pressures. As the Wall Street Journal recently wrote, “Pricing in most freight transport and logistics markets generally slides between largely stable long-term contract rates and spot-market pricing that is more sensitive to shifts in demand and the availability of capacity. Prices in spot markets for ocean shipping, trucking and other logistics services have escalated sharply this year. Overall, domestic shipping rates for moving goods by road and rail in the U.S. are up about 23% this year from 2020…”

These soaring costs are pinching both homebuilders and lumber manufacturers alike: The median new home sale price in October was up +18% YoY, as builders continue to struggle with high materials prices and spotty deliveries. Participants in the forest value chain are also having a difficult time securing trucks that can deliver wood to their mills in a timely manner. Highlighting this challenge, our friends at Forest Resources Association (FRA) recently wrote that:

- A sawmill company that supplies customers with lumber and sawmill residuals in the Southeast U.S. is experiencing delays in building winter log inventory due to the truck driver shortage. Many large wood suppliers have trucks parked due to a lack of driver availability. In-woods production has decreased 20%. Internal costs and inefficiencies have increased due to the lack of availability of rail transportation and diverting planned rail outbound shipments to an already strained truck transportation.

- An engineered wood products company that provides construction building materials reports the cost of raw materials has increased significantly. Suppliers are experiencing labor shortages and wage increases, which impact customer costs. The cost of wood fiber supply is increasing. Truck and rail transportation for outbound products have realized increased costs and availability. Limited railcar supply has impacted facilities causing temporary curtailments and/or shutdowns.

- A logging business in Florida has realized increased labor costs of 20% and diesel fuel price increases of 50%. With the labor shortage, they are additionally hiring a labor pool that is less dependable than in the past. Parts to repair equipment take six months to receive, and new logging equipment is more than four months out.

- Seasonality & Weather Challenges

British Columbia was pounded by relentless precipitation in November, which prompted a temporary halt in softwood lumber exports. Vancouver, for instance, broke records for the rainiest fall season (September to November) with 24” of precipitation (normal seasonal average is 14”). Canadian National Railway, which transports forest products, was able to restart operations in early December but the flooding caused a severe delay in shipments to the US. BC typically exports roughly 4-5 BBF, about 50% of its annual production, to the US and the delay has materially impacted lumber prices on this side of the border. We saw a similar dynamic emerge in the 1Q2018 lumber price run up, in which winter weather impacted railway operations and limited BC exports to the US.

Winter weather challenges also influence operations in the US, as these are traditionally the wet months in the South, which limit harvesting activity. Southwide sawtimber prices jumped to a 10-year high in 3Q2021 and that trend is poised to maintain pace through 1Q2022 as demand remains strong, inventory building drives increased competition, and new capacity comes online throughout the region. Any prolonged period of wet weather will intensify these demand drivers, which could impact timber availability and production capacity in certain pockets.

- Trade Uncertainty

The U.S. Department of Commerce recently announced that it will proceed with plans to impose (average) duties of nearly 18% on softwood lumber imports from Canada—nearly twice the previous rate of 9%. Canada said it is challenging the decision under chapter 10 of the USMCA trade deal. It’s too early to tell how the DOC’s decision will impact US/CAN trade flows in 2022, but this development adds another layer of complexity to a market that is already traversing pressures from nearly every angle.

The housing/remodel sectors are poised to drive stable demand for softwood lumber in 2022, and prices should reflect this relative strength for the foreseeable future. However, there is lots of peripheral “noise” impacting the current market, which could limit its capacity to find stability in the near term.

Joe Clark

Joe Clark