3 min read

Latvia’s Vibrant Forest Industry Part II: Imports & Exports

John Greene

:

January 30, 2017

Last month, the USDA’s Foreign Agricultural Service published a detailed report through its Global Agricultural Information Network (GAIN) on the forestry sector and forest products industry in Latvia. As a country with vast acres of dense timberland and a vibrant forest products industry, forestry is a major contributor to the country’s export economy; in 2015 alone, Latvia exported over $2 billion worth of forest industry products. As Scandinavian and Baltic countries continue to competitively access more foreign markets, Latvia’s forest products industry is positioned for growth.

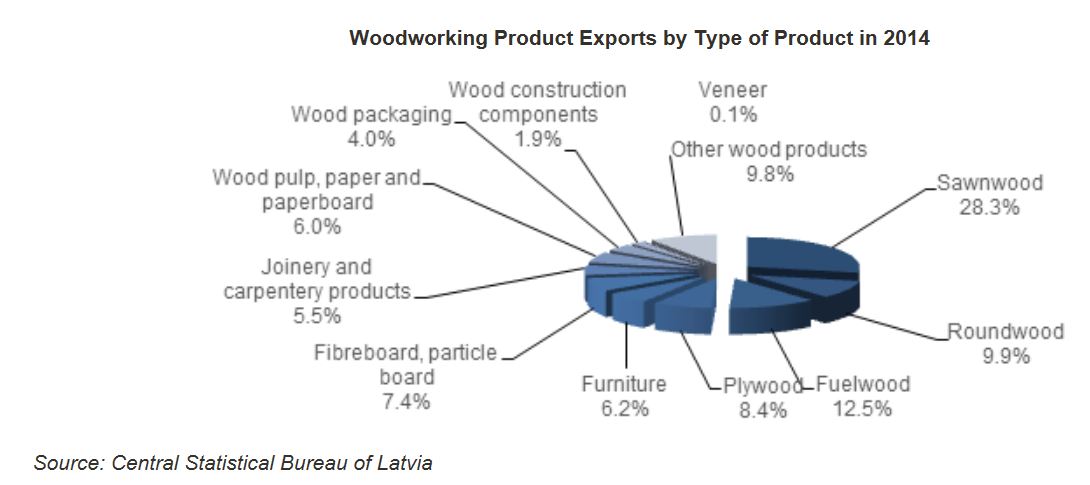

Latvian Wood Products Exports

Finished lumber, birch plywood and softwood wood-panels are the primary finished products manufactured in Latvia. Semi-finished wood products and high-value added wood products exports are also important drivers for the wood processing sector. Intensive growth in the prefabricated wood (panel) modular house production industry is driving this, and production capacities are focusing on the growing demand in Northern European countries. Prefabricated house production expansion also has a positive influence on the carpentry industry, including wood door/window production and glue-laminate timber production. Recent investments have been made in large-scale structural wood products, namely cross laminated timber (CLT) and glue laminated timber (GLT) production units.

According to annual biomass market research produced by the Forest and Wood Products Research and Development Institute of Latvia, wood pellet production also expanded in 2015-2016 with the construction of two new large-scale pellet mills. Per a 2016 article in Biomass Magazine, the entire Baltic region is becoming more and more competitive in the global wood pellet market. “Thirty-five percent of aggregate EU28 exports in 2014 came from the Baltic states—20 percent from Latvia, 10 percent Estonia and 5 percent Lithuania. Globally, 27.1 million metric tons of pellets were produced in 2014, about half, or 13.5 million, produced in the EU. Total production in the Baltic states amounted to 2.65 million tons in 2014, much of which was exported. Russia and the Baltic states combined produced 4.15 million tons of wood pellets during 2014. Producers in countries like the Baltics and Russia can more easily distribute their production to serve local European markets as opposed to overseas producers.”

Latvia is home to 23 pellet mills, which produced 1.35 million tons of mostly industrial-grade pellets in 2015. Production was largely exported to Denmark (500,000 metric tons) and the UK (600,000 metric tons), while the remaining pellets were distributed in Sweden, Italy and other European destinations. Because a vast majority of Latvia’s production is exported, its domestic market remains relatively small at around 100,000 metric tons.

Per the Latvian Ministry of Agriculture, Latvia is a net exporter of forest products:

- In 2015, Latvia exported €04 billion ($2.23 billion) worth of forest industry products, which was 3.1 percent more than in 2014 when exports amounted to €1.98 billion ($2.41 billion).

- In 2015 Latvia exported €74 billion ($1.90 billion) worth of timber and timber products, up 2 percent from €1.70 billion ($2.07 billion) exported in 2014.

The European Union (EU) is the main trading partner for the Latvian forest products sector with a nearly 90 percent share of the total Latvian wood export volume. Traditionally, Latvia’s largest forestry export markets are the United Kingdom (UK), Germany and Sweden. In 2015, Latvian forest products exports to these countries were: UK (18.9 percent of total exports), Germany (10.5 percent) and Sweden (9.5 percent).

- In 2015, exports to the UK increased to €386 million ($422.0 million), up 17.2 percent compared to 2014.

- In 2015, exports to Germany increased by 2 percent and amounted to €3 million ($233.2 million).

- In 2015, exports to Sweden increased by 20.4 percent to €3 million ($211.34 million).

Latvian Wood Products Imports

Latvia imported €705.9 million ($771.79 million) worth of forest products in 2015; imports of these products increased by 4.3 percent, up from €676.7 million ($739.87 million) in 2014.

- Lithuania has traditionally been the primary supplier of forest products to Latvia and, in 2015, the country sourced roughly 17 percent of its total forest industry imports from Lithuania—totaling €89 million ($135.45 million).

- The value of imported forestry products from neighboring Estonia was €38 million ($98.82 million), totaling nearly 13 percent of total forestry sector imports.

- Imports from Poland valued €13 million ($98.54 million), totaling nearly 13 percent as well.

According to USDA statistics, the US trade balance with Latvia in forest products has been negative in recent years. In 2015, Latvia’s exports to the US exceeded imports by $14 million, although the total forest products trade between Latvia and the US has been grown to $15.4 million.

According to Eurostat statistics, the primary wood products exported from the US to Latvia is sawn or chipped wood followed by wood continuously shaped, and the value of these exports amounted to $484,000 in 2015. However, Latvian wood and wood product imports from the US are typically volatile and are strongly dependent on currency indexes. The primary factors influencing buying decisions of Latvian (and all Baltic States) importers are logistics costs and the risk related to currency volatility.